Market overview: More Fresh Profits

S&P 500 decisively turned around, and declined powerfully. The short entry was well placed, and open profits are likely to grow still before the bottom is reached. What we‘re likely to experience next, is tech-driven brief reprieve, which would help cushion heavy S&P 500 downside temporarily. The stock market downswing hasn‘t run its course though today‘s rising real asset prices would help the bulls temporarily.

The dollar of course isn‘t really retreating, and neither the pressure on the Fed to raise, is relenting – yet precious metals keep holding up reasonably well. Is there a quiet money flow underway, one that sees long-dated Treasuries benefiting as well? I think so, and come autumn, this would become obvious. Crude oil apparently hasn‘t peaked either, no matter what those focusing solely on the real economy prospects say – remember, black gold is the one to top last, and I hadn‘t seen a decent spike yet. Time to go, for quite a few weeks more – and let the open profits grow too.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

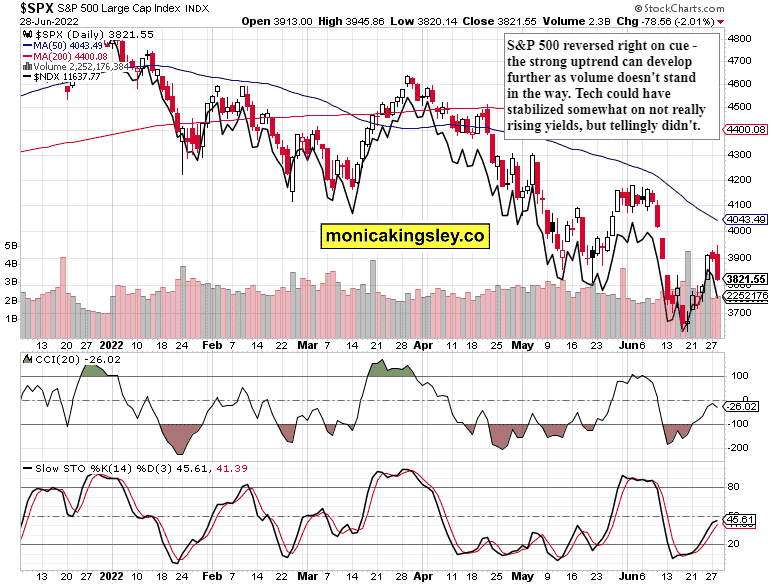

S&P 500 and Nasdaq Outlook

The caption says it all – S&P 500 is primed to decline some more, but I‘m looking for a little counter trend move first. Odds are the bulls won‘t make it far.

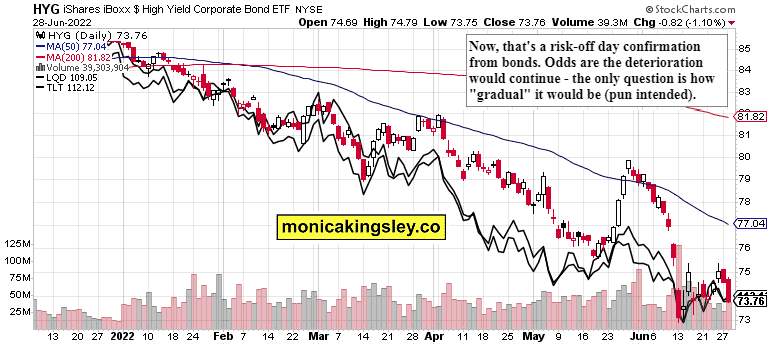

Credit Markets

Bonds turned risk-off, and soundly so. Especially the HYG move holds great promise. As you can see, the TLT downswing is in its latter innings, and in need of some consolidation (one that would coincide with deteriorating economic data showing so) first.

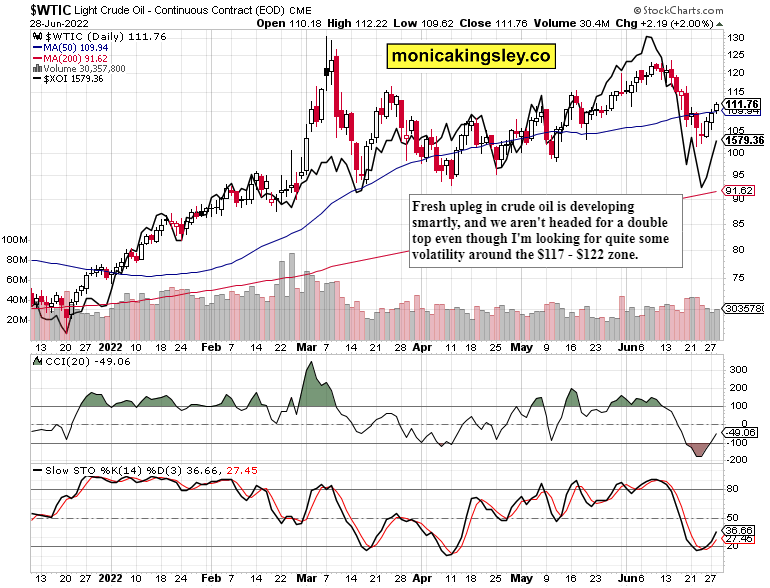

Crude Oil

Oil is turning up, the next consolidation to arrive, would happen above the 50-day moving average. I like oil stocks having come to life (against the background of steep stock market decline) particularly.

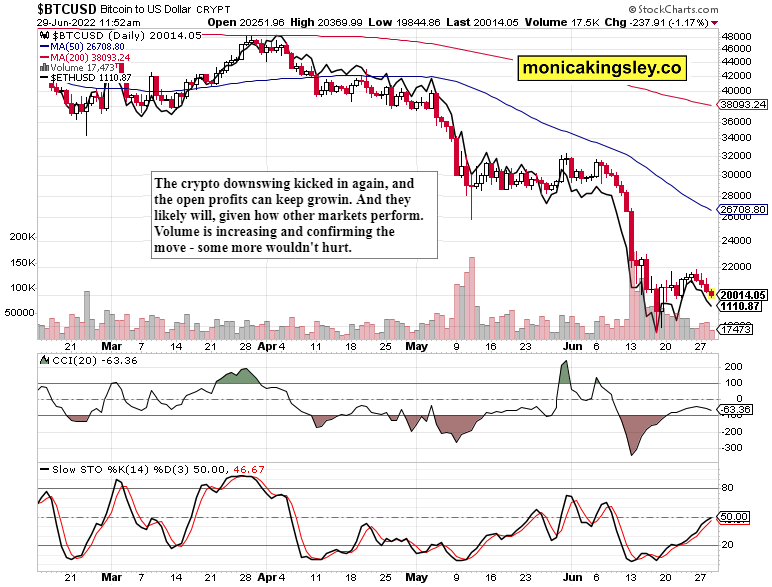

Bitcoin and Ethereum

Business as usual in cryptos – business just as lately. See how far Stochastics has risen while prices are already turning down. The weeks ahead appear one hell of a ride.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.