EURUSD and GBPUSD: 37-Year Low

- During the Asian trading session, the euro managed to hold above the 0.98000 level.

- GBPUSD marks a new 37-year low today at the 1.12200 level.

- Bank of England policymakers raised the benchmark rate by 0.50% to 2.25% from 1.75%, despite recession fears.

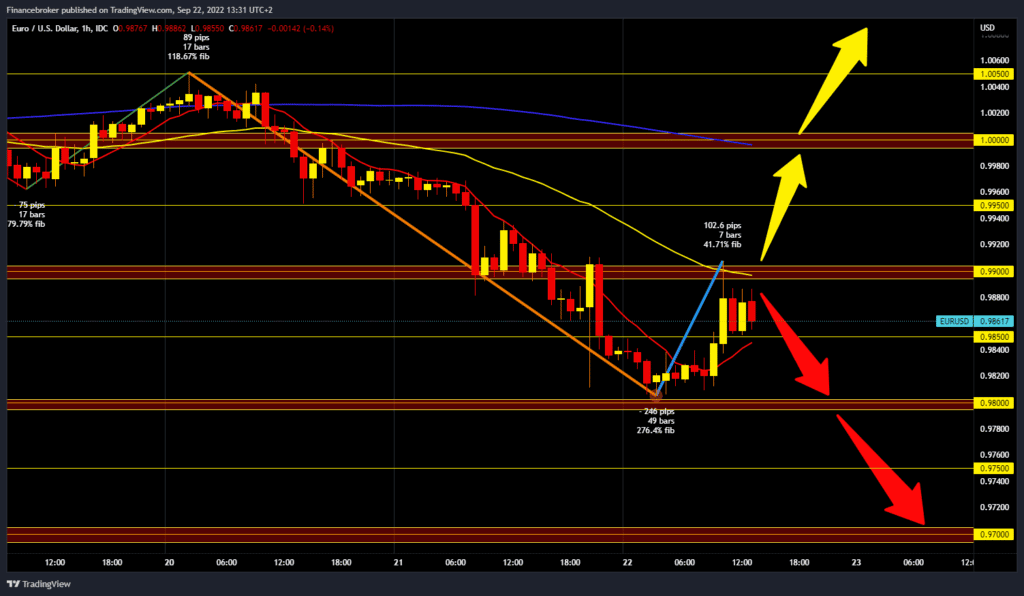

EURUSD chart analysis

During the Asian trading session, the euro managed to hold above the 0.98000 level. After that, we see a bullish impulse to the 0.99000 level, and now we are moving in the 0.98500-0.99000 range. For now, we have resistance at the 0.99000 level, and we need a break above it in order to try to continue the recovery of the euro. For a bullish option, we need a continuation of positive consolidation. Potential higher targets are 0.99500 and 1.00000 levels. We need a negative consolidation and a drop below the 0.98500 level for a bearish option. In continuation, we could meet again at the 0.98000 support level. A break below this morning’s support would form a new lower low. Potential lower targets are 0.97500 and 0.97000 levels.

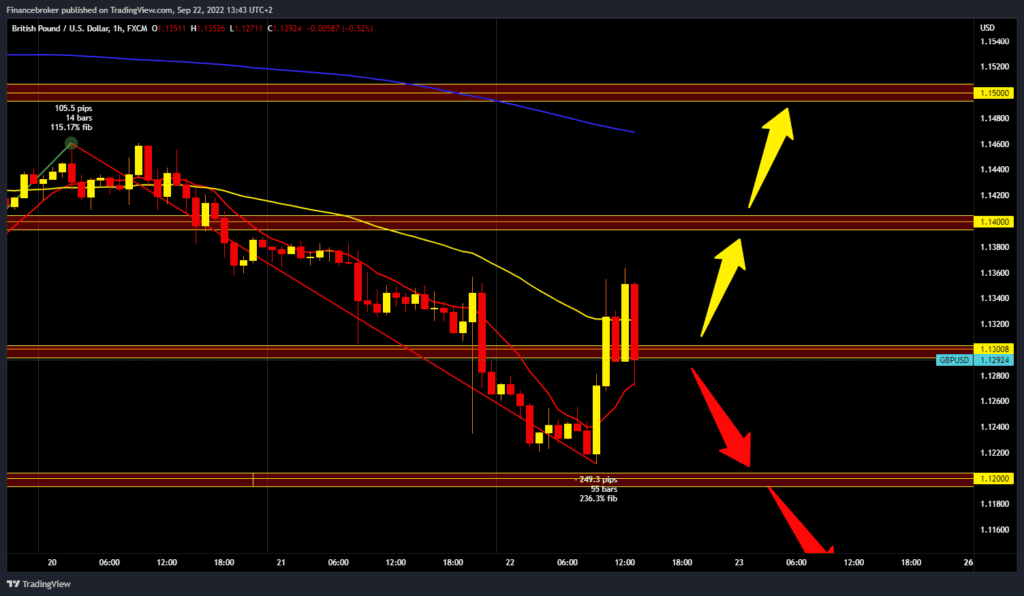

GBPUSD chart analysis

GBPUSD marks a new 37-year low today at the 1.12200 level. We then see a bullish impulse to the 1.13600 level and encounter further resistance. A new pullback to 1.13000 levels followed after the Bank of England raised its interest rate from 1.75% to 2.25%. We need a new positive consolidation and testing of the previous high at the 1.13600 level for a bullish option. A break above could move us to the 1.14000 resistance level. We need a negative consolidation and a return below the 1.13000 level for a bearish option. After that, the pair could slip back to the previous low at the 1.12200 level. Potential lower targets are 1.12000 and 1.11500 levels.

Market Overview

Bank of England policymakers raised the benchmark rate by 0.50% to 2.25% from 1.75%, despite recession fears. The seventh consecutive interest rate hike lifted the interest rate to its highest level since November 2008.

The Swiss National Bank raised its key interest rate into positive territory on Thursday to counter a resurgence in inflationary pressures. The central bank increased the reference rate of the SNB from -0.25% by 0.75% to 0.5%.