CFD Trading Tips You Should Know

Before diving into CFD trading and learning more about CFD trading tips, it’s crucial to have a solid understanding of the basics.

Let’s start from the beginning.

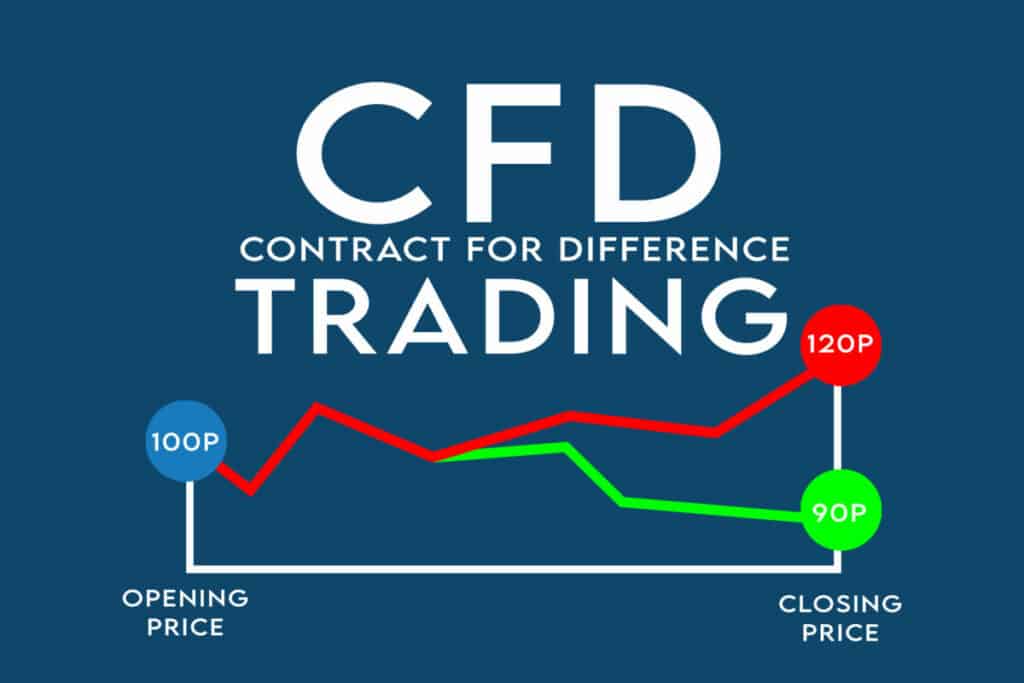

CFD stands for Contract for Difference. It is a popular derivative trading instrument that allows traders to speculate on the price movements of various financial markets, such as stocks, indices, commodities, and currencies, without owning the underlying asset.

Here are some key aspects of CFD trading:

Leverage: One of the main attractions of CFD trading is the ability to use leverage. Leverage allows traders to control a larger position in the market with a smaller amount of capital.

Long and short positions: CFD trading provides the flexibility to take both long and short positions. If a trader believes the price of an asset will rise, they can open a long (buy) position. On the other hand, if they believe that the price will fall, they can open a short (sell) position. This allows traders to profit from both rising and falling markets potentially.

No ownership of the underlying asset: Unlike traditional investing, where you actually own the underlying asset, CFD trading is purely speculative. Traders don’t own the physical asset but rather trade on the price movements of the asset. This means that traders can quickly enter and exit positions without the constraints of physical ownership.

Wide range of markets: CFD trading offers access to a wide range of financial markets, including stocks, indices, commodities, currencies, and even cryptocurrencies. This allows traders to diversify their portfolios and take advantage of various market opportunities.

Risk management tools: CFD trading platforms often provide risk management tools such as stop-loss orders and take-profit orders.

CFD trading tips

There are many CFD trading tips. So, it is better to focus on several most important ones.

Choose a reliable broker: Selecting a reputable and reliable broker is essential for successful CFD trading. Ensure that the broker is licensed and regulated by a recognized financial authority. Consider factors like trading platform quality, customer service, fees and commissions, etc.

Develop a trading strategy: A well-defined trading strategy is crucial to your success as a CFD trader. Determine your goals, risk tolerance, and preferred trading style (e.g., day trading, swing trading, trend following). Define your entry and exit criteria, money management rules, and risk-reward ratios. Stick to your strategy and avoid impulsive decisions based on emotions.

Practice Risk Management: Risk management is a key aspect of CFD trading. Set a maximum risk limit per trade or per day, and never risk more than you can afford to lose. Use stop-loss orders to automatically exit a trade if it goes against you. Consider using trailing stops to protect profits and limit losses. Diversify your portfolio to reduce risk by trading different assets in various sectors or regions.

Stay informed: Stay updated with the latest news, market trends, and economic events that can impact the assets you trade. Follow financial news outlets, utilize economic calendars, and stay informed about company earnings releases, central bank decisions, geopolitical events, and other factors that can affect the markets. Being well-informed can help you make more informed trading decisions.

Use technical and fundamental analysis: Utilize both technical and fundamental analysis to make informed trading decisions. Technical analysis involves studying price charts, patterns, and indicators to identify trends and potential entry and exit points.

Fundamental analysis involves evaluating economic indicators, company financials, and market sentiment to gauge the intrinsic value of an asset.

Part two

Test strategies with demo accounts: Most reputable brokers offer demo accounts that allow you to practice trading without risking real money. Use these accounts to test and refine your strategies before implementing them with real funds. This can help you gain confidence in your approach and identify any weaknesses or areas for improvement.

Control your emotions: Emotions can significantly impact trading decisions. Fear and greed are common emotions that can lead to impulsive actions and poor judgment. Stick to your trading plan and avoid making emotional decisions based on short-term market fluctuations. Keep a calm and disciplined approach, and don’t let emotions dictate your trading strategy.

Leverage wisely: CFD trading offers leverage, which allows you to control a larger position with a smaller amount of capital. While leverage can amplify profits, it also magnifies losses. Use leverage wisely and understand its implications. Consider the risks associated with high leverage and adjust your position size accordingly to manage risk effectively.

Monitor your trades: Once you have entered a trade, monitor it closely. Pay attention to market conditions, news events, and any factors that may influence your position.

Consider using price alerts or automated trading tools to stay informed and execute trades at desired price levels. Regularly review your open positions and adjust stop-loss orders or take-profit levels as needed.

Continuously learn and adapt: The markets are constantly evolving, and successful traders continuously learn and adapt. Stay curious and open-minded, explore new trading techniques, attend webinars or workshops, and learn from experienced traders. Stay adaptive and adjust your strategies as market conditions change.

Popular CFD trading strategies

Now, we can focus on several CFD trading strategies.

Here are a few common CFD trading strategies that traders often employ:

Trend following: This strategy involves identifying and following the prevailing market trends. Traders look for assets that are experiencing a clear upward or downward trend and open positions in the direction of that trend. Trend-following traders may use technical indicators, such as moving averages or trendlines, to confirm and validate the trend before entering a trade.

Breakout trading: Breakout trading involves identifying key levels of support or resistance and entering trades when the price breaks out of those levels.

Traders aim to capitalize on strong momentum moves in either direction while implementing a stop loss in order to manage risk.

They may use technical indicators like Bollinger Bands or price patterns like triangles or rectangles to identify potential breakout opportunities.

Range trading: Range trading is a strategy used when the price of an asset is trading within a specific range or channel. Traders look to buy near the support level and sell near the resistance level.

They aim to profit from the price bouncing between these levels. Range traders often use oscillators, such as the Relative Strength Index (RSI), to identify overbought and oversold conditions within the range.

News trading, scalping and swing trading

News trading: News trading involves taking advantage of market volatility that occurs due to significant news releases, economic data, or company announcements.

Traders monitor news events and enter trades based on the impact the news is expected to have on the market. For example, if positive earnings are announced for a particular company, traders may anticipate a rise in the stock price and open a long position.

Scalping: Scalping is a trading strategy where traders aim to make small profits from numerous trades throughout the day. Traders typically enter and exit trades quickly, often within minutes or seconds, and rely on small price movements to generate profits. Scalping requires strict discipline, fast execution, and a focus on high-liquidity markets.

Swing trading: Swing trading is a style of trading that attempts to capture short- to medium-term gains in a stock (or any financial instrument) over a period of several days to several weeks. What’s important, swing traders primarily utilize technical analysis to look for trading opportunities.

They may use fundamental analysis in addition to analyzing price trends and patterns.

Swing traders often hold their positions for a few days to several months, depending on the timeframes they are trading.

Conclusion

CFD trading tips are valuable for both novice and experienced traders. Here’s why they are important:

Risk Management: CFD trading tips often emphasize the importance of risk management. Managing risk is crucial in trading to protect your capital and avoid substantial losses. Tips related to setting stop-loss orders, defining risk limits, and diversifying your portfolio can help you develop a disciplined approach to risk management.

Maximizing profits: CFD trading tips can provide insights on maximizing profits. Strategies like trend following or news trading can help traders identify potential opportunities and capitalize on market movements.

Tips on using technical indicators, analyzing charts, and interpreting market news can enhance your ability to identify profitable trading setups.

Avoiding common mistakes: Trading tips often highlight common mistakes made by traders, such as overtrading, emotional decision-making, or neglecting proper research. Being aware of these pitfalls can help you avoid them and improve your overall trading performance.

Building confidence: Trading tips can boost traders’ confidence by providing guidance and a structured approach. Confidence is essential in trading, as it helps traders stick to their strategies and make decisions based on analysis rather than emotions. Tips on testing strategies in demo accounts, keeping a trading journal, and seeking professional advice can instill confidence and improve trading performance.

Keeping up with market developments: CFD trading tips often emphasize the importance of staying informed about market news, economic events, and industry trends. By keeping up with these developments, traders can make more informed trading decisions and adapt their strategies accordingly.

In conclusion, CFD trading tips play a crucial role in helping traders manage risk, maximize profits, etc. It’s important to remember that trading involves risks, and no tip or strategy can guarantee success. Traders should exercise caution, do their own research, and seek professional advice when necessary.