Options Volatility Skew: Understanding the Market Dynamics

Options trading is influenced by the principles of supply and demand, similar to how prices of groceries, clothes, and homes are determined. However, the prices of stock and index options tend to exhibit greater fluctuations. At times, put options are relatively more expensive than call options, and vice versa. This is where the concept of implied volatility (IV) becomes crucial, as it reflects the market’s expectation regarding the potential movement of a security. The disparity in IV between out-of-the-money (OTM) calls and puts is referred to as volatility skew (vol skew), which contributes to the price variations observed in options.

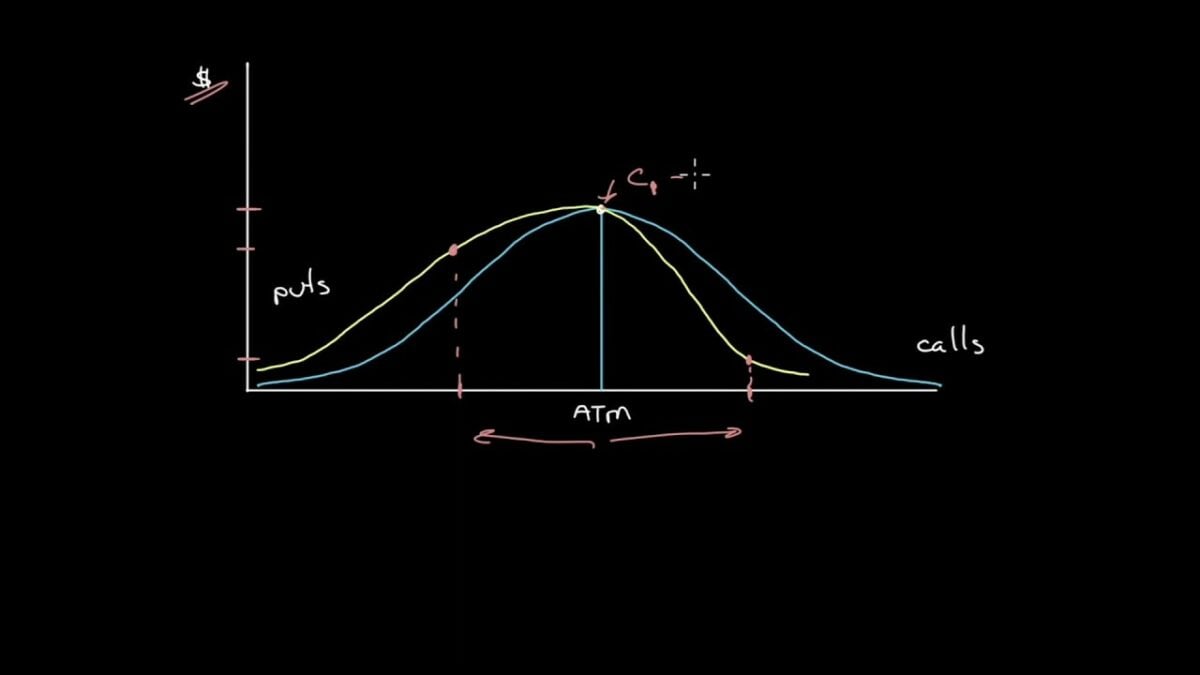

Options volatility skew refers to the uneven distribution of implied volatility across different strike prices of options on the same underlying asset. It represents the market’s perception of potential risks and future price movements. In most cases, the volatility skew is downward sloping, indicating that out-of-the-money put options have higher implied volatility than equidistant call options. This skew arises due to market participants’ preference for downside protection, especially during uncertain or bearish market conditions. Traders and investors monitor the volatility skew to gauge market sentiment and adjust their options strategies accordingly. Understanding and interpreting the options volatility skew is crucial for effective risk management and option pricing.

The skew arises due to market participants’ preference for downside protection, especially during uncertain or bearish market conditions. Investors are willing to pay higher premiums for put options to hedge against potential losses in the underlying asset.

By analyzing and understanding this skew, investors and traders can make informed decisions and develop strategies that align with their risk appetite and investment goals. Monitoring the volatility skew helps to navigate the complex options market and enhance the overall performance of investment portfolios.

The Emergence of Volatility Skew

Volatility skew first emerged following the 1987 stock market crash when traders recognized the need to safeguard their positions. Puts began to carry higher value than calls, leading to the difference in prices between the two. This discrepancy arises when investors hedge their bullish stock positions with options, either by purchasing puts or selling calls. Such actions influence the price of puts and calls in opposite directions, resulting in skew. Typically, puts trade at a higher volatility than calls as investors counterbalance the bullishness of their stock holdings.

Fear and Its Impact on Volatility Skew

The fear associated with a significant market decline often serves as a stronger motivator for investors than the euphoria experienced during a robust rally. Consequently, investors are generally more willing to pay a premium to protect their existing investments compared to the amount they would spend when initiating new positions. However, there are instances when calls are priced higher than equivalent puts, resulting in a reverse skew. This phenomenon can occur during unusually strong upward moves in the market.

The skew arises due to market participants’ preference for downside protection, especially during uncertain or bearish market conditions. Investors are willing to pay higher premiums for put options to hedge against potential losses in the underlying asset.

Analyzing Volatility Skew

To gain insights into the skew, one can compare the prices of equidistant OTM calls and puts on an Option Chain for any given security. Additionally, visualizing the shape of the skew provides valuable information. A balanced skew is referred to as a “smile,” while a “smirk” indicates a steeper slope for OTM puts compared to OTM calls. A smirk suggests that the market is apprehensive about a potential correction. Conversely, a steeper slope for calls implies that traders anticipate an upward movement.

How to Use Volatility Skew to Make Profits

Understanding options volatility skew can aid in strike selection. If traders expect a future event to drive prices downward, the skew on puts is likely to be steeper. On the other hand, if trading is expected to remain relatively stable, the skew on puts may become flatter. Volatility skew can also provide insights into the market sentiment. For instance, if an upcoming earnings announcement is on the horizon, steep put and call skews could indicate the market’s anticipation of a significant upward or downward move.

Final Thoughts

In conclusion, comprehending options volatility skew is essential for informed decision-making in options trading. By studying and analyzing the patterns of skew, traders and investors can gain valuable insights into market dynamics and adjust their strategies accordingly. Volatility skew can be used as an indicator of the market’s expectations for significant price movements, such as before an upcoming earnings announcement. By understanding and analyzing volatility skew, traders and investors can make more informed decisions in options trading and adjust their strategies accordingly. Overall, volatility skew is a vital concept in options trading, providing insights into market dynamics, sentiment, and potential price movements.