EURUSD and GBPUSD pullback

- During the Asian session, the euro withdrew from yesterday’s high of 1.07870 level to 1.07460 level.

- During the Asian session, the GBPUSD pair made a pullback, and the pound weakened against the dollar.

- Germany’s consumer price inflation accelerated faster than expected in May and reached its highest level.

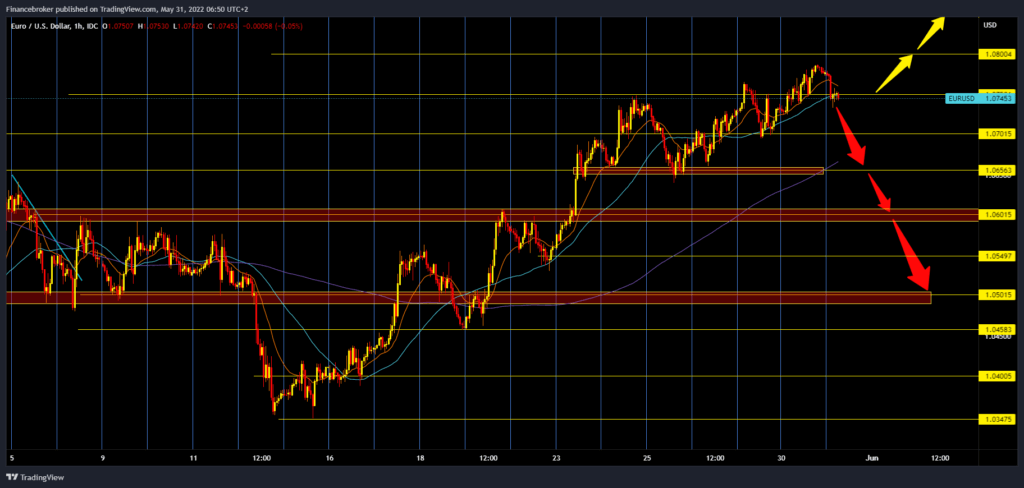

EURUSD chart analysis

During the Asian session, the euro withdrew from yesterday’s high of 1.07870 level to 1.07460 level. During that time, the dollar managed to stabilize and make certain gains. The dollar index rose from the beginning of trading last night from 101.40 to 101.66. If the strengthening of the dollar continues, we can expect the continuation of the EURUSD pullback to the first next support in the 1.07000 level zone. The latest news is that the European Union will ban 90% of Russian oil imports by the end of 2022.

This kind of news will negatively affect the euro because it will create additional pressure on energy prices in Europe, and thus there will be a new increase in inflation. We need to continue the current negative consolidation for the bearish option and lower it to the 1.07000 level. After that, if the pair makes a break below, we can expect a further descent to the 1.06500 level, last week’s low of May 25th. And we are looking for greater potential support in the zone around the 1.06000 level. For the bullish option, we need until yesterday’s maximum. The pair could make a break above and test the 1.08000 level with further positive consolidation. The potential following bullish targets are 1.08500, then 1.09000 levels.

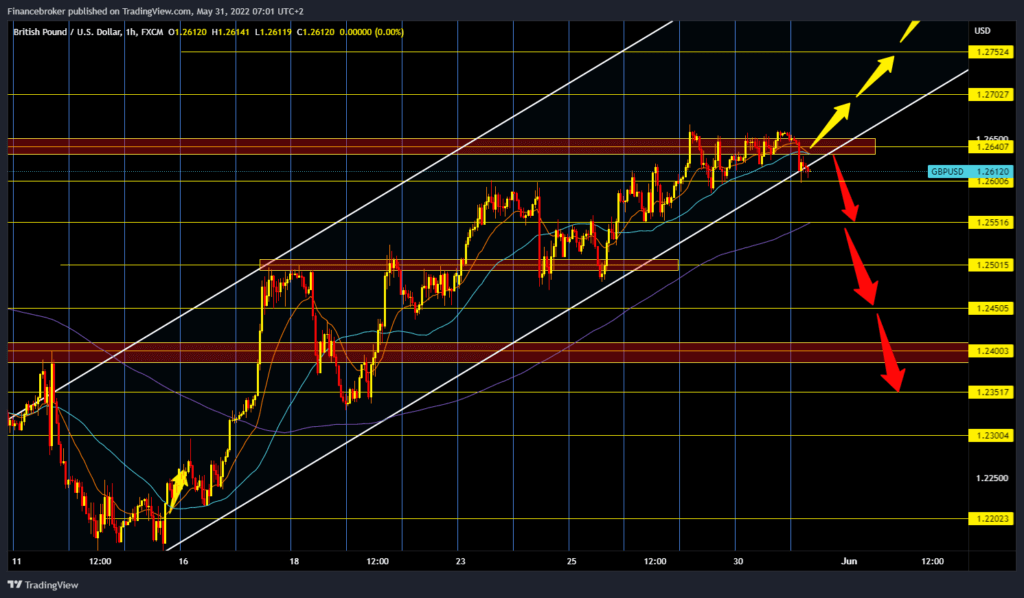

GBPUSD chart analysis

During the Asian session, the GBPUSD pair made a pullback, and the pound weakened against the dollar. The pair was stopped yesterday at 1.26625 level, from which we see the current pullback to 1.26000 level. Additional pressure is now on the lower line of the growing canal, formed on May 12. And a break could happen below, and that would put us in a bearish trend. We need to continue the negative consolidation and pullback below the 1.26000 level for the bearish option.

After that, the pound could continue to slide even lower toward the following levels of support. Potential bearish targets are 1.25500 and 1.25000 levels. For the bullish option, we need a new positive consolidation and a pound return above the 1.26000 level. After that, we return to the growing channels and then we can expect the bullish trend to continue. Our potential bullish targets are 1.27000 and 1.27500 levels.

Market overview

German inflation reached a new record

Germany’s consumer price inflation accelerated faster than expected in May and reached its highest level in almost half a century, preliminary data from Destatis showed on Monday.

Consumer prices rose 7.9 % year-on-year in May, faster than the 7.4 % rise in April. Economists expected inflation to rise to 7.6 %. This was the highest inflation rate since the winter of 1973-74.

The latest rise in inflation was largely driven by a 38.3 % rise in energy prices. Since the beginning of the war in Ukraine, especially energy prices have risen markedly and significantly affected the high inflation rate, according to Destatis.