EURUSD, GBPUSD and NZDUSD on the back of weak dollar

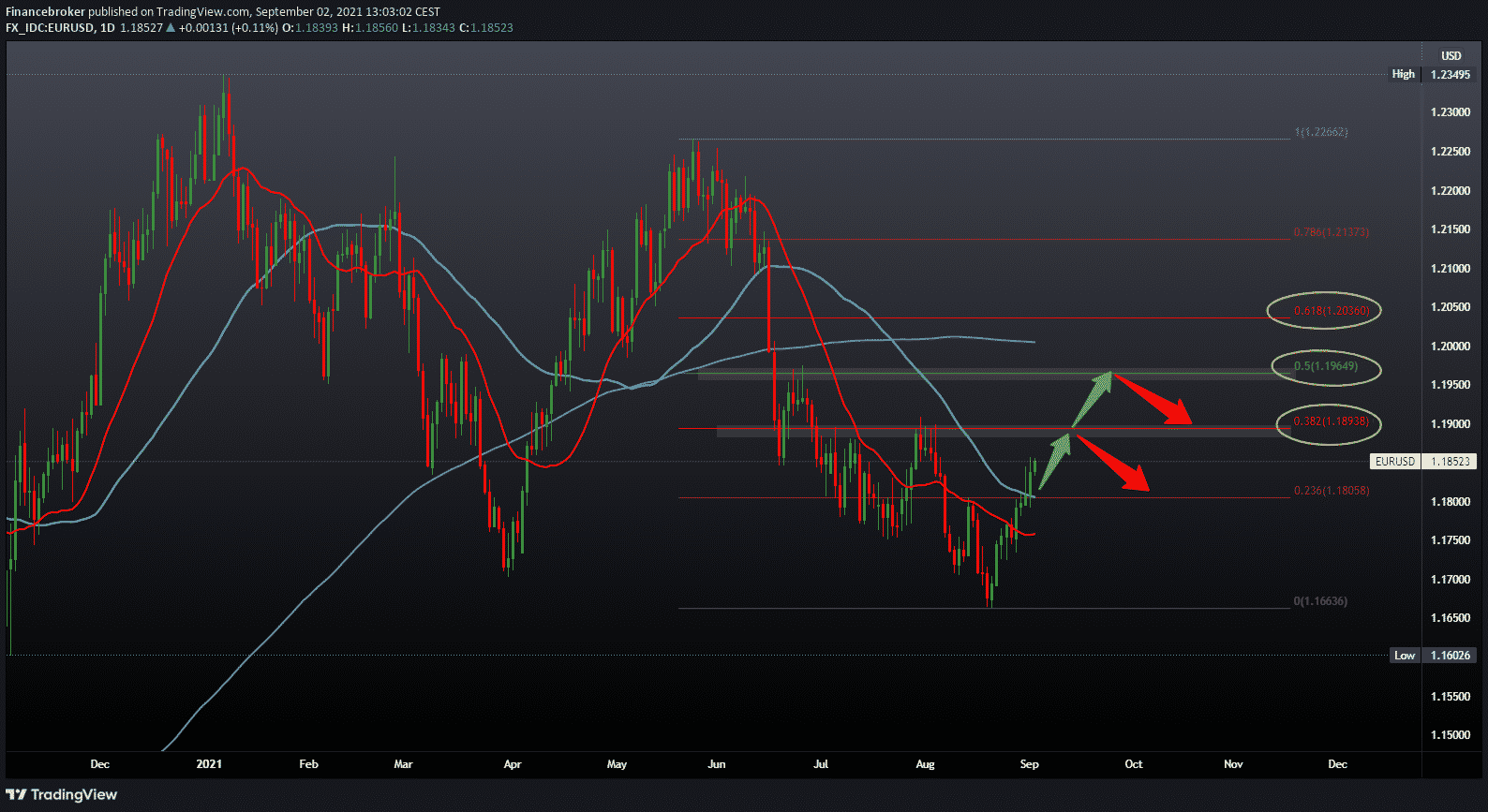

Looking at the chart on the daily time frame, we see that EURUSD is still recording gains on the chart. The pair found support at 1.18000 at 23.6% Fibonacci level with the help of a 50-day moving average. Our next bullish target is at 38.2% Fibonacci level at 1.18940, where our previous high is from the beginning of August. In the following, our target is 50.0% Fibonacci level at 1.19650 and the previous high from July. We need a pullback below the 50-day moving average and 23.6% Fibonacci levels for the bearish trend. After that, there is a chance to visit the previous low in the zone 1.16500-1.17000.

GBPUSD chart analysis

Looking at the graph on the daily time frame, we see that GBPUSD is still making shifts to the bullish side by testing 1.38000 and moving averages. For a potential continuation of the bullish trend, we need a break above the 38.2% Fibonacci level at 1,38300. After that, our target is 50.0% Fibonacci level at 1.39100, while our main target is the previous high at 1.39900, close to 61.8% Fibonacci level. We need negative consolidation and lowering the price to lower levels on the chart for the bearish scenario. The first support expects us at 1.37320, and then if that support breaks through, we could expect GBPUSD to visit the previous low at 1.36000.

NZDUSD chart analysis

Looking at the chart on the daily time frame, we see that the NZD, after falling to 0.68000, quickly recovered and climbed to the current 0.70900. NZDUSD is moving in one major corrective channel, and we are now very close to the top line of this channel. That place coincides with the 200-day moving average and resistance at 61.8% Fibonacci level at 0.71270. A break above would further amplify the bullish signal for further growth towards previous highs in the 0.72500-0.73000 zone, where we were last in June. We need resistance to the 61.8% level and negative consolidation for the bearish scenario that will reverse the current momentum on the bearish side. We can seek support at lower Fibonacci levels.

Market overview

Eurozone producer price inflation jumped further in July due to higher energy prices, Eurostat data showed on Thursday.

Producer prices rose 12.1 percent year-on-year in July, faster than the 10.2 percent rise recorded in June. Economists predicted annual growth of 11 percent.

Excluding energy, producer price inflation rose to 6.7 percent from 5.6 percent in the previous month.

Energy prices advanced 28.9 percent a year, and raw material prices rose 12.6 percent.

On a monthly basis, producer price inflation rose to 2.3 percent in July from 1.4 percent in June. The growth rate was significantly above the economists’ forecast of 1.1 percent.

Consumer price inflation in Switzerland rose in August, data from the Federal Bureau of Statistics showed on Tuesday.

The consumer price index rose 0.9 percent year-on-year in August, after rising 0.7 percent in July. Economists expected growth of 0.8 percent.

Consumer prices rose 0.2 percent in August, after falling 0.1 percent in the previous month. Economists forecast growth of 0.1 percent.

The core CPI rose 0.5 percent year-on-year in August and rose 0.2 percent from the previous month.

New Zealand merchandise conditions rose 3.3 percent from the second quarter of 2021, New Zealand Statistics announced on Thursday.

That exceeded the forecast for an increase of 2.5 percent after an increase of 0.1 percent in the previous three months.

Export prices jumped 8.3 percent quarter-on-quarter, exceeding profit expectations of 3.0 percent after falling 0.8 percent in the first quarter.

Import prices rose 4.8 percent from growth forecasts of 1.8 percent after easing 0.8 percent in the previous three months.