Solvency Ratio Unveiled: Your Guide to Secure Investments

In the realm of finance, understanding the financial stability of a company is crucial for making investment decisions, such as buying shares of a company. Solvency ratios indicate a company’s ability to repay long-term debts and provide an overview of its financial well-being. These ratios are used to assess the company’s financial health. This article explains solvency ratios, their types, and how to use them to evaluate a company’s financial health.

Naturally, companies are often borrowing money for various reasons, such as expanding their business, funding new projects, or managing cash flow. Borrowing helps companies get money to invest in growth without giving away ownership.

Debt can also provide tax benefits and maybe a more affordable way to obtain funding. Naturally, debt repayment is also required at some point. If a company is not able to repay its liabilities, it may go bankrupt.

Understanding Solvency Ratios

A solvency ratio is a significant metric we can use to measure a company’s ability to meet its long-term debt obligations. It evaluates a firm’s cash flow compared to all its liabilities, providing a measure of its financial health. Analyzing a company’s solvency ratio aids in understanding its long-term viability and the risk associated with its debts. It is crucial to compare a company’s solvency ratio with its industry peers to gain a holistic view.

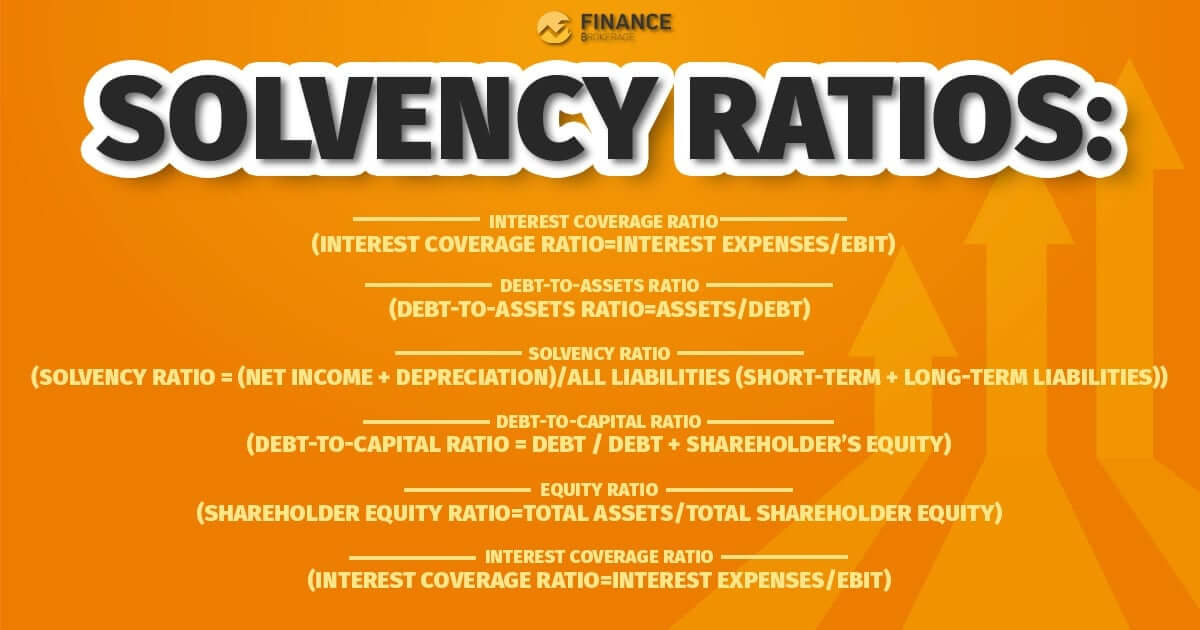

Different Types of Solvency Ratios

1. Debt-to-Assets Ratio

Debt-to-Assets ratio measures the proportion of a company’s assets that are financed by debt. A higher debt-to-assets ratio means more borrowing, which could lead to financial problems if not handled properly. A greater proportion suggests that the company relies heavily on borrowing.

Debt-to-Assets Ratio=Assets/Debt

2. Interest Coverage Ratio

The ratio shows how well a company can handle its debt. It compares the company’s earnings before interest and taxes (EBIT) to its interest expenses. A higher interest coverage ratio suggests the company can easily meet its interest expenses from its earnings, reflecting better financial health. The higher the ratio, the better – it means the company has more income to meet its long-term liabilities.

Interest Coverage Ratio=Interest Expenses/EBIT

3. Equity Ratio

This ratio evaluates how much of a company’s assets are funded by the owner’s equity. A higher equity ratio means less leverage and, hence, a stronger financial position. The lower number means that the company has more debt than equity.

Shareholder Equity Ratio=Total assets/Total shareholder equity

4. Debt-to-Equity Ratio (D/E)

The D/E ratio reveals the proportion of a company’s funding that comes from debt compared to equity. A higher D/E ratio implies more debt financing, highlighting potential financial risk. A higher ratio, in this case, indicates more risk than a lower one.

Debt to Equity Ratio=Equity/Debt Outstanding

5. Debt-to-Capital Ratio

The debt-to-capital ratio (D/C ratio) is a tool that shows a company’s financial leverage by comparing total debts to total capital. It helps to understand how much debt a business uses compared to capital to keep operating. This ratio can provide insights into your business’s capital structure and financial stability. A high debt-to-capital ratio means a company relies on debt for funding, making it risky to invest in.

Debt-to-Capital Ratio = Debt / Debt + Shareholder’s Equity

6. Solvency Ratio

Different types of financial ratios fall under the solvency ratio category. The most important are listed above; however solvency ratio formula can be stated this way:

Solvency Ratio = (Net Income + Depreciation)/All Liabilities (Short-term + Long-term Liabilities)

As you can see, this formula determines the proportion of net income over short-term and long-term liabilities, so a company can be said to be financially strong if the ratio is over 20% (the result of calculations is greater than 0.2).

Solvency Ratios vs. Liquidity Ratios

Both solvency and liquidity ratios measure a company’s financial health, but they have different focuses. Solvency ratios show how well a company can handle its long-term debt and meet its obligations.

Solvency ratios are also often called leverage ratios. They give an idea of the company’s financial health and stability. In contrast, liquidity ratios examine a company’s ability to cover short-term obligations and its immediate financial health.

Role of the Net Income

The profitability of a company and its ability to fulfil its long-term financial obligations are determined by its net income. Solvency ratio formula, commonly incorporates net income to assess whether a company can utilize its earnings to settle its debts.

Higher net income means better financial health, improved solvency ratios and showing ability to cover long-term debts. Net income measures a company’s financial performance and ability to sustain operations and meet long-term obligations.

How to Use Ratios

1. Evaluate Long-Term Financial Health

Use solvency ratios to assess a company’s ability to sustain operations by meeting long-term debts and obligations. Consistent trends in solvency ratios over time offer insights into financial stability or the lack thereof. A steady or improving solvency ratio indicates sound financial health, signalling the company’s ability to meet its long-term obligations.

A decreasing solvency ratio can mean financial trouble, suggesting the company may struggle to pay off its long-term debts. Examining solvency ratios and other financial metrics provides a comprehensive understanding of a company’s finances. This information is valuable for making investment and management decisions.

2. Comparison with Industry Peers

Comparing a company’s solvency ratios with industry averages or direct competitors provides a relative performance metric. It offers an external perspective, allowing for a more comprehensive analysis of financial health. This comparison not only reveals the company’s position within the industry but also highlights potential risks and opportunities.

Understanding how a company compares to others can provide important information about its financial stability and future success. This helps investors and stakeholders make better decisions about investments, credit, and other financial activities.

3. Identifying Risks and Opportunities

Solvency ratios assist in pinpointing financial risks and opportunities. A company that has low solvency ratios could have excessive debt, indicating a financial hazard. On the flip side, high solvency ratios could signify the underutilization of debt financing, presenting an opportunity to use debt for expansion.

Evaluating these ratios offers insights into a firm’s long-term financial health, aiding stakeholders in making informed decisions. Assessing properly helps companies optimize their capital structure, ensuring growth, stability, and a competitive advantage in the market.

4. Investment Decision Making

Investors and stakeholders utilize solvency ratios for making knowledgeable investment choices. These ratios deliver crucial data regarding a company’s financial strength and its capacity to yield returns while handling debt responsibilities.

Analyzing these metrics can reveal warning signs or investment prospects, giving stakeholders a complete understanding of the company’s financial situation. It is important to understand the risks and rewards of investment. This understanding helps in making informed decisions and aligning investment strategies with financial goals and risk tolerance.

Limitations and Conclusion

Despite their utility, solvency ratios have limitations. They should not be viewed in isolation. A comprehensive financial analysis should include various financial ratios, cash flow analysis, and industry comparisons. Moreover, sector-specific nuances must be considered, as optimal solvency ratios can differ significantly across industries.

To sum up, solvency ratios are essential instruments for evaluating a company’s capacity to fulfil its extended-term financial responsibilities. Possessing a thorough comprehension and effective utilization of metrics such as the Debt-to-Assets Ratio, Interest Coverage Ratio, Equity Ratio, and Debt-to-Equity Ratio can provide valuable insights into a company’s financial health and assist in making well-informed strategic decisions.