What is Flamingo coin (FLM) – is it a good investment?

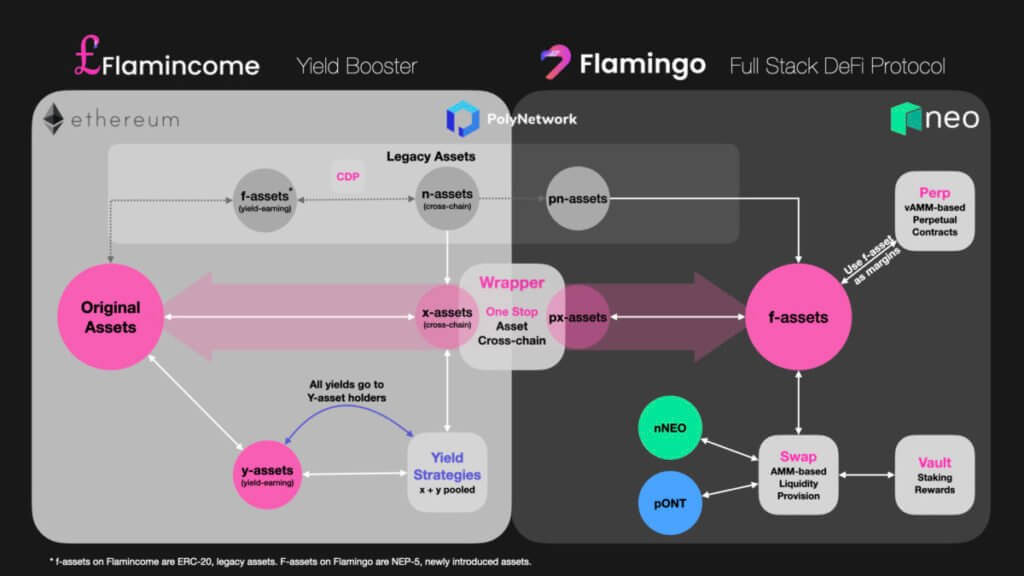

Flamingo is a decentralized, interoperable and comprehensive financial protocol based on the NEO blockchain. The Flamingo coin, supported by Neo Global Development (NGD), emphasizes Neo’s vision of developing a smart economy, in which decentralized finance is a vital component. NGD facilitated the early development of the Flamingo project in the crypto market, and the governance mechanism gradually changed from Proof-of-Authority (POA) to DAO. The Flamingo project is community-driven.

How does Flamingo work?

Flamingo is a DeFi protocol cluster. It integrates multiple modules to provide a complete DeFi infrastructure. Users join Flamingo with different roles, respectively or simultaneously, as trader, staker and liquidity provider.

Flamingo coin general info

Project name Flamingo

FLM Stock Symbol

Market Cap $28,790,487.69

Circulating supply 312,284,062 FLM coins

Official website Flamingo.Finance

Based on DeFi on Neo Blockchain

The launch year 2020

All-Time High N/A

At the moment of writing this article: Flamingo coin price live data – USD 0.092193 with a 24-hour trading volume of USD 6,822,054.

What makes Flamingo unique?

Flamingo is positioned as a singular platform that combines several decentralized financial tools for Neo blockchain into a common ecosystem that its users will rule through a decentralized autonomous organization.

Decentralized finance is an emerging and rapidly growing trend in the crypto industry. It encompasses various financial solutions that often operate on top of cryptocurrency blockchains. Operating as a second-layer industry, DeFi platforms are conceptually aligned with the idea of the cryptocurrency industry as a whole: to eliminate third parties and singular points of failure from monetary and financial systems. The DeFi industry already had over $4 billion in collateral assets.

The unique advantage of Flamingo comes from the fact that it aims to mix all the key financial instruments for the Neo crypto token (token wrap, liquidity pooling, Vault and contract trading) and make them accessible through a single platform that its users will govern in a decentralized way.

How many Flamingo coins are there in circulation?

Flamingo coins were intended to be issued in multiple batches and distributed among ecosystem participants based on their effective participation in the network. The Flamingo team insisted that no FLM tokens be sold, issued or given to the platform team before the public launch.

During the first week of the launch of the Flamingo Vault – the so-called mint rush period – 50 million FLM were distributed among the staking pools.

After the launch of Flamingo Swap, in weeks 2-5, an additional 40 million FLM was distributed to liquidity providers.

Finally, in weeks 10-13, another 30 million FILM were distributed among liquidity providers, FUSD coiners and Flamingo Perp traders.

After the initial minting period and the launch of the autonomous decentralized governance organization, the issuance of new FLM coins and their distribution will be subject to the consensus of the ecosystem stakeholders.

At this moment FLM circulating supply amounts to 312,284,062 FLM coins.

How is the Flamingo network secured?

FLM is based on NEP-5, Neo’s token compatibility standard, so it is secured by Neo’s blockchain. Neo is secured by two hash functions: SHA-256 (the same by which Bitcoin [BTC] is secured) and RIPEMD-160.

Flamingo coin and main features of the project

- Interactive ability

Flamingo coin is based on Neo, which pioneered the Poly Network, a protocol that interacts with Ontology and Switcheo Network.

- Interoperability

The Flamingo protocol is connected to many heterogeneous blockchain networks thanks to Poly Network. Flamingo users can take advantage of interoperability to access more assets in the vast blockchain ecosystem.

- Efficient capital usage

Built as a DeFi protocol cluster, Flamingo integrates the liquidity pool into Swap and the collateral pool into Vault.

In current AMM-based DEXs, the capital efficiency of the liquidity provider is limited by the use of LP tokens, resulting in underutilized and poorly provided AMMs. High mortgage rates in aggregated systems lead to similar issues when users deposit assets into the global token.

LPs of FLM trading pairs in Swap are able to stake the LP in the Vault module while trading FUSD at the same time. Under this mechanism, the efficiency of capital is doubled. Additionally, LPs can continue using synthetic stablecoin FUSD as profit for leveraged perpetual trading in Perp.

Flamingo promises to bring unprecedented efficiency in the use of capital and liquidity compared to separate DeFi protocols.

The Future of the Flamingo Project – Should you invest?

Flamingo’s objective is to be a springboard to accelerate the development of Neo’s DeFi ecosystem. Neo’s commitment to DeFi won’t cease with Flamingo. From insurance to lending and asset management, the potential is limitless.

Therefore, Flamingo encourages all community participants to make proactive recommendations to further optimize Flamingo and build a stronger ecosystem.

Who are the founders of Flamingo coin?

The founder of Flamingo is Da Hongfei, a Chinese entrepreneur also known for co-founding one of Ethereum’s main competitors: the Neo blockchain network, on which Flamingo is based. Hongfei also co-founded OnChain, a private blockchain services company.

Da Hongfei graduated in English and Technology from South China University of Technology and worked as the CEO of IntPass Consulting before teaching himself to code and entering the blockchain scene in 2013- 2014.

The main components of the Flamingo coin project

Flamingo release product features as follows:

- Wrapper: cross-chain asset gateway

- Swap: on-chain liquidity provider

- Vault: one-stop asset manager

- perp: perpetual contract

- DAO: Decentralized Governance

Wrapper

Wrapper stands for a cross-chain asset gateway for Bitcoin, Ethereum, Neo, Ontology Network and Cosmos-SDK based blockchains. Users are in a position to wrap tokens such as BTC, ETH, USDT, and NEO on the Neo blockchain as NEP-5 tokens (nETH, nUSDT, nNEO, nONT, etc.). Wrap NEP-5 tokens can also be exchanged for native tokens.

Vault

Vault is Flamingo’s unique asset manager. Integrate staking/mining assets and issue stablecoins. FLM will be published, and users can request that FLM be distributed at will.

Vault has two main functions:

NEP-5 Token Staking: Users receive FLM when whitelisting NEP-5 (wrapped token and LP token) in Vault.

FUSD staking: The whitelisted LP token holder can earn the FUSD stablecoin using the staking LP token as collateral and receive FLM.

Swap

Swap represents Flamingo’s on-chain automated market maker (AMM), providing liquidity for wrap assets, FLMs and other NEP-5 tokens. The same, similar Uniswap, adopts the CPMM (constant product market maker) model.

In Swap, users can either trade token pairs or provide liquidity to the selected liquidity pool by depositing tokens on both sides of the trading pair.

FUSD

FUSD is a synthetic stablecoin backed by a Flamingo collateral, pegged to the USD.

Minting FUSD: Stakeholders of LP tokens can charge FUSD against their staked LP tokens while keeping the actual mortgage rate above the liquidation mortgage rate. Users can then use the minted FUSD at will.

Burn FUSD: FUSD holder could burn their minted FUSD to unlock their collateral.

Flamingo coin from Minting FUSD: Users will receive FLM corresponding to the amount of FUSD mined. FLM distributions can only be requested by users when their actual mortgage rate is higher than the collateral’s target mortgage rate.

The value of FUSD is pegged 1:1 to USD, intended to provide the Neo ecosystem with a reliable stablecoin.

FUSD can be minted by users who stake whitelisted liquidity fund tokens, earned by providing liquidity to the token pair in the Swap module.

Tokens are minted against in-game tokens as long as the collateralization ratio stays above the liquidation threshold. To unlock the collateral, users are able to burn the minted FUSD at any time.

Each LP token has its target collateralization ratio. It’s based on its unique risk profile. If a user’s collateral is lower than the liquidation collateral ratio, a three day leniency period is triggered.

The user can manually increase their collateralization ratio above the threshold during that period. In the event of liquidation, the assets in play are sold by the quantity necessary to restore the ratio, and a fee of 10% is paid to the liquidator.

Users will receive flm in proportion to the amount of FUSD minted, but FLM cannot be claimed when the actual collateral ratio is above the target collateral ratio for their staked assets.

Perp

Perp represents an AMM-based perpetual contract exchange for virtually any underlying asset with infinite liquidity.

Similar to Swap, traders can perpetuate contract trades using the same CPMM pattern with 10X long or short leverage. Traders will use FUSD as profit margin and receive FLM. The financing rate is in place to ensure that the contract FLM price matches the actual price.

Over time, Flamingo management will be fully supported by the community in the form of a Flamingo improvement proposal and a Flamingo configuration change proposal. Through the DAO, the FLM holder can vote on important topics such as tokenomics, parameter configuration, and functional improvement/change. Voters will receive FLM for their participation in the administration.

How and where to buy Flamingo coin(FLM)?

FLM has been listed on a number of cryptocurrency exchanges. Unlike other major cryptocurrencies, it cannot be purchased directly with fiat currency. However, you can still buy FLM coins easily by first buying Bitcoin, ETH, and USDT from any major cryptocurrency exchange and then transferring to the exchange that offers to trade Flamingo coins.