Market overview: Right on Cue

S&P 500 declined, but the short-term bullish case is far from lost. There is a stark contrast to yesterday‘s tech earnings as opposed to Walmart or Snapchat lately – shifting focus to the current stage of the economy, which isn‘t that gloomy yet, regardless of the likely negative quarterly GDP figure coming tomorrow. Coupled with the subsequent Yellen press conference, we have a lot of not-a-recession talk to look forward for. After all, the greatest deterioration is in the leading components, and that takes time to seep into coincident indicators – late 2022 pr early 2023 looks to be a better timing for an officially declared recession. With the Fed doing 75bp hike, and no more, the table is set for a relief rally later today, and for getting second thoughts tomorrow (as usual lately, one day after FOMC). More thoughts covering other markets, are available for premium subscribers).

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article features good 6 ones.

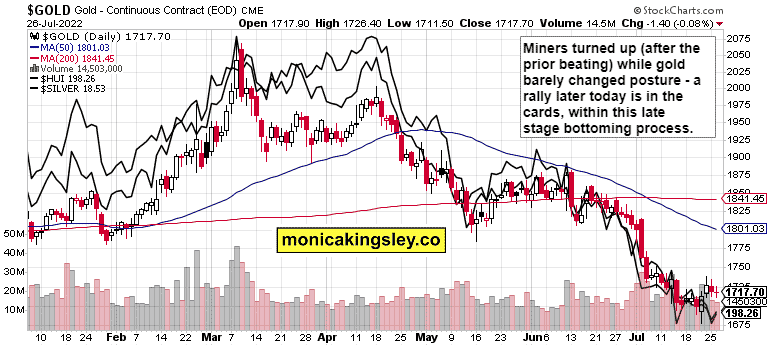

Gold, Silver and Miners

Precious metals gave some bullish signals for the short term, but this bottoming process isn‘t over yet – especially in time isn‘t over yet.

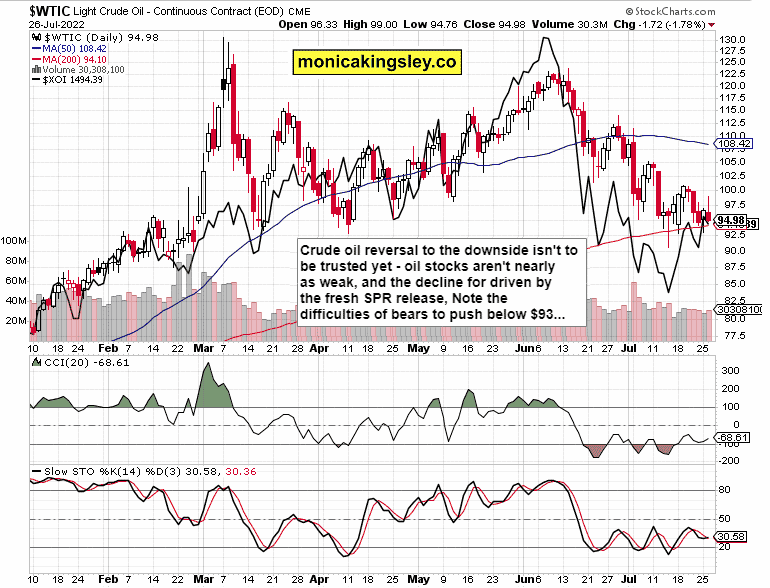

Crude Oil

Crude oil didn‘t stage a genuine reversal – the turnaround is set to continue. Given how much time has passed since the $93 test, and how far oil stocks have travelled, the bullish case is clear beyond medium term.

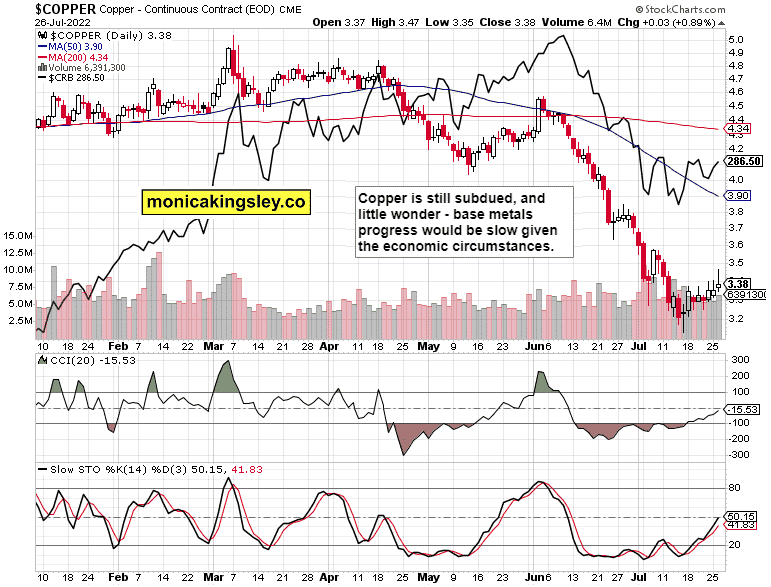

Copper

Copper sure has issues rising, but the willingness to try is there. More time is needed to enable such a move – the macroeconomic factors still speak against betting big on the long side here.

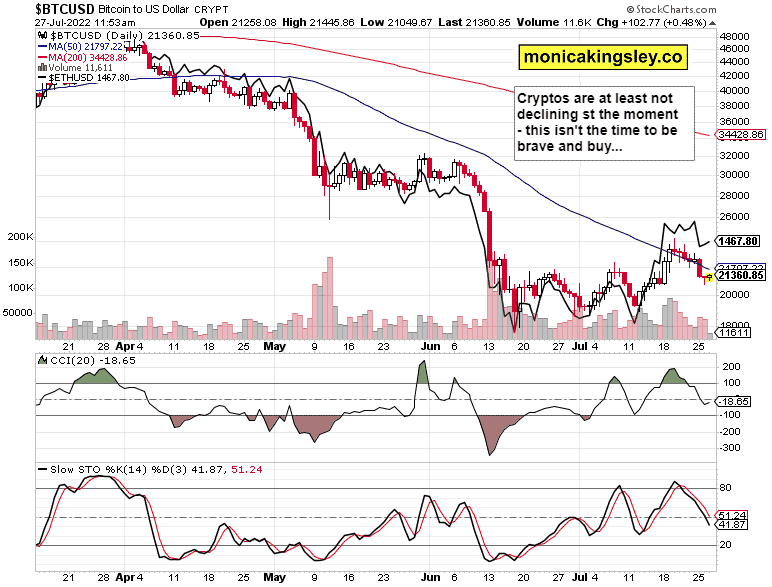

Bitcoin and Ethereum

Cryptos aren‘t making progress, and aren‘t following the simmering risk-on sentiment. As stated yesterday, increased focus on all that‘s wrong in the space, doesn‘t help, and the situation isn‘t likely to improve in the short run.

Thank you for having read today‘s free analysis, which is a small part of the premium Monica’s Trading Signals covering all the markets you’re used to (stocks, bonds, gold, silver, oil, copper, cryptos), and of the premium Monica’s Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates. While at my homesite, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves. Thanks for subscribing & all your support that makes this endeavor possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.