EURUSD and GBPUSD: Potential resistance zone

- During the Asian session, the pair was around the 1.06500 level.

- During the Asian session, the British pound strengthened against the dollar after a sharp fall from yesterday.

- Eurozone Producer Price Inflation.

- Swiss Inflation.

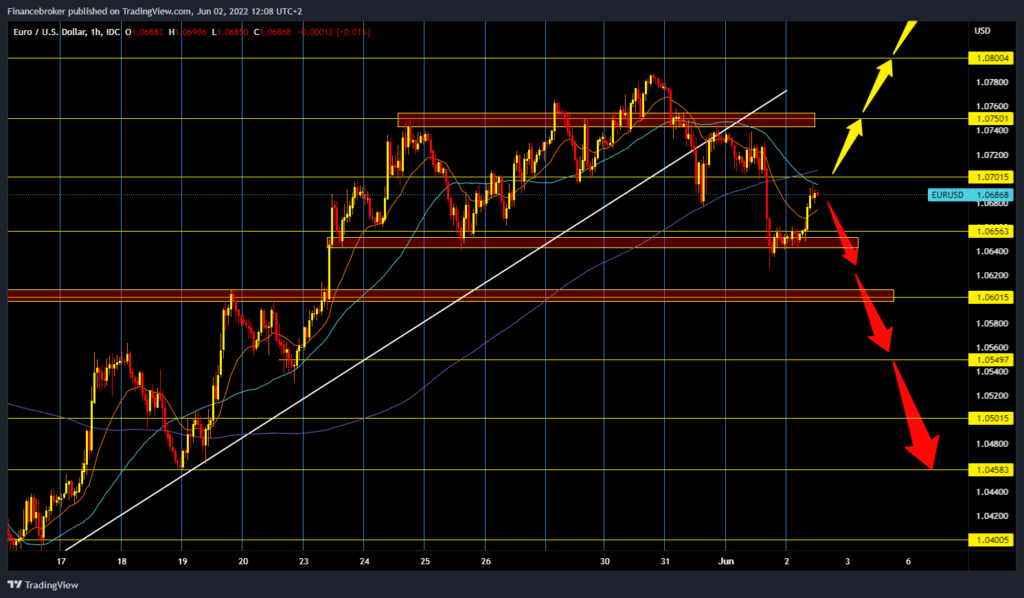

EURUSD chart analysis

During the Asian session, the pair was around the 1.06500 level, and as we approached the European session, the euro gained strength, and the pair climbed to the 1.06880 level. We can say that the euro is already on its third day of withdrawal, and now we need to pay attention to whether EURUSD will form a new lower high or will manage to climb to the 1.07400 level. A break above this zone would be a positive sign for us for a potential bullish sequel. Our next target is 1.07800 level, our maximum from the beginning of the week. We now need to form a lower high on the chart and a new negative consolidation for the bearish option. After that, the pair will retest the previous low at the 1.06400 level. A break below this level could bring us down to the following potential support levels. Our bearish targets are 1.06000, 1.05500 and 1.05000 levels.

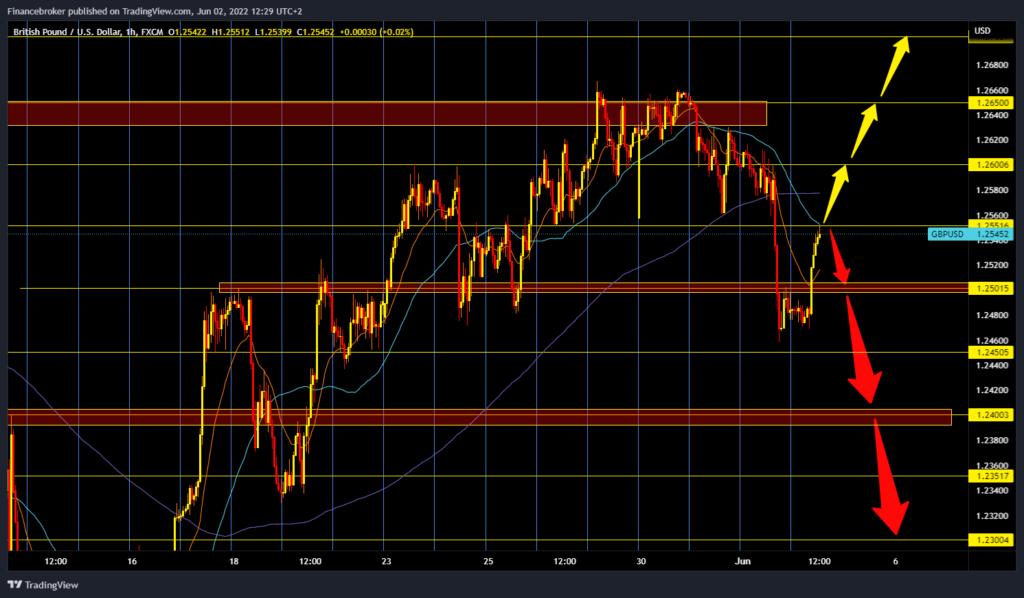

GBPUSD chart analysis

During the Asian session, the British pound strengthened against the dollar after a sharp fall from yesterday. A minor repair of sentiment in the market helped the pound. Now we come to a potential resistance zone at the 1.25000 level, and we need a break above to continue towards the 1.26000 level. If the pound manages to take such a step and consolidates to 1.26000, we could attack the 1.26500 level again, the zone of the May maximum. And then maybe we can move on to the 1.27000 level. For the bearish option, we need a new negative consolidation and a pullback to the previous support zone at 1.24800. A drop in prices below this potential support would increase bearish pressure. Our following bearish targets are 1.24500, 1.24000 and 1.23500 levels.

Market overview

Eurozone Producer Price Inflation

Eurozone producer price inflation accelerated to a new record high in April. Producer prices rose 37.2 % year-on-year in April, faster than the 36.9 % rise in March. However, this was less than expected by 38.5 %. A 99.2 % increase in energy prices and a 25.1 % rise in raw material prices led to a new record for producer price inflation. Producer prices in the EU27 rose 1.3 % on a monthly basis in April, bringing annual growth to 37.0 %.

Swiss Inflation

Switzerland’s consumer price inflation has risen to its highest level since September 2008, data from the Federal Bureau of Statistics showed on Thursday.

In May, consumer prices rose 2.9 % year-on-year after rising 2.5 % in April. Economists expected inflation of 2.6 %. On a monthly basis, consumer prices rose 0.7 % in May, after rising 0.4 % in the previous month. The core CPI, excluding prices of fresh and seasonal products, energy and fuel, rose 1.7 % year-on-year in May and 0.5 % year-on-month. Imported inflation was 7.4 % in May.