What Is Spinning Top Candlestick and How to Trade It?

Would you like to learn more about the spinning top candlestick? There is no necessity to contact your friend who has a degree in finance in order to understand what the spinning top candlestick is. All you need to do is to read this article.

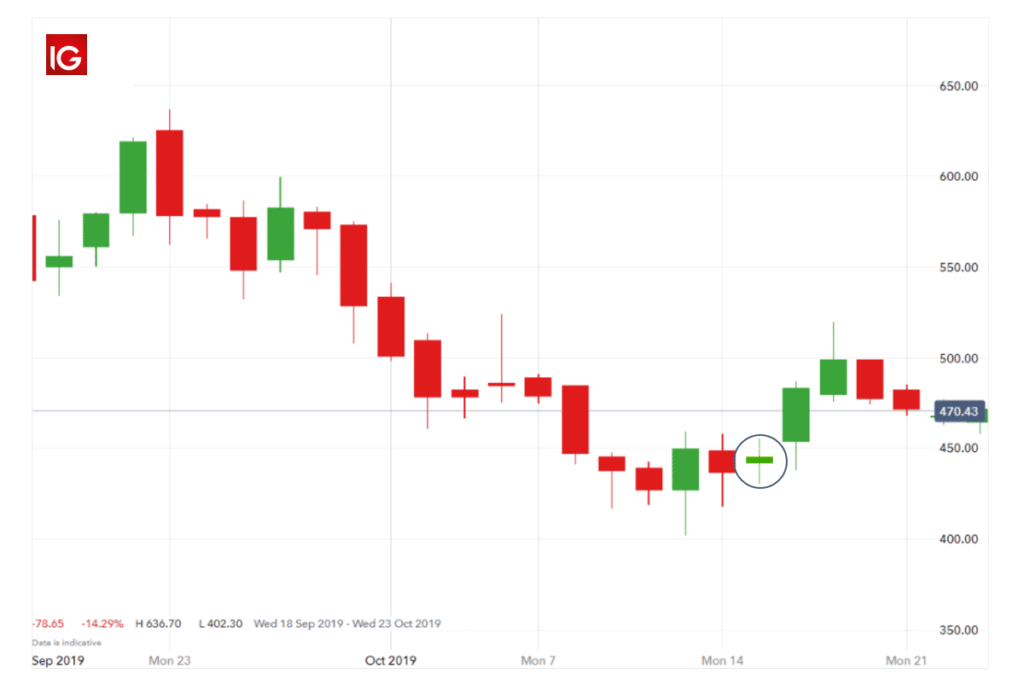

Let’s start from the beginning. A spinning top is a candlestick formation that signals indecision about the future trend direction. It is similar to a doji pattern. As a reminder, it is regarded as a neutral pattern, even though many do end in reversals.

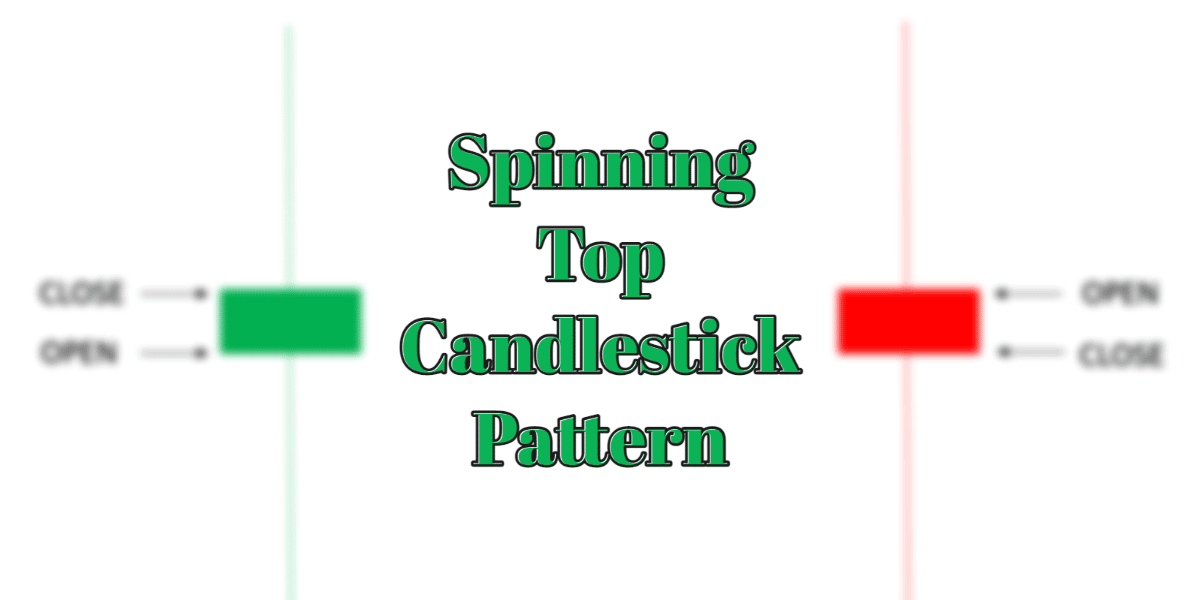

You need to keep in mind that there are two alterations of the spinning top candlestick pattern. The bullish spinning top, as well as the bearish spinning top. The first one (bullish pattern) happens when the closing price is higher compared to the opening price. The second one (bearish pattern) happens when the opening price is higher compared to the closing price.

Important details about spinning top candlestick

Do you know how it is created? Let’s find out!

It is created when the bulls send the price higher compared to the opening price, and the bears then push it back down before the market closes. Now, let’s discuss the second option.

When bearish traders push prices lower compared to the open price, and bullish traders, on the contrary, push the price back up before the market closes.

To put it another way, the market has analyzed upward as well as downward options; however, then settles at roughly the same opening price – resulting in no relevant change.

It is worth mentioning that traders shouldn’t act solely on any candlestick pattern. You need to take into consideration other forms of technical analysis. It is desirable to pay attention to other patterns as well as indicators. Moreover, it is important to confirm the signal. It is a good idea to follow your trading plan and risk management strategy.

Traders and a spinning top candlestick pattern

Interestingly, there are a couple of ways to trade when you notice the above-mentioned pattern. First things first, you need to verify the signal.

The vast majority of traders utilize technical indicators in order to verify what traders consider a spinning top is signaling, as technical indicators can provide more information regarding price trends.

In order to trade when you notice the above-mentioned pattern, it is possible to utilize derivatives. For example, contract for differences (CFDs) or spread bets. In the case of derivatives, you don’t become an owner of the underlying assets. So what do you do? You hypothesize about their price movements. This means you have the opportunity to trade rising as well as falling markets in order to take action following both bullish as well as bearish spinning tops.

The purpose of the article was to help you learn about a spinning top candlestick and its role.