EURUSD and GBPUSD: dollar strong at the start of the week

- During the Asian trading session, the pair EURUSD fell below 1.03000, last week’s support level.

- During the Asian trading session, the pound fell against the US dollar.

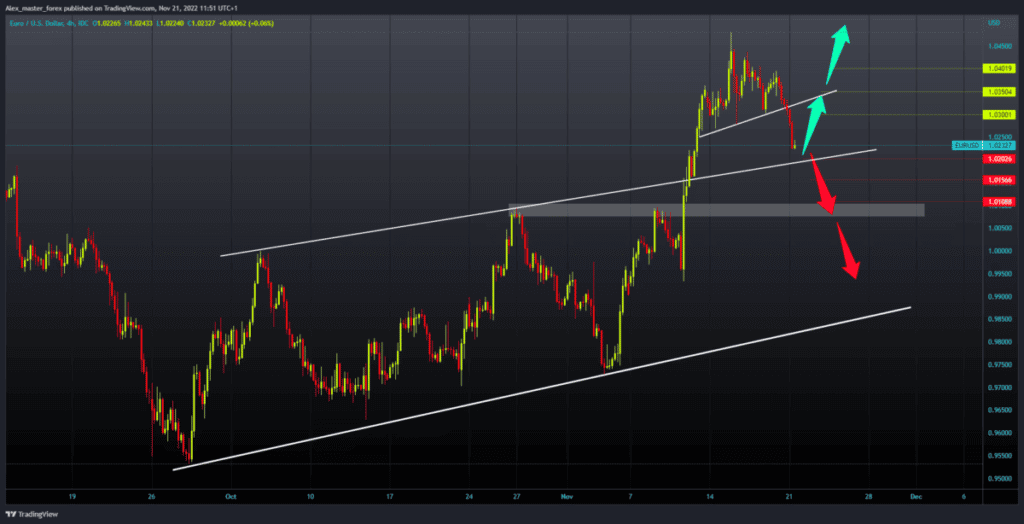

EURUSD chart analysis

During the Asian trading session, the pair EURUSD fell below 1.03000, last week’s support level. We are now sliding towards the 1.02000 level, where we could find potential support. Additional support at that level is in the trend line. A breakout of the euro below this trend line could push the euro into a stronger bearish pullback.

After that, we would look at the 1.01000 level as the next potential support because that position coincides with the previous breakout point. And here, we could expect great support for the euro. We need a positive consolidation and a return to the 1.03000 resistance level for a bullish option. Then we need to break above and try to stay there in order to continue the recovery with a new bullish impulse. Potential higher targets are 1.03500 and 1.04000 levels.

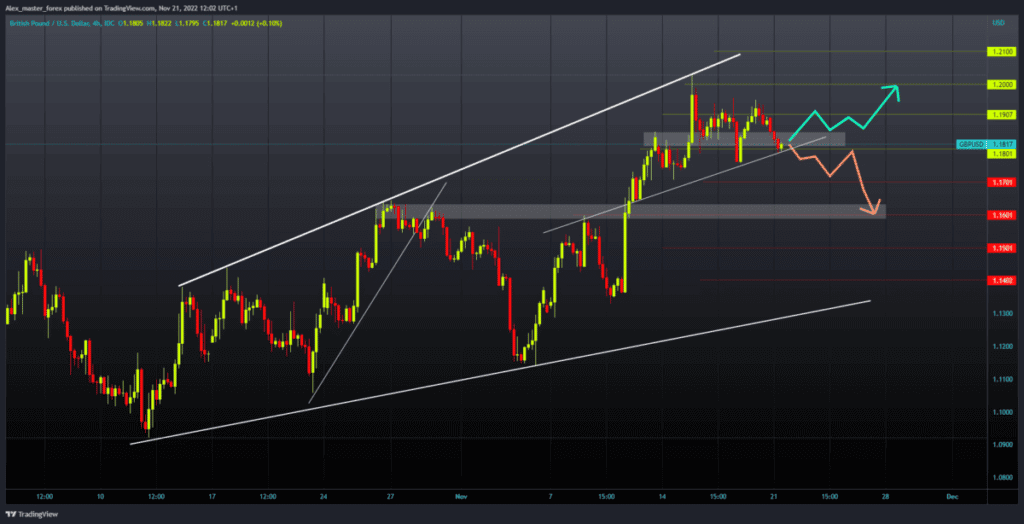

GBPUSD chart analysis

During the Asian trading session, the pound fell against the US dollar. We are now testing the 1.18000 level as a potential support that could end this pullback in the pound. We need a new positive consolidation above the 1.18000 level for a bullish option. Thus, the pair would form a new higher low from which we could expect a further recovery of the pound.

And potential higher targets are 1.19000 and 1.20000 levels. We need a negative consolidation and a breakout of the pound below the current support level for a bearish option. With that, we would test the next low at the 1.17500 level. If he does not provide us with sufficient support, the pair could continue to fall. Potential lower targets are 1.17000 and 1.16000 levels.

Market overview

Producer price inflation in Germany fell more than expected in October and reached the lowest level in the last four months, Destatis data showed this morning.

Producer prices rose 34.5% year-on-year in October, much less than the 45.8% increase in September. It was also well below economists’ expectations.