Day Trading Millionaire: Is It Possible to Earn a Million?

Sure, it is possible to make money. However, if someone asks: Can forex trading make you rich? Even though our instinctive reaction to that would be a straightforward “No,” we should qualify that response.

Firstly, forex trading may make you rich if you are a hedge fund with a lot of money or an unusually skilled currency trader. However, for the average retail trader, rather than being an easy road to riches, forex trading can be a rocky highway to enormous and potential penury.

You will find many questions such as “Can you become a millionaire by day trading,” “How to become a millionaire day trading,” or “Can you become a millionaire from day trading .” As can be seen from the information stated above, the chance is very low.

However, that doesn’t mean you should forget about forex trading. Interestingly, many people like trading foreign currencies on the forex market because it requires the least amount of capital to start day trading.

As you already know, forex trades 24 hours a day during the week. It offers a lot of profit potential due to the leverage forex brokers provide. But remember that forex trading can be highly volatile, and an inexperienced trader can lose a lot of money.

Day trading and risk management

Risk management is an essential part of forex trading strategy, usually done with a stop-loss order.

Successful forex day traders manage their risk; it is one of the most crucial elements of ongoing profitability. First and foremost, you must keep your risk on each trade very small, and 1% or less is typical. For example, if you have a $3,000 account, you shouldn’t lose more than $30 on a single trade.

That amount of money may seem small; however, losses do add up, and even a well-balanced day trading strategy will see a number of losses. What you need to know is that risk is managed using a stop-loss order; we will return to a stop-loss order soon.

Forex trading strategy and its role

While a forex trading strategy can potentially have many components as well as can be analyzed for profitability in numerous ways, a strategy is often ranked based on its win rate and risk/reward ratio.

Your win ratio represents the number of trades you win out of a given total. Let’s assume you win 55 out of 100 trades; your win rate would be 55%. Having a win rate above 50% is excellent for the vast majority of day traders, and 55% is achievable.

Risk/reward ratio

Now, we can switch to a risk/reward ratio. It signifies how much capital is being risked to attain a certain profit.

For instance, if a trader loses ten pips on losing trades, however, makes 15 on winning trades, they are making more on the winners than they are losing on losers. Notably, that means that even if the trader only wins 50% of their trades, they will be profitable. Hence, making more on winning trades is also an essential component for which many forex day traders aspire.

Moreover, a higher win rate for trades means more elasticity with your risk/reward, as well as a high risk/reward, which means that your win rate can be lower, and you’ll still be profitable.

One hypothetical scenario and forex day trading

Let’s discuss one scenario. Let’s assume a trader has $5,000 in capital funds, and they have a presentable win of 55% on their trades. They risk 1% of $50,000, or $50, per trade. That is fulfilled by using a stop-loss order.

For this case, a stop-loss order is placed five pips away from the trade entry price, and a target is placed eight pips away. Notably, that means that the potential prize for each trade is 1.6 times the risk (8 pips divided by five pips). It is noteworthy that you want winners to be more significant compared to losers.

While trading a forex pair for two hours during an active time of day, it is generally possible to make about five “round turn” trades (round turn includes entry and exit) using the above parameters. Furthermore, if there are 20 trading days in a month, the trader is making 100 trades, on average, in a month.

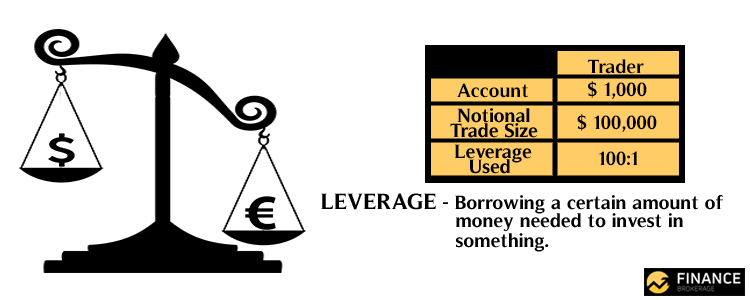

Trading leverage

As an example, we can use the United States. In the United States, forex brokers provide leverage up to 50 to 1 on major currency pairs. For this case, suppose the trader is using 30 to 1 leverage, as that typically is more than enough leverage for many forex day traders.

Since the forex trader has $5,000 and leverage is 30 to 1, the trader can take positions worth up to $150,000. Nevertheless, the risk is still based on the original $50,000; this keeps the risk limited to a small part of the deposited capital.

Some people might not be aware, but forex brokers, in many cases, don’t charge a commission but rather enlarge the spread between the bid and ask, hence making it more difficult to day trade profitably, but brokers typically charge about $2.50 for every $100,000 trader ($5 round turn).

Trading currency pairs and forex traders

If you are day trading a currency pair such as the USD/CAD, you can risk 50 U.S. dollars on each trade, as well as each pip of movement is worth $10 with a standard lot (100,000 units worth of currency).

As a result, you have the opportunity to take a position of one standard lot with a five-pip stop-loss order, which will maintain the risk of loss to $50 on the trade. Furthermore, that means a winning trade is worth $80 (8 pips multiplied by $10).

For example, this estimate shows how much a forex day trader could make in a month by executing 100 trades.

- 55 trades were profitable: 55 multiplied by $90 equals $4,400

- 45 trades were losers: 45 multiplied by ($50) equals ($2,250)

Gross profit: $4,4000-$2,250=$2,150 if no commissions (win rate would likely be lower)

Net profit: $2,150-$500=$1,650 if using a commission broker (win rate would likely be higher)

Presuming a net profit of $1,650, the return on the account for the month is 33% ($1,650 divided by $5,000). Clearly, that may seem very high, and it is an excellent return.

Risk factors

You need to remember that slippage is an unavoidable part of trading. More importantly, it results in a larger loss than expected, even when using a stop-loss order. Also, slippage is widespread in very swiftly moving markets.

In order to account for slippage in the calculation of your potential profit, you need to lower the net profit by 10% (This is a high estimate for slippage, assuming you avoid holding through major economic data releases). Notably, that would reduce the net profit potential generated by your $5,000 trading capital to $1,485 per month.

You can adjust the above-mentioned scenario based on your typical stop-loss and target, capital, slippage, win rate, position size, as well as commission parameters.

The simple risk-controlled strategy indicates that with a 55% win rate, as well as making more on winners compared to what you lose on losing trades, it is possible to attain returns more significant than 20% per month with forex day trading. The vast majority of forex traders shouldn’t expect to make that much; while it sounds simple, in reality, it is not an easy task.

Even so, with a reasonable win rate and risk/reward ratio, a dedicated forex day trader with a good strategy can make 5% to 15% per month, thanks to leverage. Hopefully, you don’t need much capital to get started; $500 to $1,000 is usually enough.

Several avoidable mistakes forex day traders make

If you want to become a successful day trader, you need to pay attention to details. We already discussed some of them, but it is important to memorize them by heart.

Mistake number one: If you keep losing, don’t keep trading. There are two trading strategies to keep an eye on: Your win rate and risk-reward ratio.

Mistake number two: Trading without a stop loss. Traders should have a stop-loss order for every forex trade they make.

We need to mention another mistake: Adding to losing day trade. Averaging down is adding to your position as the price moves against you, in the inaccurate belief that the trend will reverse. Without a doubt, adding to a losing trade is a dangerous practice.

Do you know which is one of the most serious mistakes many traders often make? They lose more money than they can afford. The central part of your risk management strategy is establishing how much of your capital you are willing to risk on each trade.

One serious mistake is to trade without a plan. A trading plan is a written document that outlines your strategy. Your trading plan defines how, what, and when you will trade. It should include what markets you will trade, at what time, and what time frame you will use for analyzing and making trades.

Moreover, the plan should outline your risk management rules and should outline exactly how you will enter and exit trades for both winning and losing trades.