EURUSD and GBPUSD testing current resistance zones

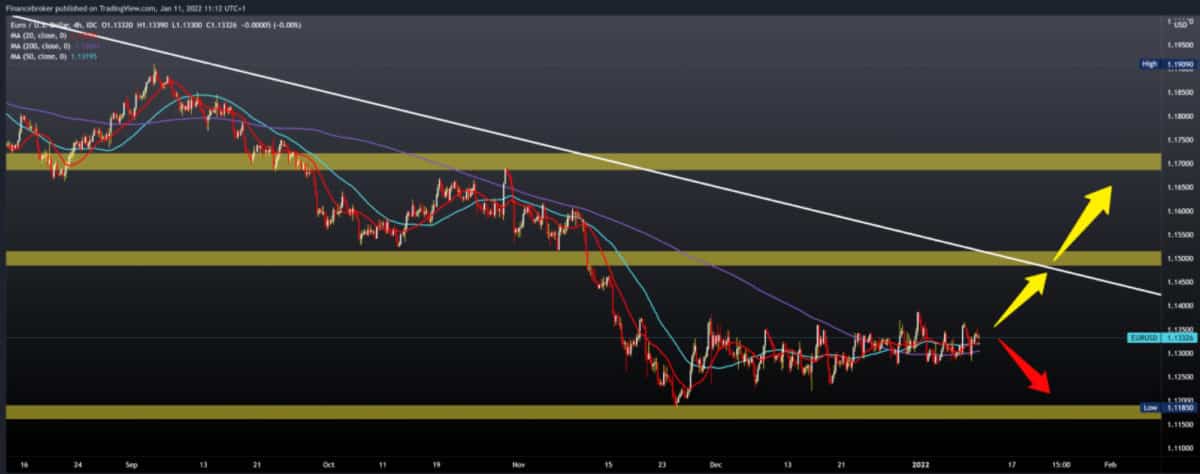

EURUSD chart analysis

During the Asian session, the euro strengthened against the dollar. Yields on US long-term bonds have slowed, so the dollar is in a slight retreat. Since the end of November EURUSD has remained in a consolidation regime with gains limited to close proximity of 1.1400, with the lower end offering a conflict around 1.1220. Meanwhile, the pair’s price continues to monitor the dollar’s performance, as well as differences in policy between the ECB and the Federal Reserve and the response to persistently rising inflation on both sides of the Atlantic. The steady progress of the coronavirus pandemic remains an exclusive factor to be viewed when it comes to the prospects for economic growth and investor morale.

Bullish scenario:

- We need to continue the positive consolidation, and with the help of moving averages, we are going up.

- Pair must stay above 1.13500 to try to attack the 1.14000 level.

- Of the moving averages, the MA200 is important to us, which makes a slightly upward turn, and it could determine a longer-term trend on the chart.

- Our next target is the zone at 1.15000, where we find the upper trend line, and it may be important for us to continue the bullish continuation.

Bearish scenario:

- We need a negative consolidation to pull the pair below the MA200 moving averages.

- Then we see how the pair will behave around 1.13000, and further negative consolidation lowers us to the previous low to 1.12000.

- Increased bearish pressure at that level could break below and form new lows this year.

GBPUSD chart analysis

British consumers avoided restaurants and hotels last month after a variant of the Omicron virus spread and instead spent a lot on food at home ahead of the Christmas holidays, research showed on Tuesday. Payment card provider Barclaycard said stronger supermarket shopping led to a 12.2% increase in pre-pandemic spending in December 2019. More Britons have either isolated themselves or decided to stay home because of a new variant that has hampered vendors face to face, as well as restaurants and leisure venues, “said Jose Carvalho, head of consumer products at Barclaycard. Although retailers did well in 2021, the BRC warned that consumer spending is likely to be pressured by rapidly rising inflation, rising energy bills, and tax increases.

The Bank of England estimates that consumer price inflation will reach around 6% in April, the highest in 30 years.

Bullish scenario:

- We need a further continuation of this positive consolidation and a break above the upper trend line.

- Pair is currently consolidating around 1.36000, and we need a break above, and our next target is the 1.37000 level.

- Our main target and resistance with further positive bullish momentum is the 1,38500 resistance zone.

Bearish scenario:

- We need a new negative consolidation that would direct money to lower levels.

- Our first support is at 1,355,500, where the MA20 moving average is waiting for us, then the next support is at 1,335,000.

- At this level, we get additional support in the MA200 moving averages.

- The break below can drop us to 1.33500-1.34000 of the previous higher support zone on the chart.

Market overview

Japanese news

Japan’s leading index increased to a four-month high in November, preliminary cabinet estimates on Tuesday showed. The leading index, which measures future economic activity, increased to 103.0 in November from 101.5 in the previous month. This was the highest reading since July when the result was 103.8. The coincidence index also advanced to a four-month high in November. The indicator reached 93.6 in November, compared to 89.8 a month ago.

European news

Investor confidence in the eurozone unexpectedly improved in January. After a sharp slowdown in the previous month, the results of a survey by the behavioral research company Sentik showed on Monday.

The title index rose to 14.9 from 13.5 in December. Economists forecast a weaker result of 12.0.

“Investors do not expect the economic momentum to stop in the new year either – despite new variants of the virus and growing numbers of those infected,” Sentix said.

The German investor confidence index improved in January, rising to 17.0 from 14.4 in the previous month. This was the first increase in the last five months. The current situation index also rose for the first time in five months, climbing to 19.0 from 13.8. The expectation was stable at 15.0.

The investor confidence index for the United States fell to 23.3 in January from 24.2. The measure of expectation rose to 13.0 from 14.5. The current assessment measure has been reduced to 34 for the sixth month in a row, the lowest level since April last year.