Price action indicator and price action strategy – what is behind

The price action indicator is one of the most used tools in trading. Short-term and long-term traders equally apply it in their strategies to gain an edge. Understanding price action trading is necessary for new and seasoned traders in any financial market. This article covers everything you need to know about price action in trading.

What is price action?

By price action, we mean a form of trading that analyzes price movements only graphically, without any other indicator. This minimalist approach to technical analysis using price action indicators offers many benefits, including improving responsiveness to market movements.

But what is the price action indicator? What is price action in Forex and other financial markets? What are the differences with other forms of trading? We explain everything in detail so you have the right cards to decipher the price action strategy.

Price action indicator: the most responsive technical analysis tool that exists

The price, the price, and nothing but the price! If we had to sum up the philosophy of price action, this is what we would tell you. This trading concept consists of analyzing market movements using, most of the time, Japanese candlesticks, which are the technical analysis charts most used by traders.

It is an approach according to which all the information necessary for trading is found in the price chart of a financial asset, whatever it is (stock, index, currency, commodity, etc.).

The graphic, which, as previously pointed out, is extremely clean, is sometimes said to be “naked.” No indicator appears to disturb the reading, except the indication of the price levels, in the form of a candlestick. Buying and selling are simplified, enhancing the immediacy of decision-making.

Pure or naked price action focuses only on real-time prices instead of searching for complex calculations and formulas. Relying on this indicator means you trade relying on your intuition and understanding of the current market situation.

Price action signals or price action patterns are market triggers used to predict market price behavior.

Thanks to these patterns, it is possible to know everything that has happened in a market during a given period and to make trading decisions accordingly. If the price action analysis shows that the price is rising, it is possible to anticipate a long position. Conversely, in the event of a possible fall, a short sale may be considered.

The best strategies with price action indicator

- The sequence of highs and lows

- Price action trend trading

- Trend following breakout entry

- Head and shoulders reversal trade

The sequence of highs and lows

Price action trading is all about following prices’ highs and lows. Following the sequence of highs and lows allows mapping out upcoming asset price trends. In case the price is sitting at higher lows and higher highs, it shows we have an uptrend. It’s a suitable strategy for determining the henry points at the lower end of an uptrend and for putting a stop loss before the previous higher low.

Price action trend trading

Price action trend trading strategy involves the study of price trends where traders aim to identify trend reversals. It’s suitable for new traders enabling them to chase price action trends once detected.

Head and shoulders reversal trade

This is the most common price action strategy. It enables traders to pick out the henry point and stop the loss point. Head and shoulders are a pattern that shows price rising and following. When trading using this strategy, traders open a trade after the first shoulder and set the stop loss order after the second shoulder to benefit from the temporary peak.

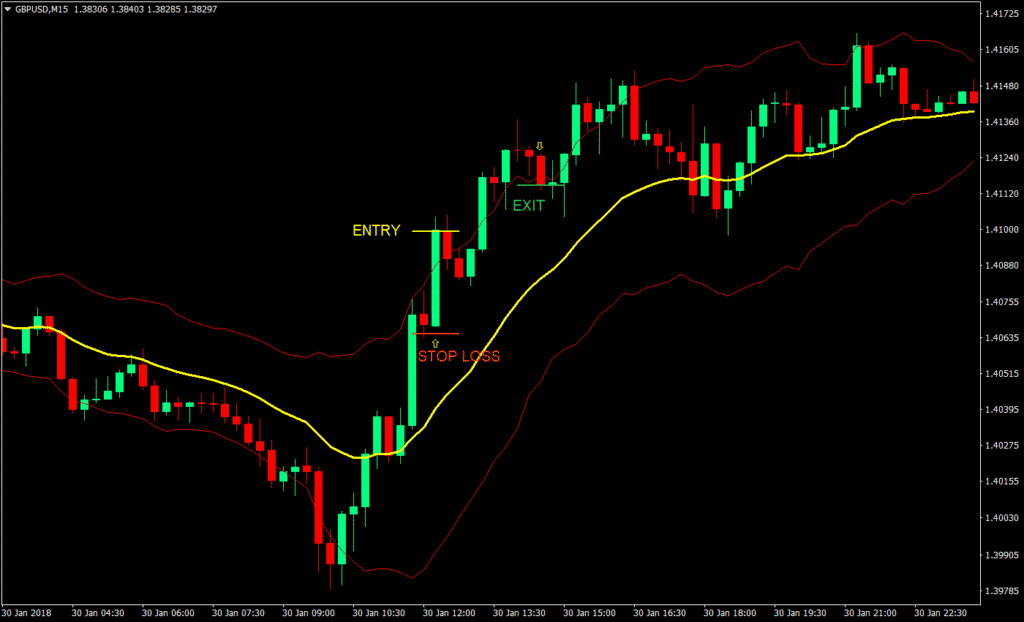

Trend following breakout entry

This trend traces all major movements assuming that there will be a retracement after a price spike. There is a breakout if a trend goes outside the specified resistance and support line. Trading breakouts means going long in case the asset trends upwards or its price breaks above the resistance line. Also, it means going short in case the price goes below the support level.

How does price action differ from other trading analysis methods?

Who says simplified reading says quickly assimilated information? The vast majority of technical indicators are generally lagging either:

Due to a derivative representation of past price movements.

Fundamental analysis, which has a more global approach, considers various financial elements, such as economic statistics, etc.

The price action has a more direct approach and allows you to enter a position at the start of the movement. Consequence: the earning potential is increased.

This requires a certain knowledge of the underlying index since the price action leads to establishing its trading strategy solely on the value of an asset. For example, you could say to yourself, “I am going to position myself for the purchase when this one reaches 300 euros because I know that it will increase from then on. »

On the other hand, who says knowledge, also says understanding. Your neighbor might have a different opinion than you do. This is why the price action also includes a part of interpretation that can vary from one person to another.

However, this strategy also makes it easier to identify an uptrend in a market. If a price is showing higher highs and higher lows, the situation is looking good and leaves little room for doubt to those who take notice of the information.

Who is the price action intended for?

As said before, this trading method is suitable for different types of assets. Due to its instantaneous understanding, it is a valuable ally for those who practice swing trading, day trading, and scalping.

Its disadvantage, however, is its accessibility: it indeed requires time to adapt to be well mastered, in particular, because it makes it possible to overcome certain binary signals, such as the crossing of moving averages, for example, very useful to those who are new to trading.

Another important tip, if you want to get into price action, is backtesting! As a reminder, a backtest is a method of analysis that consists of evaluating the behavior of a trading strategy using past data to see if it would have worked. It makes it possible to prepare, validate and refine its strategy before investing real sums.

Example: do not hesitate to test your price action strategy by taking periods of very high volatility as a benchmark, such as the subprime crisis, Brexit, or the coronavirus pandemic. The price action technique is generally undermined in times of high uncertainty, and backtesting makes it possible to identify for which periods and markets this strategy works best.

An effective trading technique in very liquid markets

The more liquid the market*, the more the price action will show its effectiveness. As such, Forex is a target of choice for traders who practice price action since this currency exchange market is: active 24 hours a day, 5 days out of 7, From Sunday to Friday evening.

Always on the move, it makes it possible to open and close positions quickly and is well suited to investors who want to trade at any time of the day.

It is, therefore, a good starting point if you want to learn about price action because you can take modest positions and validate the effectiveness of your strategy. This is an excellent way to improve your reading of candlesticks and gain confidence later when you want to place larger orders.

A market is said to be “liquid” when there are many buyers and sellers, and the assets are trading quickly without seriously affecting prices. The latter is more stable, and the risks are generally reduced compared to illiquid markets.

The Forex market is one of the most liquid markets. Therefore, Forex traders often use these indicators. The most commonly used price Action Indicators in MT4 are the following ones:

- Pin Bar Indicator MT4

- Engulfing Bar Indicator MT4

- Inside Bar Indicator MT4

- Support and Resistance Indicator MT4

- Head and Shoulders Indicator MT4

- Double Top and Bottom Indicator MT4

What are the limits of price action?

The absence of multiple indicators can be a source of doubt or concern for people who like to make objective decisions through data analysis.

As such, fundamental analysis, which can provide important information from a macroeconomic point of view, loses its meaning here, in particular, because of the reduced time scale on which price trading is carried out.

Price action indicator – Bottom Line

The price action indicator is one of the most convenient tools for traders to spot the emergence of a market trend. Experienced traders identify this indicator quickly and apply them in their strategy, especially in highly liquid markets. While technical analysis relies on various calculations to determine trends, price action focuses only on real-time asset price movements. Also, while technical analysis of the charts aims to find the patterns in chaotic trading environments, the price action indicator enables investors to take an intuitive approach. Price Action indicators represent a beach-bone of numerous trading strategies. Therefore, different trading methods can be used to predict trends and make profits.