EURUSD and GBPUSD: The Upper Trend

- During the Asian session, the EURUSD pair consolidated at the 0.97000 level and started a bullish recovery.

- The pound is also positive today. From the start of the trading day, the pound is up 1.10% against the dollar.

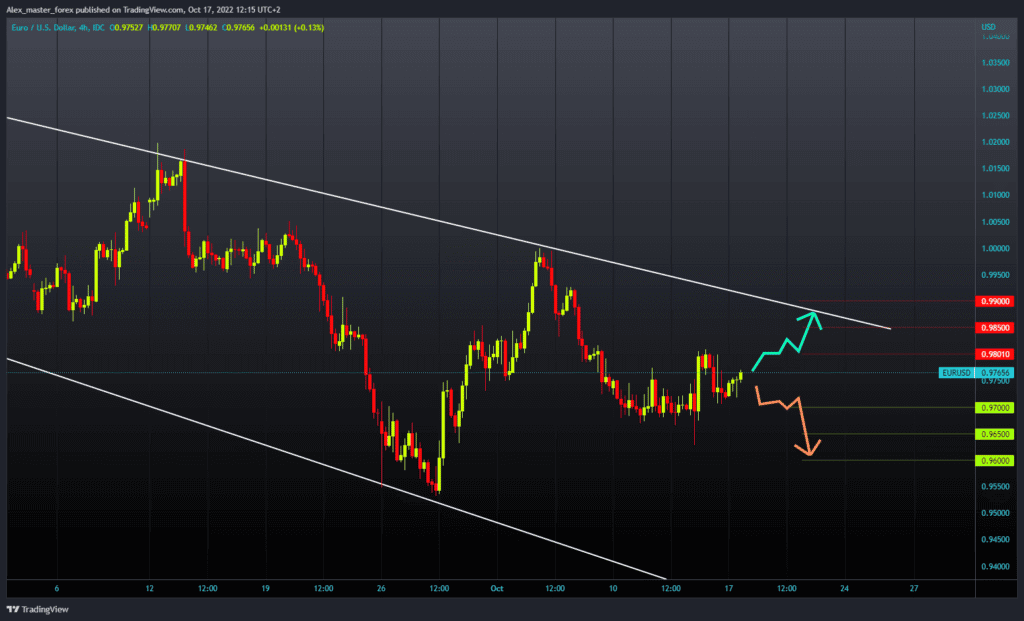

EURUSD chart analysis

During the Asian session, the EURUSD pair consolidated at the 0.97000 level and started a Compared to the beginning of the trading day, the euro advanced 0.50% against the US dollar. We need a stable euro to move us to the 0.98000 resistance level from Friday to continue the bullish option. After that, we should try to stay there and continue the euro’s recovery with the next bullish impulse. Potential higher targets are 0.98500 and 0.9900 levels. We need a negative consolidation and a return to the 0.97000 support zone for a bearish option. A break below the euro could form a new October lower low. Potential lower targets are 0.96500 and 0.96000 levels.

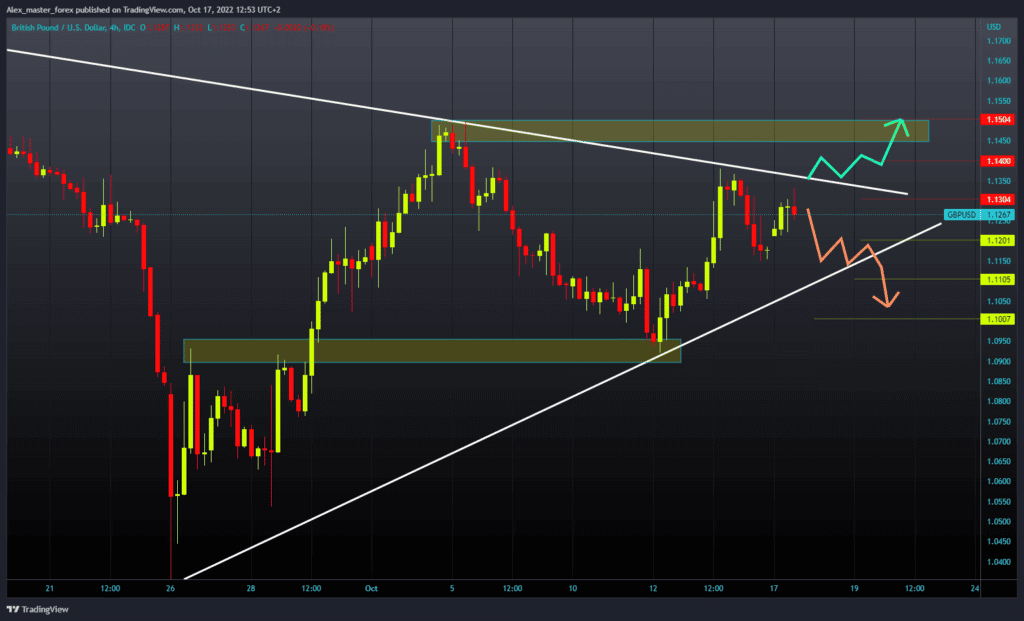

GBPUSD chart analysis

The pound is also positive today. From the start of the trading day, the pound is up 1.10% against the dollar. We are now at the 1.13000 level and need a jump to the 1.14000 level to test last week’s resistance. The upper trend line creates additional pressure in that zone. A break above the pound and staying above it would greatly help us; after that, we could expect a new bullish impulse. A potential higher target is the 1.15000 resistance level from October 5. We need negative consolidation and pullback to the 1.12000 level for the bearish option. After that, we would again test this morning’s low at the 1.11500 level. A break below the pound would increase the bearish pressure, and we would see a continuation of the pound’s decline. Potential lower targets are 1.11000 and 1.10000 levels.

Market Overview

Japanese Finance Minister Shunichi Suzuki, who indicated after meetings last week that Japan would not necessarily reveal when it intervenes in the currency market, was quoted by the Nikkei business daily on Monday as saying authorities would take decisive action against excessive currency movements driven by speculation.

Today we have no important economic news in the EU and US sessions.