On-Balance Volume (OBV): A Detailed Guide

The On-Balance Volume (OBV) evaluates market buying and selling intensity by accumulating volume during up days and subtracting volume on down days. Let’s examine how it works in detail.

What Is On-Balance Volume?

On Balance Volume is a powerful technical analysis tool introduced by Joseph Granville. It helps traders understand the relationship between price movement and daily trading volume.

OBV is a cumulative indicator, adding the daily volume to a running total when the closing price is higher and subtracting it when the closing price is lower. To calculate OBV, add or subtract the daily volume from the previous OBV based on whether the price increased or decreased.

Granville emphasised OBV as a key to stock market profits, as it reflects buying and selling pressure and helps confirm the prevailing trend. Understanding this indicator can be crucial for predicting price movement and making informed decisions in the stock market.

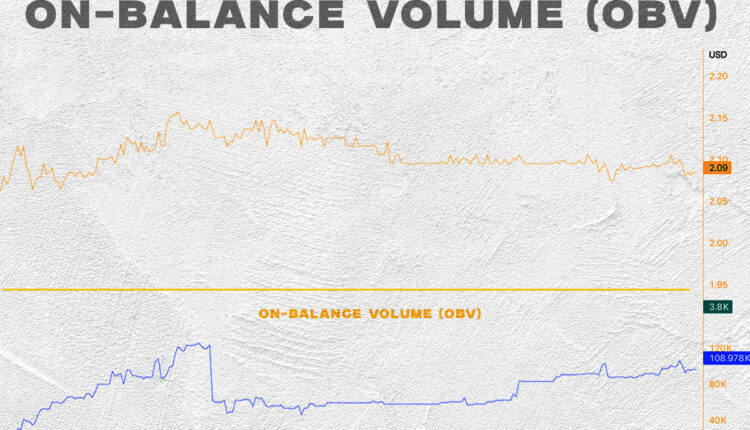

On-Balance Volume Chart Example

What Does the OBV Indicator Tell You?

The On Balance Volume is an indicator that accumulates the volumes of a value according to the direction of the price variation. It allows you to assess buying or selling pressure through volumes.

Thus, this indicator allows you to measure a trend’s strength or weakness and identify the risks of a trend reversal. The On Balance Volume is based on the principle that prices represent the bullish or bearish consensus on the value, and volumes represent the participants’ commitment.

A rising OBV shows that buyers are very strong and vice versa if the indicator falls. As Dr Alexander Elder, a renowned trader and author, points out: “When the OBV does not take the same direction as the prices, collective emotions are not in phase with the collective consensus.”

“A crowd will follow its heart more easily than its reason. This is the reason why changes in volume direction often precede price changes.”

Calculating On-Balance Volume

How to calculate the balance volume? This indicator calculates a ratio between the variation of volumes and prices. We can calculate it by adding the volumes of the day when the price rises and subtracting the volumes of the day when the price falls.

The OBV accumulates the volumes as follows:

- When the value closes upwards, all the volume of the day is considered as an upward volume. The volume of the day is added to the previous cumulative total.

- When the value closes downwards, all the volume of the day is considered as a downward volume. The volume of the day is subtracted from the previous cumulative total.

Formula for On-Balance-Volume

The calculation formula is as follows:

Upward closing:

OBV = OBV[n-1] + Volume

Downward closing:

OBV = OBV[n-1] – Volume

If prices have not changed:

OBV = OBV[n-1]

This is a cumulative indicator since we calculate it by adding the volumes of the day when prices rise and subtracting the volumes of the day when prices fall from the value of the indicator in n-1.

How to Use On Balance Volume Indicator in daily trading?

Let’s take an example:

- If the daily volume is 1000 shares and the closing price is higher than the previous day’s, 1000 is added to the OBV.

- If the daily volume is 800 units and the closing price is lower than the previous day’s, then 800 is subtracted from the On Balance Volume.

- If the daily volume is 500 units and the closing price equals the previous day’s, then the OBV remains unchanged.

On Balance Volume in Technical Analysis

A rising OBV shows where the market’s savvy investors are located. When the crowd follows the price movement, the OBV and the value will rise together. On the other hand, if prices vary before the OBV, we have a non-confirmation. Non-confirmations occur when the market is at its extremes.

If, in an uptrend, the OBV becomes bearish, this means that there were much larger volumes during the downtrend sessions than during the uptrend sessions, even if there were more uptrend sessions. There is, therefore, a high probability of a downward reversal.

Conversely, if the On Balance Volume becomes bullish in a downtrend, there were much larger volumes during the uptrend sessions than during the downtrend sessions, even if there were more downtrend sessions. The probability of an upward reversal then becomes very high.

The graphical reading of the On Balance Volume can be associated with the detection of divergence between the price evolution and that of the indicator.

It is quite possible to calculate a moving average of the OBV by using the crossings of the two curves between them. When the moving average crosses the OBV downwards, it represents a sell signal; otherwise, it is a buy signal.

The logic behind this system is as follows: volumes precede the trend. When prices are stable or correct the trend, a volume increase allows us to anticipate the beginnings of the trend’s resumption. Similarly, at the end of a trend, we theoretically see a volume decrease before prices fall.

OBV vs Accumulation/Distribution

On-balance volume and the accumulation/distribution line both serve as momentum indicators that leverage volume to forecast the actions of “smart money.” However, their methods diverge significantly. To calculate on-balance volume, add the volume from days when prices rise and subtract the volume from days when prices fall.

In contrast, the accumulation/distribution (Acc/Dist) line employs a different approach. Its formula considers the current price’s position within its recent trading range and multiplies this by the volume of that specific period, allowing it to provide insights without becoming overly complex. Thus, while both indicators focus on volume, their calculations and implications differ substantially.

Limitations of OBV

A drawback of the On-Balance Volume (OBV) indicator is that it acts as a leading indicator. It can generate forecasts but offers limited insight into past market actions based on its signals.

This characteristic makes it susceptible to false signals. To mitigate this, we can add lagging indicators. Incorporating a moving average line with the OBV can help identify breakouts. If the OBV experiences a breakout simultaneously with price movements, it can validate the breakout.

Additionally, it’s important to exercise caution with the OBV, as a significant volume spike in a single day can distort the indicator for an extended period.

For example, unexpected earnings reports, changes in index membership, or large institutional trades can lead to significant fluctuations in the indicator. However, these sudden volume changes may not necessarily reflect an ongoing trend.