When is the Best Time to Buy a Cryptocurrency?

It is no secret that cryptocurrencies like Bitcoin experience daily (or even hourly) price volatility. As a consequence, people often get the idea that they should be attempting to time their investments – buying within specific windows to get the best possible price. Nevertheless, because cryptocurrency is traded 24 hours a day by investors around the world, timing a cryptocurrency buy is never cut and dried.

It is not surprising that people ask questions like “When is the best time to buy cryptocurrency,” or “When is the best time of day to buy cryptocurrency”.

So, if you want to invest in crypto, your best bet is to practice dollar-cost averaging (DCA). It is an investment technique that intends to decrease the impact of market volatility by investing a fixed amount of money on a regular schedule (for instance, purchasing $100 of Bitcoin every two weeks). And DCA is not unique to the cryptocurrency market. Traditional investors have been using DCA for a long time to weather stock market volatility. Besides, you may even use dollar-cost averaging already if you invest via your employer’s retirement plan every payday.

As stated above, using this method, you buy a little bit at a time over an extended period. Hence, even if you invest at some intervals that happen to be not all that low, you will locate others that are very low, and it may average out.

There are ebbs as well as flows to the cryptocurrency market that vary wildly depending on the specific cryptocurrency you are buying. Tokens may trade with yet another pattern. So, for someone intent on timing a crypto purchase, it will pay to really analyze the history of specific investment types.

As you already know, the title of this article is “When is the best time to buy a cryptocurrency” Let’s find out!

Cryptocurrency and investors

To cut a long story short, the best time to buy Bitcoin or any cryptocurrency is when you are ready to buy a cryptocurrency. Using the DCA approach, you will be able to control the volatility of your own cost (at least at some level) and avoid roller coasters. But don’t forget that the success of any DCA strategy is still subject to what is happening in the market.

People must prepare for the worst-case scenario. Never put more into crypto that you are willing to lose. People shouldn’t forget there are no guaranteed winners or asset classes that provide any sort of stability, especially if they tank to zero. For instance, some people have made a lot of money on the right buy at the right time; however, this is often just luck and not from timing the market.

One of the questions that come to mind is, “When is the best time of the day to buy cryptocurrency?”

Again, because crypto trades all day long, timing your trades to a certain time of day can be fraught with peril. Nevertheless, if you analyze a few months of data, a number of general patterns emerge.

Comparing the trading activity of Bitcoin, Ether, Solana, as well as Cardano – cryptocurrencies with some of the highest cap rates – shows that major cryptocurrencies tend to rise as well as fall together, which is quite handy for the sake of comparing windows of time for buys.

For instance, looking at data from October and November of 2021, the very best time of day to buy Bitcoin and other popular cryptocurrencies, in general, was in the morning, and the earlier, the better. Besides, other coins that are not considered to be as “serious” also followed similar patterns as Bitcoin and Ether, such as Dogecoin and Shiba Inu.

When is the best time of the week to buy cryptocurrency, do you know?

According to the same data used to determine the best day to buy crypto, the best time of the week to buy them seems to be Thursday. Do you know why, Let’s find out! Notably, six of the eight weeks saw a decline on that day. Moreover, if that trend continues ( which is most certainly not guaranteed), Thursday morning is the best time to buy Bitcoin or other cryptocurrencies.

When it comes to the second-best of the week, it is Monday (five of eight saw a dip). The third and fourth place belongs to Friday and Saturday (four of eight for both).

With crypto, everything is continually changing. It is a serious problem if you are trying to time purchases. For the time being, nevertheless, the best time of the month to buy is near the end. Notably, values tend to rise in the first ten days of the month, followed by a price collapse in the second half of the month.

Once again, this may vary with other cryptos or, in the case of altcoins. Based on the coins with the highest car rates, nevertheless, the trend seems to be fairly consistent.

What is the best move with crypto?

Timing a cryptocurrency buy can be difficult if the not treacherous thing to try since there are various kinds of elements that affect the price of a coin. Even though there are fewer personality-based drivers (such as sex scandals involving CEOs of major companies, for instance, there are more lemming-like sell-off.

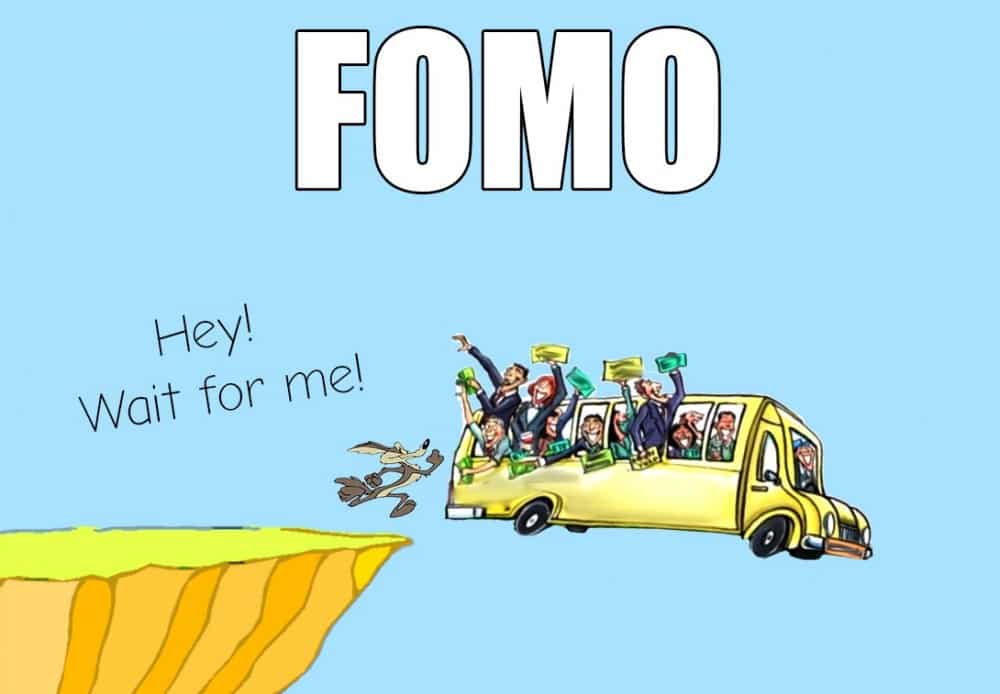

We shouldn’t forget about risk tolerance, as well as the fear of missing out (FOMO) on selling crypto holding for a short-term profit is a tempting siren song.

In the case of cryptocurrencies, as with any kind of investment, your best bet will always be to hold on for the longer term as well as to buy a little bit at a time. As a result, your highest returns will come from this strategy, although it is not particularly attractive and doesn’t provide any of that Vegas-like thrill for investors hoping for a quick winner.

What are altcoins

We mentioned altcoins, so let’s learn more about them. So, if you are interested in crypto investing, then you need to know more about altcoins. First of all, altcoins (alternative coins) is a term used to describe all cryptocurrencies other than Bitcoin. Their name comes from the fact that altcoins are alternatives to Bitcoin as well as traditional fiat money.

The first altcoins launched in 2011, and, at the moment, there are thousands of altcoins—early altcoins aimed at improving aspects of the world-famous cryptocurrency Bitcoin, such as transaction speeds or energy efficiency. However, more recent altcoins serve a variety of purposes depending on the goals of the developers.

Since they are such a big part of the market, crypto investors should understand how they work.

It is not obligatory but recommended to have at least some information about different types of altcoins. There are different types of altcoins, including mining-based coins, stablecoins, staking-based coins, as well as governance tokens. The type of altcoin depends on how this specific altcoin works and what its purpose is.

We can start with stablecoins. Importantly, stablecoins are cryptocurrencies designed to follow the price of another asset. The vast majority of the biggest stablecoins are pegged to the U.S. dollar and attempt to mimic the dollar’s value. If the price goes up and down, the issuer of the coin will take steps to correct it.

As they are intended to maintain the same value, stablecoins are normally not chosen as cryptocurrency investment. Instead, people use them for savings or to send money. Hopefully, it is also possible to earn interest on stablecoins by lending them out or through certain savings protocols.

Types of altcoins

As we discussed, stablecoins now we can move on to other types of altcoins. For example, mining-based. This type of cryptocurrency uses a process called mining to verify transactions and add more coins to the supply. Miners use devices in order to solve mathematical equations.

Usually, the first miner to solve the equation gets to verify a block of transactions. But they don’t solve equations out of curiosity, as in return, miners who verify blocks receive crypto rewards.

Since Bitcoin, the largest cryptocurrency in terms of market cap is a mining-based cryptocurrency, mining was the first method used to process crypto transactions. One serious problem with mining is that it consumes a lot of electricity.

Staking-based

It should be noted that these cryptocurrencies use a process called staking to confirm transactions and add more coins to the supply. Holders of such a cryptocurrency (staking-based) can choose to stake their coins, meaning they are pledging those coins to be used for transaction processing.

It is important to note that the cryptocurrency’s blockchain protocol chooses a participant to confirm a block of transactions. However, in return, participants receive crypto rewards.

Altcoin, called Peercoin, was the first to introduce the concept of staking. Even though Peercoin hasn’t become a household name, staking has become popular because it is more energy efficient compared to mining.

Governance

It is noteworthy that governance tokens are cryptocurrencies that give holders voting rights to help shape the future of the project. In many cases, governance tokens allow you to create as well as vote on proposals related to the cryptocurrency. Interestingly, this helps make the cryptocurrency a decentralized project since all holders have a say, and decisions aren’t made by one central authority.