How to Trade The Mat Hold Pattern Effectively Nowadays?

Have you recently considered how to trade the Mat Hold Pattern effectively as a part of your trading strategy? Are you eager to learn more about this type of pattern in the technical analysis that will help you improve your trading career and increase your profits shortly?

If so, you should be aware that the Mat Hold pattern refers to a specific five-candlestick pattern that usually appears once there’s a present trend. When traders spot the Mad Hold pattern, they should know that the trend will go in the identical direction.

In other words, this pattern looks like a candlestick formation and indicates the prolongation of the past trend. If you are into Forex trading or the stock market, you’d want to learn about this particular pattern that often appears on charts and could signal some significant things.

Why is the Mat Hold chart pattern so special and popular nowadays? How can you use it effectively to boost the success of your trading results? Let’s find all the necessary information and tools for using it, shall we?

Understanding the Mat Hold Candlestick Pattern

The Mat Hold Chart refers to a five-chart pattern that tells traders when the trend would move in the same direction as its ongoing trend. This pattern signals traders the current market conditions, along with take-advantage areas, prior continuing the trend in the exact direction.

The main point of the mat Hold pattern is that it has to have characteristics such as pullback and price correction or retracement before the current trend gets in its primary direction. Thus, the pattern usually appears once the price correction emerges in the market, enabling supreme entry-level in the present trend.

There’s an indistinguishable form, such as the famous “rising and falling 3 methods pattern”. Nonetheless, according to experts’ opinions, the Mat Hold pattern is 10 times more reliable. The main reason is that the slight gap happens following the 1st positive candle.

Two types of the Mat Hold Chart Pattern

As we all know, there are different types of continuation patterns. We have a bullish pattern and a bearish pattern here. So, the Mat Hold Chart pattern in the technical analysis can be either a bullish continuation pattern or a bearish continuation pattern.

Let’s find out more about these trading patterns, shall we?

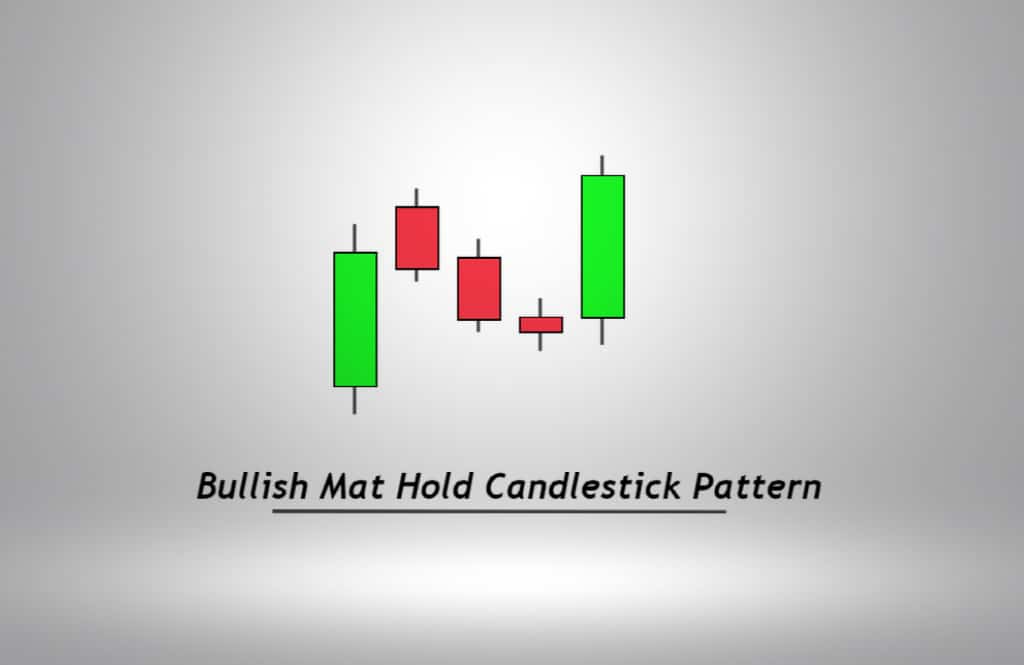

Bullish – Explained

A bullish Mat Hold continuation pattern begins once the huge upward candle is followed by a higher opening gap and three diminutive candles that decline. These candles must remain above the minimum point of the initial candle. The fifth candle, being substantial, once more ascends. This arrangement transpires within a broader upward trend.

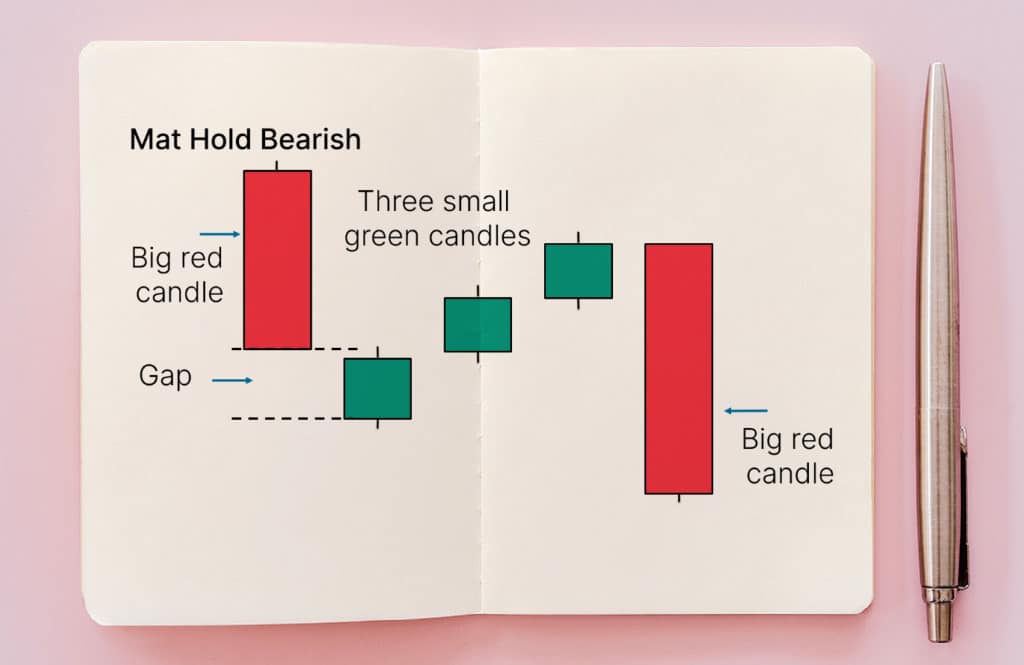

Bearish – Explained

The bearish candlestick pattern shares similarities, although the first and fifth candles are sizable descending candles, while candles two through four are smaller and exhibit an upward movement. It is imperative for these candles to remain beneath the peak of the initial candle.

The arrangement concludes with a lengthy candle, namely the fifth candle, descending. This occurrence is mandatory within a declining trend.

How do you easily identify the Mat Hold Pattern?

Before identifying the Mat Hold Candlestick pattern, it is crucial to note the following components:

- It will happen either in a bearish or bullish trend.

- The Mat Hold Pattern includes five candlesticks.

- A bearish or bullish candle with three opposite candles and a candle that goes in the same direction as the number one candle.

- Regarding the bullish or bearish version, the last candle must be closed either below or above the prior 4th candle.

What are the top advantages and disadvantages of the pattern?

According to technical analysts, just like any other candlestick chart pattern, the Mat Hold pattern also has its own advantages and disadvantages. Let’s start with the advantages of the pattern:

The main advantages of the pattern

- Maximum reliability and accuracy regarding this candlestick pattern.

- It functions perfectly when combined with numerous other technical tools.

- It enables an extraordinary opportunity to connect with the present trend.

The main disadvantage of the pattern

According to experts, one of the main disadvantages of using this pattern is that it is an extremely rare chart pattern. It may take days, weeks, or more to spot it. So, it would be best if you observed charts.

How to Trade Forex with Mat Hold Candlestick Pattern the Best?

Engaging in forex trading by applying the Mat Hold candlestick pattern necessitates the identification of an existing trend. Consequently, one must patiently await a market retracement, seizing the opportunity to participate in the prevailing trend while minimizing risks.

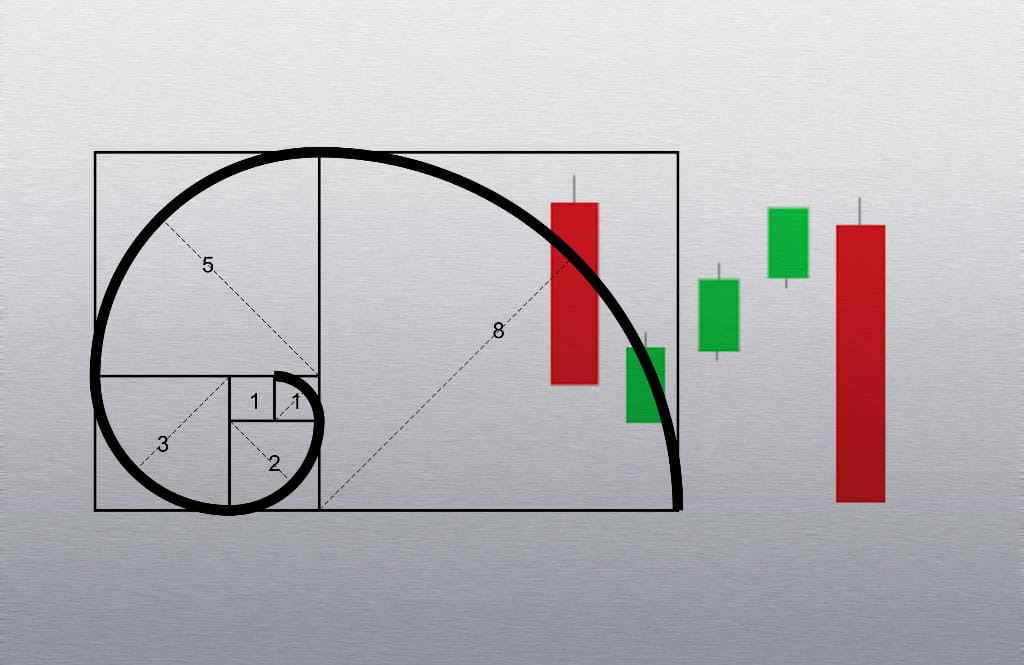

It is worth noting that the Mat Hold chart pattern can manifest itself within both bullish and bearish trends. Given its nature as a chart pattern, combining it with Fibonacci retracement levels is advisable. This additional confluence trading tool enhances comprehension of support and resistance levels.

Here, we present two trading strategies and accompanying illustrations incorporating the bullish and bearish Mat Hold patterns in conjunction with the Fibonacci ratios.

Bullish Mat Hold Pattern & Fibonacci Levels

The bullish Mat Hold pattern comprises five candlesticks and emerges amid an uptrend. It signifies the imminent prolongation of the bullish trend. The initial candlestick is a positive, bullish candle, followed by three smaller, bearish candlesticks.

The fifth and final candlestick is a substantial bullish candle with a longer body that concludes above the closing price of the fourth candlestick (as demonstrated in the chart provided).

It is important to acknowledge that the Mat Hold pattern possesses certain limitations, necessitating the utilization of complementary tools for optimal entry-level placement, stop-loss, and take-profit target determination. In this regard, incorporating Fibonacci support and resistance levels proves advantageous.

As depicted in the following chart, plotting Fibonacci retracements from the highest to the lowest point of the preceding trend furnishes valuable support and resistance levels.

In this scenario, upon identifying the Mat Hold candlestick pattern within an ongoing movement, one would seek the subsequent Fibonacci level to initiate a long position once the final bullish candlestick has formed (as exemplified in our illustration, the 50.0% line).

The stop-loss placement should be positioned at the 23.6% or 0.0% levels, while the take-profit target is established at the 61.8% or 78.6% Fibonacci levels.

Bearish Mat Hold Pattern & Fibonacci Levels

The inverse variant of the bullish Mat Hold pattern is the bearish type of pattern. Traders know this pattern as the “inverted Mat Hold pattern” as well. This configuration consists of an initial bearish candle coming after 3 tiny bullish candlesticks, culminating in a fifth elongated negative candle that concludes beneath the 3 preceding candlesticks.

When encountering the Mat Hold bearish pattern, employing Fibonacci retracements requires extending the Fibonacci tool (commonly available in trading platforms) from the low to the high point of the preceding trend.

To accomplish this, expand the chart and analyze the price range of the previous asset movement. This helps identify support and resistance levels, determining optimal entry points, stop-loss, and take-profit targets. In the example, when the Mat Hold pattern appears at the start of a downtrend, draw Fibonacci retracements to establish crucial support and resistance levels.

The 38.2% level is an ideal entry point for short-selling, with potential target zones at various Fibonacci levels. Set the stop-loss above the highest level of the three candles in the Mat Hold pattern or at the highest Fibonacci level.

What is essential to note about the Mat Hold Pattern?

The Mat Hold pattern, a five-candlestick formation, is a reliable indicator for trend continuation in price action. This versatile pattern can manifest as a bullish or bearish signal, contingent upon the persuasive market context.

Traders seeking to capitalize on this pattern must exercise patience and await the completion of the final fifth candle, which should exhibit a close above the three preceding smaller candles in the case of a standard Mat Hold pattern (or below for the Inverted Mat Hold pattern).

To optimize risk management and profitability, it is prudent for traders to employ Fibonacci retracement levels in conjunction with the Mat Hold pattern. This strategic combination enables the establishment of appropriate stop-loss and take-profit orders, leveraging the benefits of moving averages and precise price analysis.

Conclusion

In summary, traders can effectively integrate the Mat Hold pattern into their trading strategies by meticulously analyzing price charts, identifying trend reversals, recognizing double bottom formations, and considering the implications of bearish pennants.

Utilizing these key factors enhances decision-making capabilities, facilitating successful trading outcomes.