Bart Simpson Chart – Cryptocurrency Explained by a PRO

Are you interested in discovering everything about the so-called Bart Simpson chart? Do you consider yourself a big fan of the crypto industry and the Simpson series? If your answers are positive, you’d be excited to learn more about the Bart Simpson Pattern.

It’s no surprise that Bart, the iconic rebellious character from the immensely popular cartoon series The Simpsons, is making his mark in the crypto universe. With The Simpsons being one of the most successful animated shows worldwide, it’s only fitting that Bart would find himself in the realm of cryptocurrencies.

Even though, for the majority of people, Bart Simpson refers to one of the most popular cartoon characters in pop culture, for crypto enthusiasts, it is more than that. It has found its place in the crypto industry too!

Well, let’s find out all the interesting details about this famous Bart Simpson Chart pattern, shall we?

What is the Bart Simpson chart exactly?

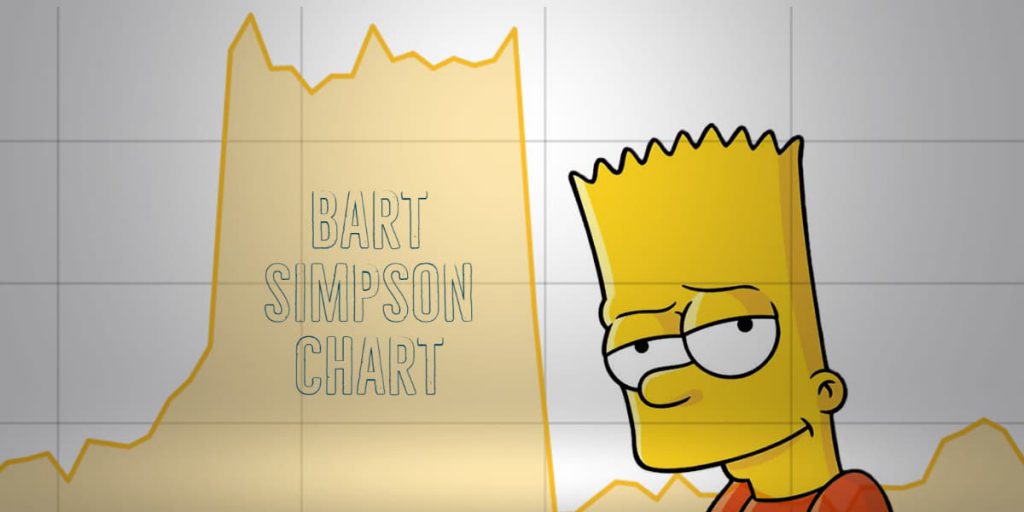

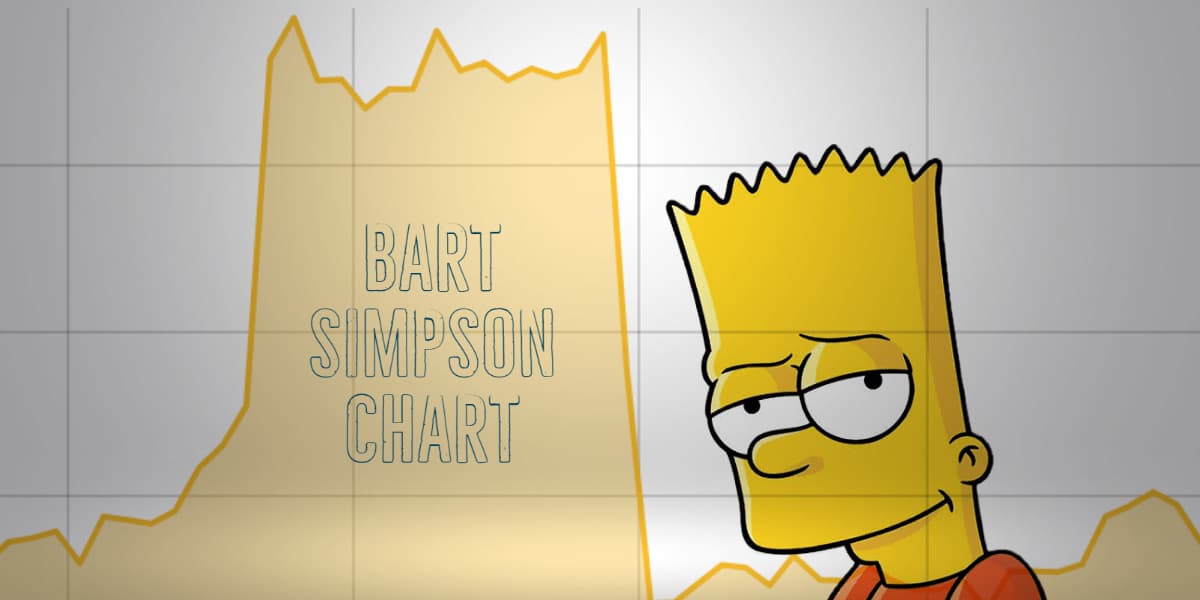

The Bart Simpson chart, or the Bart Simpson pattern, as some traders refer to it, represents the sharp surge of a particular asset’s price. As a plural, Barts refers to price patterns that look like Bart Simpson’s specific hairstyle on the chart. The price oscillates in a tight range once the surge reaches its peak on the chart.

These oscillations would produce weaves or zigzags that physically remind us of Bart’s authentic sharp hair in the cartoon series. The Bart formation typically consists of a sudden price spike, followed by a consolidation phase and a sharp retracement back to the initial range.

When did the Bart Simpson chart make its debut?

The Bart Simpson pattern debuted during the 2018 Bitcoin bear run when volume and liquidity decreased. In March of this year, a Bart pattern emerged, illustrating the impact of waning interest in the asset class. BTC shot up from $39,120 to $41,700 in 30 minutes on March 16, only to fall back to $39,000 within the hour.

When is the head of Bart formatted in the chart?

Once the particular price breaks out from its previous range and experiences a significant surge, it forms the head of Bart. Large investors usually initiate this upward movement. Its main goal is to manipulate the market and exploit crypto margin traders, both those who have taken short positions and those who have gone long.

These entities create an artificial price surge by placing numerous buy orders, luring other traders into the market.

What impact do Bart’s patterns have on the market?

The Bart Simpson chart pattern is distinct in cryptocurrencies, particularly concerning Bitcoin. This is attributed to the asset class’s notable low liquidity and heightened volatility characteristics.

The majority of investors and traders are familiar with this pattern, and a significant number have experienced negative consequences as a result. When Bitcoin undergoes a Bart pattern, it can influence altcoins, creating a ripple effect.

Nevertheless, long-term investors typically have little cause for concern, as these price fluctuations do not inflict significant damage in the grand scheme.

What does the presence of Bart patterns highlight?

The presence of Bart patterns highlights the inherent market volatility and the dynamic nature of Bitcoin trading. These patterns serve as a reminder of the unpredictable nature of cryptocurrency price movements, which can create both opportunities and risks for traders and investors alike.

Market participants must stay vigilant, adapt their strategies to changing market conditions, and carefully analyze the underlying factors driving these price fluctuations to make informed decisions in cryptocurrency trading.

What are the Inverted Bart and Its Bullish Consolidation Patterns?

On the other hand, the Bart formation can also occur oppositely. The price declines abruptly in this scenario, followed by a consolidation phase characterized by narrow trading ranges. Eventually, the price surges upwards to finalize the movement, forming an inverted depiction of Bart’s head.

This inverted Bart pattern is recognized as a bullish consolidation pattern, indicating a potential reversal in the prevailing trend. To implement this strategy, prominent investors initially inundate the market with sell orders, leading to a sharp decline in price, reverting it to its original range.

Inducing losses for margin traders

This deliberate maneuver eradicates profits from the prior price spike and induces losses for margin traders who had assumed long positions during the initial surge. By liquidating traders in both upward and downward directions, these entities optimize their profits while exacerbating the losses experienced by others.

Can crypto exchanges themselves trigger Barts?

Usually, these price movements are instigated by large investors known as whales. However, some believe that Barts can be triggered by crypto exchanges themselves, which is entirely possible thanks to their large holdings and the lack of regulations.

It is one of the reasons why analysts often refer to the crypto market as a “whale’s playground.” These large investors can bring forth drops and surges whenever they choose.

Bart Simpson Price and Other Analysis on the CoinMarketCap

As of the mid of June 2023, the current price of Bart Simpson stands at USD 4.66e-14, with a 24-hour trading volume of USD 283,416. Remember, BART to USD price is continuously updated in real-time on the CoinMarketCap.

With a CoinMarketCap ranking of #3105, the live market cap for Bart Simpson is currently not available. The circulating supply and maximum supply of BART coins are also not available, amounting to 4,200,000,000,000,000,000 coins.

Where can you buy Bart Simpson?

For those seeking to purchase Bart Simpson at the present rate, the leading cryptocurrency exchanges for trading in Bart Simpson stock are MEXC and Uniswap v2. Additional options can be found on our dedicated crypto exchanges page.

Welcome to the captivating realm of Bart Simpson Coin – the sole coin that embodies the mischievous spirit of its namesake!

Insights for Bitcoin Price Prediction and Crypto Market Analysis

Bart patterns offer valuable insights into Bitcoin price prediction and crypto market analysis. Traders and investors often study these patterns to understand the behavior of market participants and develop effective trading strategies.

By recognizing market patterns like the Bart formation, traders are able to capitalize on short-term price movements and enhance their cryptocurrency trading endeavors. However, it is important to note that market patterns are not foolproof indicators and should be combined with a thorough analysis of fundamental and technical factors.

Successful cryptocurrency trading requires a comprehensive approach incorporating risk management, market analysis, and the ability to adapt to ever-evolving market conditions.

What is the Simpsons series all about?

The Simpsons, created by Matt Groening for Fox, is an animated sitcom known for its satirical depiction of American life. The dysfunctional Simpson family, consisting of Homer, Marge, Bart, Lisa, and Maggie, resides in the fictional town of Springfield. The show began as animated shorts on The Tracey Ullman Show in 1987 before expanding into a half-hour prime-time series in 1989.

With 750 episodes, it holds the record for the longest-running American animated series and sitcom. The success of The Simpsons also led to a feature film, The Simpsons Movie, and various spin-offs, including comics, video games, and merchandise. While it received acclaim during its early seasons, some critics argue its quality declined.

Nevertheless, The Simpsons remain influential, winning numerous awards and leaving an enduring impact on television. Homer’s catchphrase “D’oh!” has become part of popular culture, and the show has influenced subsequent adult-oriented animated sitcoms.

Why did The Simpsons gain so much popularity?

The Simpsons have gained a reputation for their uncanny ability to predict significant world events well in advance, from the presidency of Donald Trump to the global pandemic and geopolitical conflicts such as Russia’s war on Ukraine.

Drawing a parallel, when observing a rapid surge in the price of an asset followed by a period of tight consolidation, one can’t help but speculate about what may lie ahead.

Just as The Simpsons’ predictions have intrigued viewers worldwide, the potential outcomes of such price movements in the financial markets spark curiosity and anticipation among traders and investors.

What are the Future Crypto Trends and Bitcoin Trading?

Anticipating upcoming trends in the cryptocurrency market requires thorough the following:

- Crypto market analysis

- Technical analysis

- Interpretation of chart patterns.

Bitcoin trading is a barometer for the overall market, making it essential to analyze historical data and patterns to inform trading strategies. By studying visual representations such as ascending triangles and head and shoulders formations, traders can gain valuable insights into market trends.

Staying updated on crypto market dynamics, including regulatory changes and institutional adoption, is crucial. With this comprehensive approach, investors can identify opportunities and risks in the ever-evolving crypto market.

With the proper conduct of diligent cryptocurrency market analysis and crypto market trends, investors can make well-informed decisions, navigate market volatility, and stay ahead of emerging trends in the dynamic world of cryptocurrencies.

Bottom Line

The Bart Simpson chart, with its distinctive pattern resembling Bart’s iconic hairstyle, captures the rapid price surge of an asset followed by a consolidation phase and sharp retracement. By understanding this phenomenon, traders can identify potential market opportunities and navigate the twists and turns of trading.