Theta Gang Strategy – How to Profit From?

As a trader who is exploring new strategies to increase your chances of profiting, have you ever thought about implementing the theta gang strategy? It’s an options trading strategy, also called theta gang wheel strategy, capitalizing on the fact that the prices decay over time.

Instead of trying to predict if an asset will go up or down, you play the time game and collect a premium which turns to profits as time passes, then rinsing and repeating. Options can be used to create an additional income stream in almost any portfolio. Whether you plan to take a position in a stock or own stocks, options strategies, and especially theta gang strategy, can generate income.

The strategies you could use to benefit from theta can be endless. We are going to focus on the most popular ones that are relatively simple to understand. In this post, we’ll explore the three best options strategies for generating income. Also, this article assumes you know the basics of puts and calls, which should be the minimum requirement of anyone wanting to implement theta gang strategies.

Time Decay On Options: Time Erosion (Theta)

Before diving into income-generating theta gang strategies, it is important to understand the concept of time-value erosion and its effect on the price of options and the income earned.

The erosion of the time value, represented by the theta coefficient, corresponds to the variation of the price of the option according to the time when the other variables are constant. Since options have an expiration date, their value decreases as that date approaches. Theta indicates the rate at which the option price will decline over time and is expressed according to the following relationship:

Theta = Change in option price ÷ Change in time

(when other factors, such as the price of the underlying, are constant)

All income-generating strategies require the sale of an option, which allows income to be received in the form of credit.

Time value erosion works favorably for the option writer since revenue is earned at the time of the initial trade, and the value of the option declines throughout the life of the option. Also, the rate at which the option price decreases over time is not linear.

If all other parameters remain constant, the value of short-duration options will decline more rapidly than that of long-term options. Option sellers can make the most of time value erosion by selling short-dated options (weekly options).

Theta gang strategies explained

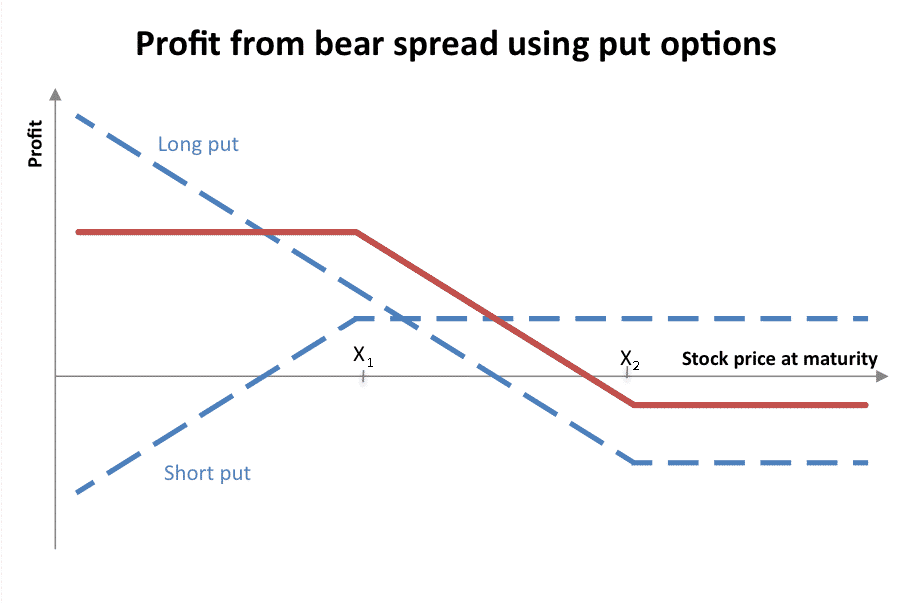

Theta Gang Strategy #1: Call credit spread

An out-of-the-money call option is sold, and another more out-of-the-money call option is brought to hedge against a strong upside move. In this case, profit is made if the stock stagnates, falls, or even rises slightly.

The maximum loss is limited. The worst-case scenario is known in advance. So there will be no surprises for you in the event of a disaster. If the stock rises and moves above the purchased call option, you will have an unrealized loss.

If this move occurs just after the call credit spread is in place, the loss may be less than the known maximum due to the time value remaining in the options. The maximum gain from a credit spread is also limited, and it is easy to calculate. It’s simply the amount of credit (or the difference of the 2 premiums) received at the start of the transaction.

In the best case, the price action remains below the strike of the call option sold for the entire duration until the day of expiry. Both options expire worthless, and the options are removed from the options trader’s account, and he keeps the premium. Impact of declining time value on credit spread.

Like volatility, the effect of the passage of time (measured by theta) can vary depending on where the underlying stock is trading. Since the call credit spread setup we are interested in is initially out of the money, we start with a positive theta.

This means that money is made through the passage of time, all other things being equal.

If the asset is trading above the strike price of the purchased call, the position will move to negative theta, and the passage of time will hurt the trade.

So, if you ask yourself 2 minutes to think about it, it is quite logical.

If the stock is below the strike of the sold call, we want time to pass because the P&L will slowly move towards the maximum gain.

If the stock is above the purchased call option, the trade will approach the maximum loss over time.

Being a bear trade, the delta of a call credit spread will always be negative, no matter what stage of the trade we are in or how it is set up.

Theta Gang Strategy #2: writing cash-covered put options

Writing a cash-covered put option involves writing a put option and setting aside the cash needed to buy the stock should the option be exercised. This strategy is primarily considered an equity acquisition strategy, but it can also be used as an income generation strategy.

The option seller receives the premium from selling the option and can generate an income stream while acquiring shares. For instance, if a stock is trading at $100 and an investor writes a put option on that stock with a strike price of $95 at an option premium of $1, the investor will be obligated to buy the stock if its price is below $95 at expiration.

It enables the investor to use the income received to reduce the total cost of the shares, which he will buy at the strike price. The actual cost of each action is, in effect, reduced to $94 ($95 – $1).

If the market price rises, the investor benefits from the premium received; if the price falls below the strike price, the investor buys the shares at the strike price and receives a discount (the $1 premium).

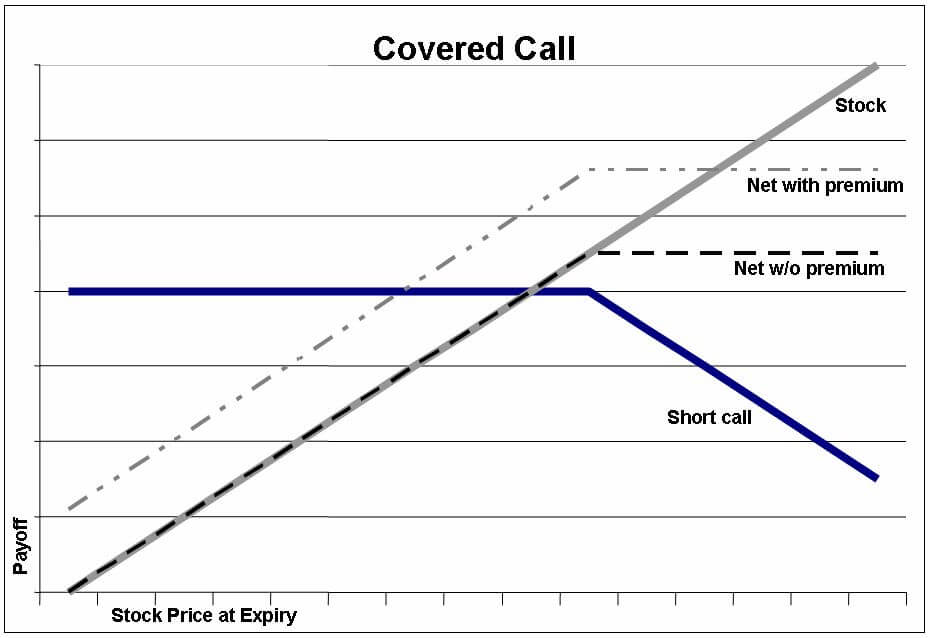

Covered call writing means you sell covered calls.

It is carried out in two stages: you must first hold at least 100 shares, then sell an “out-of-the-money” call option.

This income generation strategy is best suited to a neutral or bearish outlook on the underlying stock. When selling the call option, the investor is obligated to sell the stock at the option’s strike price at expiration if this is favorable to the call option holder ( i.e. the buyer).

The objective of this type of theta gang strategy is for the option to have no value at expiration (which would mean that the price of the underlying is below the strike price), thereby retaining the income from the sale of the option.

The seller can repeat covered call writing to generate an income stream until the stock price is above the strike price at expiration. The seller will then have to sell the stock to the buyer of the call option at the strike price.

For instance, if a stock is trading at $100 and an investor writes a call option on that stock with a strike price of $105 at a premium of $1, the investor will be forced to sell the stock if its price is above $105 at expiration. If the stock price is below $105 at expiration, the investor will keep the $1 income and can continue writing covered calls to generate an income stream.

Theta Gang Strategy #3 – Short Iron Condor

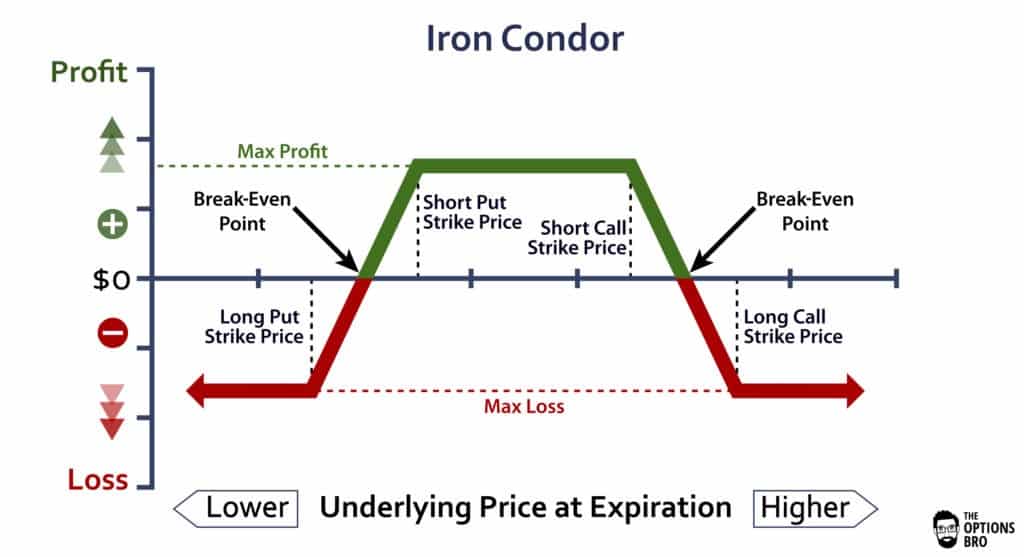

In the Iron Condor, two options are bought, and two are sold. The strategy actually combines two vertical spreads – a short vertical put spread and a short vertical call spread – which both expire on the same date.

In both cases, an option is issued, which is out of the money. The option is covered by another option which is out of the money. This strategy makes it possible to anticipate a loss of time value (theta). Note that the erosion of the time value of options written is greater than that of options purchased as a hedge.

If the underlying value does not leave the fluctuation band of the call and put options are issued, then the premium received is equal to the profit. The fluctuation band of options written and purchased determines the premium to be received. The narrower the band, the higher the premium. Indeed, the risk that the price leaves this band of fluctuation is higher.

Bottom line

Investors wishing to hold stocks for the long term should consider writing cash-covered put options to get the stock at a lower price and then writing covered call options to generate income once the stock is acquired. In addition, investors who wish to generate income by speculating on the movement of a stock’s price should consider using credit spreads.

The key to generating consistent income through these strategies is to consistently follow a plan based on what works every cycle. Finally, as with all income-generating strategies, short-dated writing options can generate income at an increased rate due to the effects of time-value (theta) erosion.