Hanging Man vs Hammer Candlestick Pattern

The Hammer and Hanging Man are critical candlestick patterns in technical analysis, especially when it comes to identifying potential reversals in price trends within the financial markets.

Hanging Man vs Hammer Candlestick pattern (introduction)

Let’s start with a Hammer Candlestick pattern.

Definition and structure

The Hammer Candlestick pattern is a single candlestick formation typically identified at the end of a downtrend and signals a potential bullish reversal.

What’s interesting, the above-mentioned pattern gets its name from its shape, which resembles a hammer with a small body and a long lower wick, at least twice the length of the body. The colour of the body can be either red or green, indicating that the closing price is lower or higher than the opening price, respectively.

Psychological implications

The psychology behind the Hammer is more or less straightforward. Throughout the trading period, sellers push prices lower, evidenced by the long lower wick. Nonetheless, by the close of the period, buyers manage to push prices back up towards the open, manifesting a change in momentum.

The longer the lower shadow, the stronger the potential reversal, as it indicates a more substantial shift from sellers to buyers.

Trading and risk management

Traders may look to enter a long position after identifying a hammer pattern, especially if it’s confirmed by subsequent bullish candlesticks. It is a good idea to use additional indicators and patterns for confirmation and to employ sound risk management strategies, such as setting stop-loss levels below the low of the hammer candle.

Hanging Man Candlestick pattern

Now, let’s focus on the hanging man.

Definition and structure

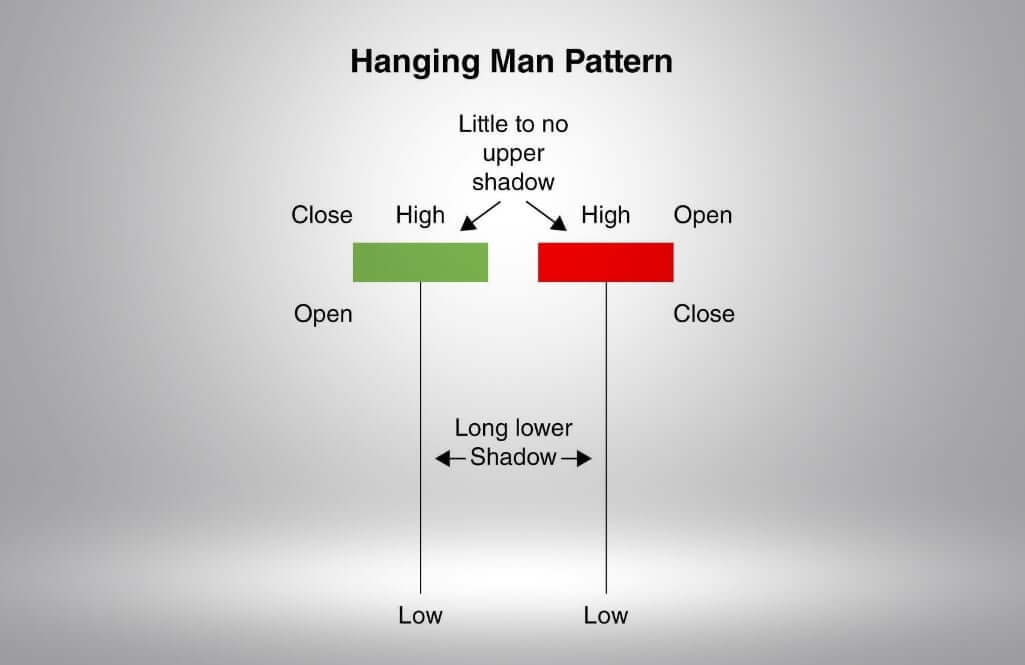

Contrastingly, the Hanging Man pattern is a bearish reversal pattern that forms after an uptrend. It shares a structural similarity with the Hammer – a small body and a long lower wick – but differs significantly in its placement and implications.

The color of the Hanging Man’s body can be either green or red, even though some traders place more emphasis on red bodies due to their inherently bearish nature.

Psychological implications

The Hanging Man signals that, despite ongoing buying pressure, sellers are beginning to step in. The long lower wick shows that sellers were able to push the price down significantly during the period, even though buyers managed to pull prices back up by the close. This struggle between buyers and sellers indicates potential weakness in the prevailing uptrend.

Trading and risk management

When a Hanging Man pattern is spotted, traders may consider preparing for a potential short position, especially if the pattern is confirmed by subsequent bearish price action. As with the Hammer, it is important to look for additional confirmation through other technical analysis tools and to enforce robust risk management, like placing a stop-loss above the high of the hanging man candle.

Key differences between hammer and hanging man

We need to analyze key differences when it comes to hanging man vs hammer candlestick pattern.

Market context:

Hammer: Appears during a downtrend and implies a potential bullish reversal.

Hanging Man: Occurs during an uptrend, signaling a possible bearish reversal.

Implication:

Hammer: Suggests the bulls have started to step in and control the market.

Hanging Man: Indicates the bears are starting to make their presence known, potentially overpowering the bulls.

Confirmation:

Hammer: Requires confirmation with subsequent bullish candles or other bullish indicators.

Hanging Man: Necessitates confirmation through bearish subsequent candles or additional bearish indicators.

Additional insight

These patterns’ effectiveness can be amplified when used in conjunction with other technical tools, such as trend lines, moving averages, or momentum oscillators, ensuring a more holistic approach to market analysis.

The Hammer and Hanging Man provide not just a glimpse into the psychological dynamics at play in the market but also tangible, actionable setups when implemented within a well-rounded trading strategy.

It’s vital to keep in mind that no pattern or indicator should be used in isolation. A nuanced understanding of the market, coupled with stringent risk management and a robust trading plan, is vital in navigating the financial markets effectively.

While each pattern may signal a potential reversal in isolation, combining these patterns with additional technical analysis tools and fundamental insights can offer a more comprehensive view of the market.

Furthermore, considering the broader economic and market conditions is also crucial, ensuring that trades align not only with technical signals but also with the larger market narrative.

Summary

Understanding the structural and psychological aspects of the Hanging Man vs Hammer Candlestick patterns allows traders and investors to navigate the markets with an enlightened perspective on potential reversal points.

The discerning application of these patterns, backed by rigorous analysis and solid risk management principles, enables individuals to negotiate the complexities of market movements with greater precision and confidence.

Both patterns, while similar in appearance, offer distinct, context-specific insights that, when appropriately utilized, can augment a trader’s analytical repertoire significantly.

While the preceding discussion comprehensively delineates these patterns, it’s imperative to emphasize the crucial role of ongoing learning, continuous analysis, and adaptive strategy development in achieving sustained success within the financial markets.

Remember, mastery of technical analysis is not merely about recognizing patterns but understanding their implications within the broader market context and strategically applying this knowledge in a disciplined and risk-averse manner.