EURUSD and GBPUSD: New Lower High

- Yesterday, the euro once again found support at the 1.01200 level and thus confirmed the previous low of August 3.

- In the first part of the day, the pair GBPUSD moved around 1.21000 levels.

- Consumer price inflation rose to 10.1% in July from 9.4% in June, the latest data from the State Bureau of Statistics showed this morning.

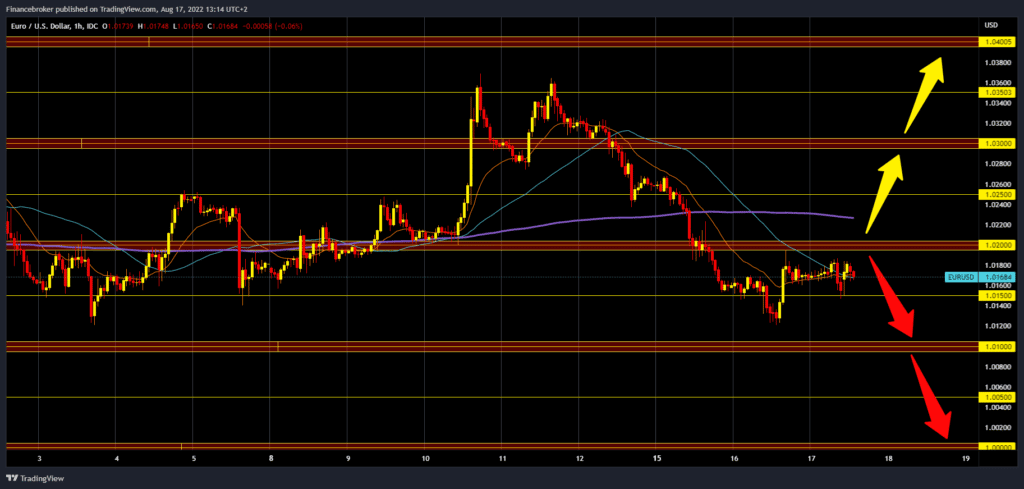

EURUSD chart analysis

Yesterday, the euro once again found support at the 1.01200 level and thus confirmed the previous low of August 3. This was followed by a quick return to the 1.02000 level, and since then, we have been consolidating in the 1.01500-1.02000 range. For a bullish option, we need a positive consolidation and a euro jump above the 1.02000 level.

If we manage to do that, we need to stay above so that we can better consolidate from that position and start a new bullish impulse. In the zone around 1.02200, we encounter additional resistance in the MA200 moving average. A break above the euro would ease the way to the 1.02500 level. A potential higher target is the 1.03000 level. For a bearish option, we need negative consolidation and a fall of the euro below the 1.01500 level. After that, the pair EURUSD could continue to the 1.01000 support zone. If the pressure on the euro continues and the dollar continues to strengthen, then we can expect a continuation of the fall of the euro first to 1.00500, then to 1.00000 levels.

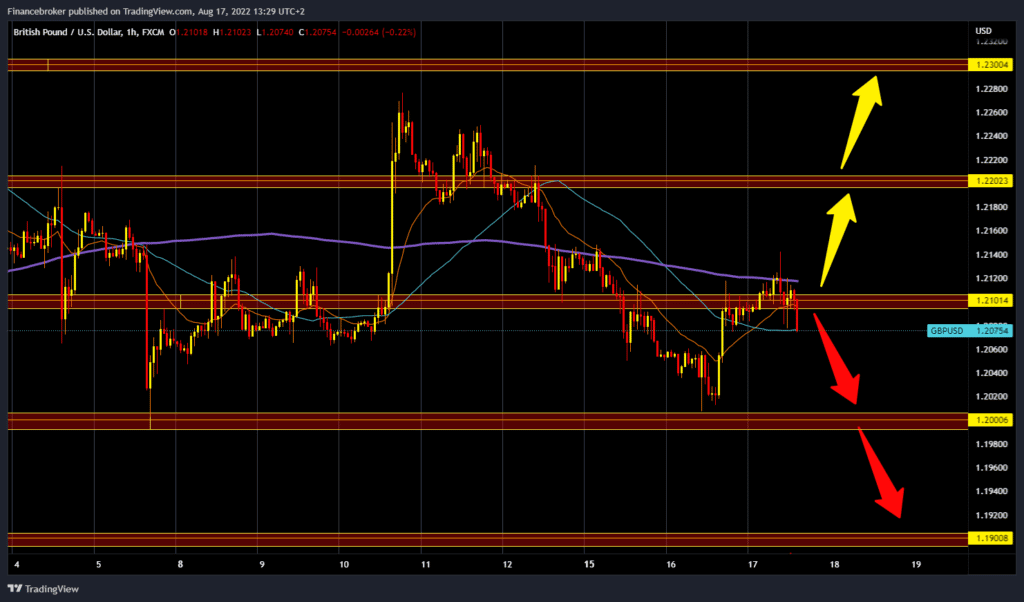

GBPUSD chart analysis

In the first part of the day, the pair GBPUSD moved around 1.21000 levels. We saw the pound attempt to climb above the MA200 moving average, but there was no strength to hold above. This drop was followed by a withdrawal of the pound below the 1.21000 level, and we are currently at the 1.20800 level. We have additional support at that level in the MA50 moving average.

We can say that the pair formed a new lower high at 1.21400, and based on that, we expect further withdrawal of the pound unless we see a break above that level. For a bearish option, we need a continuation of the current negative consolidation. We can expect the pound to slide to the 1.20500 level first and then descend to the psychological support at the 1.20000 level. If we do not find support there, we can then expect the pound to fall below and test the first July support zone at the 1.19000 level.

Market overview

Consumer price inflation rose to 10.1% in July from 9.4% in June, the latest data from the State Bureau of Statistics showed this morning. This kind of inflation was last seen in 1982, 40 years ago. The Bank of England forecasts that the inflationary spike will last until October, when inflation is expected to jump to 13.0%. The BoE is likely to decide on an interest rate hike of $0.50 on the 15th of September instead of an increase of 0.25%, predicted Capital Economics economist Ruth Gregory. The BoE has raised its interest rate in the last six meetings, which now stands at 1.75%. Core inflation, which excludes energy, food, alcoholic beverages, and tobacco, rose to 6.2% from 5.8%.