EURUSD and GBPUSD: Upward channel

- During the Asian session, the euro added new gains against the dollar.

- During the Asian session, the pound continues its consolidation in the zone around the 1.2650 level.

- The U.S. dollar continued to fall on Monday.

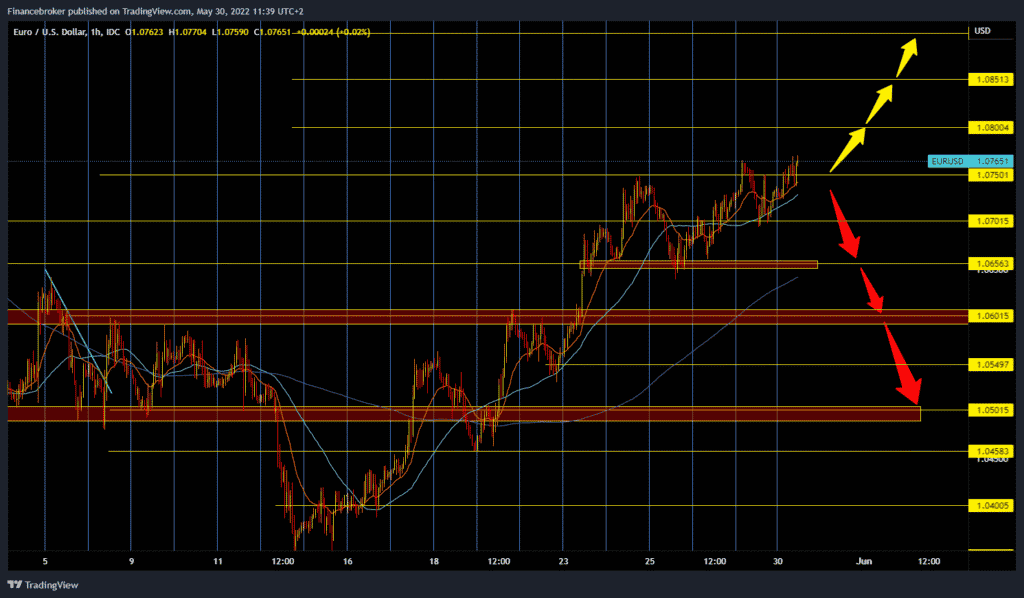

EURUSD chart analysis

During the Asian session, the euro added new gains against the dollar. The second reading of the US GDP on Thursday showed a negative picture of the state of the US economy in the first quarter. Last week, notes from the last Fed meeting showed a milder tone regarding the increase in interest rates, which was reflected in the confirmation of the withdrawal of the American currency. On the other hand, the European Central Bank seriously considering ending the long-standing negative interest rate measure, which further strengthens the euro.

The euro is exchanged for 1.07878 dollars, strengthening the euro by 0.33% since the beginning of trading tonight. A summit of EU leaders is being held today and tomorrow. Among other things, they will discuss the introduction of new sanctions against Russia. Looking at the chart, we see that today the euro could climb to the 1.08000 level on the back of a weak dollar. We need a pullback down to the 1.07000 support zone for the bearish option. A break below this zone would increase bearish pressure to sell the euro, and the pair would likely drop to the 1.06500 level. Continuing below this zone, we would probably return to the bearish trend.

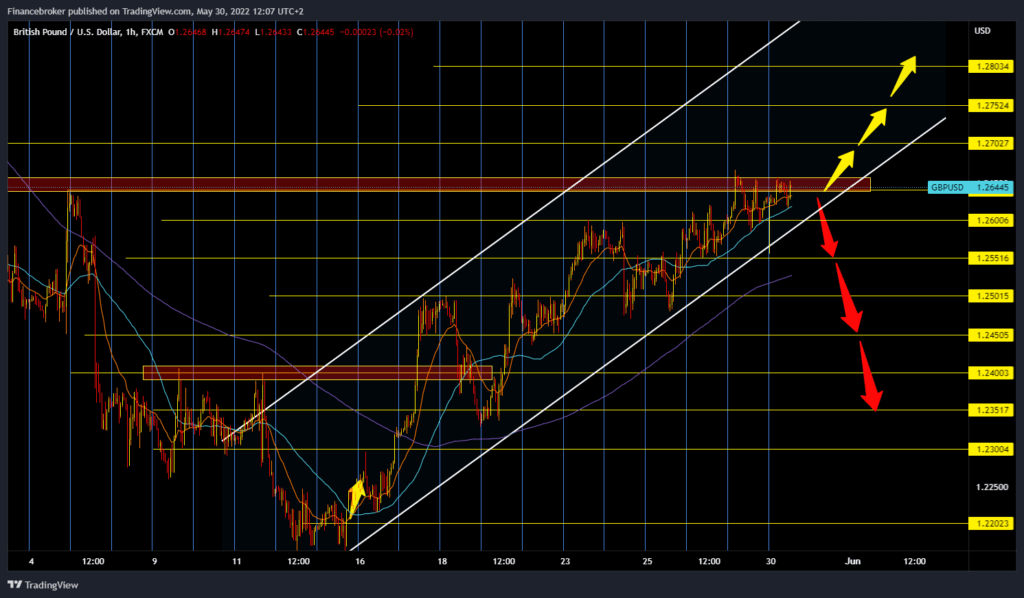

GBPUSD chart analysis

During the Asian session, the pound continues its consolidation in the zone around the 1.2650 level. The break of the pound above is more and more certain, and it only takes a little more to get to the 1.27000 level. The dollar is still in retreat after climbing to the 105.00 level, and it is now very possible that we will test the 100.00 level.

Looking at the pound chart, we need to continue this positive consolidation and break above the 1.26750 level to continue the bullish option. After that, we expect a further continuation towards 1.27000, then 1.27500 and maybe 1.28000 levels. We need bearish consolidation and pullback to the 1.26000 level and lower support lines for the bearish option. Breaking the pounds below would increase bearish pressure to continue retreating to lower levels. Our potential following bearish targets are 1.25500, then 1.25000. If the pair falls to this 1.25000 level, then it is possible to visit the May minimum once again.

Market overview

The U.S. dollar continued to fall on Monday. The appetite for increased risk in all markets was strengthened, supported by encouraging economic data and bets that the Federal Reserve will tighten its policy more slowly than expected.

The dollar index is on its way to its first monthly decline in the previous five months. The dollar is losing its safe haven and is currently losing strength after a dizzying start to the year.

Stores are likely to be weak this Monday as U.S. stock and bond markets are closed today for a national holiday – Memorial Day. Friday’s data showed that U.S. consumer spending rose more than expected in April.

European stocks rose to new three-week highs on Monday as easing restrictions on COVID-19 and a new stimulus in China helped maintain last week’s optimism.

A series of further economic data could be released this week to give indications of global growth prospects, including U.S. job numbers and China’s procurement manager index figures.