EURUSD and GBPUSD: Crisis

- During the Asian trading session, the euro continued to weaken strongly against the dollar.

- Similarly, the euro and the pound continue their bearish trend.

- Fall in UK retail sales.

- Falling consumer confidence in Australia.

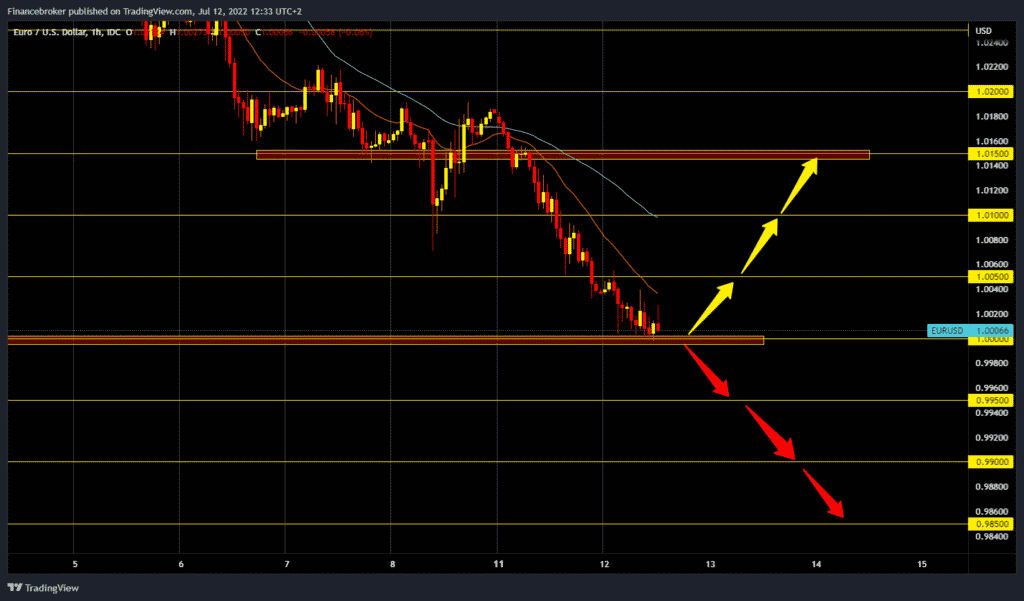

EURUSD chart analysis

During the Asian trading session, the euro continued to weaken strongly against the dollar. Political scandals in Europe with the announcement of an energy crisis drag the euro down. For the first time since 1991, Germany’s trade balance with foreign countries is in deficit. On the other hand, while ECB officials expressed reservations about raising the benchmark ECB interest rate this summer, the regular monthly report from the US labor market showed a better-than-expected picture on Friday. That sent a signal that US price inflation could continue to rise.

An increase of 0.75% at the end of July is almost certain. The euro is trading at $1.00245, which represents a weakening of the European common currency by 0.14% since the start of trading last night. For a bullish option, we now need a new positive consolidation and a return above the 1.00500 level. After that, we found support in the MA20 moving average, and we could see a potential recovery in the euro. Our next target is the 1.01000 level, then the 1.01500 resistance zone. We need a continuation of the negative consolidation and a drop below the 1.0000 level for a bearish option. After that, the euro could continue to weaken, and our targets are 0.99500 and 0.99000 potential support zones.

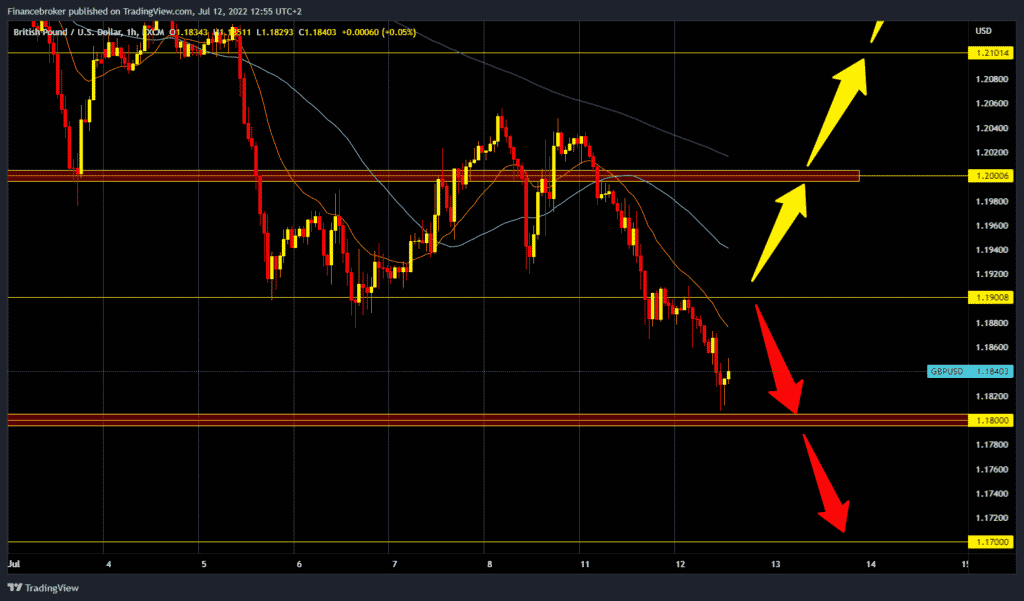

GBPUSD chart analysis

Similarly, the euro and the pound continue their bearish trend. The pound continues to weaken against the US dollar during the Asian trading session. The pound is now trading at $1.18400, down 0.38% since trading began last night. Today’s minimum was at the 1.18080 level, and we were here last time in March 2020. For a bullish option, we need another positive consolidation, and the pound must return above the 1.19000 level if it is to continue its recovery. By breaking above this level, the pound gains support in the MA20 moving average. That could add some strength to the pound to try to climb even higher and closer to the 1.20000 level. We need a continuation of the negative consolidation and a drop below the 1.18000 level for a bearish option. After that, the pound could continue lower towards the next support zone around the 1.17000 level.

Market overview

Fall in UK retail sales

UK retail sales dropped for the third consecutive month through June as households cut spending due to rising costs, data compiled by the British Retail Consortium and advisory firm KPMG showed on Tuesday. In June, sales decreased by 1.3% on an annual basis. Total sales fell by 1.0%.

Falling consumer confidence in Australia

Westpac survey data on Tuesday showed that confidence among Australian consumers further deteriorated to new lows in July amid surging inflation and rising interest rates. The Westpac-Melbourne Institute consumer sentiment index fell 3.0% to 83.8 in July from 86.4 in June. The index, which measures the financial situation of consumers over the next twelve months, was largely unchanged. The finance sub-index recorded a milder decline of 2.8% compared to a year ago.