What Is Staking in NFT and How it Works?

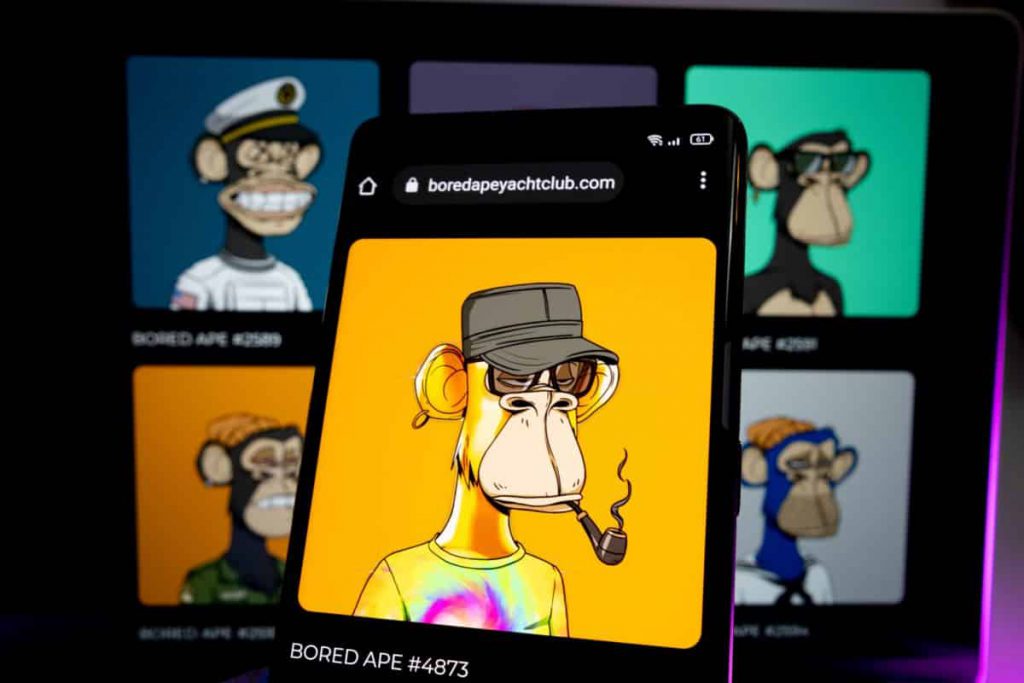

Every time conversations about non-fungible tokens (NFTs) come up, people almost always think of NFTs as digital representations of art as well as collectibles that could potentially appreciate in value in the future. That’s true for a vast majority of NFT projects; however, as the market continues to grow, artists, developers, as well as collectors are exploring new use cases for non-fungible tokens. Nevertheless, one up-and-coming case for NFTs is “staking”.

People from all around the globe are interested in “skating”. One of the easiest ways to gather more information about NFT staking is to open the internet. For example, many people ask questions like “What is staking in NFT” “What is NFT staking” or they simply type “staking meaning”.

We will learn more about NFT staking in this article.

First and foremost, we need to answer one question “What is NFT staking?” It refers to locking up NFTs on a platform or protocol in exchange for staking rewards and other benefits. It is worth noting that staking NFTs allows holders to earn an income from their collection while maintaining ownership.

In the case of the crypto world, non-fungible tokens are in vogue. NFTs are inadvisable smart contracts, usually based on the Ethereum network, that use the ERC721 token standard, meaning every token is unique.

People should not forget that these cryptographic tokens – much like cryptocurrencies – are recorded on the blockchain. Importantly, they can be used to prove the ownership, authenticity, as well as provenance of pretty much anything physical or digital, including artworks, avatars, etc.

Why do people talk about NFT staking?

Without a doubt, NFTs are everywhere. People talk or read about them regularly. However, a lot of buzz and hype around NFTs concerns their potential to revolutionize art collecting. It is no secret that many NFTs that have made headlines generally involve art.

They also found a home in blockchain-based play-to earn-games and GameFi projects. When it comes to play-to-earn crypto games, they use NFTs to give players verifiable ownership of virtual items players collect in games such as Axie Infinity, Illuvium, and Gods.

The uniqueness of NFTs makes them perfect for wait-and-HODL strategies, even though it can take some time before such long-term investments come to fruition.

Unsurprisingly, non-fungible tokens are not without shortcomings: the process of minting, buying and selling can be resource-intensive, etc. Unfortunately, there is also the uncertainty of whether or not a non-fungible token will actually appreciate in value over time.

NFT staking creates a new opportunity for collectors to monetize their NFT collections. Interestingly, NFT staking has become the new way to earn a passive income in the crypto world.

HOLDers who stake NFTs lock their assets in Decentralized finance platforms. They lock their assets in order to receive rewards without having to sell or lose ownership of their collection.

Interesting details about NFT staking

NFT staking is similar in concept to DeFi yield farming, but do you know what is that? We are talking about an investment strategy that entails lending or staking cryptocurrencies to liquidity providers in order to earn rewards in the form of transaction fees or interest. Notably, it is similar to earning interest from a bank account, but without a middleman facilitating transactions and taking a cut.

NFT staking involves “locking” tokens in a digital wallet to support a blockchain network’s operation and security in exchange for rewards. As a reminder, platforms that support staking routinely use a proof of stake (PoS) mechanism for this purpose.

Blockchains depend on a global network of transaction validators to secure the network by validating transactions before the data is added to a new block on the chain.

Besides, these validators are rewarded in the native cryptocurrency of a specific blockchain for allocating their resources to the network.

In the case of energy-consuming blockchains that use a proof of work (PoW) mechanism, the resource validators must devote their computing power, which consumes a lot of electricity as well as expensive specialized hardware.

Proof of stake improves upon the proof of work model’s competitive approach by requiring significantly fewer computing resources to prove transactions and secure the network. People who want to become validators simply have to “stake” or pledge the native cryptocurrency of a blockchain.

How NFT staking works

We discussed various details about NFT staking. So, if someone asks questions like “What is staking in NFT” or “What is NFT staking”, you already know what to say.

There are other important topics as well. For example, do you know how NFT staking works?. Let’s find out.

One interesting detail about the blockchain protocol is that it locks up the funds in a staking pool and then unmethodically chooses validators who are tasked with “mining” or confirming blocks of transactions. Importantly, the more a participant pledges, the more likely participants are to be chosen.

Whenever a new block is added to the chain, new tokens are minted and distributed to the validators as staking rewards.

Moreover, there are various factors which determine how much a validator receives as a staking reward.

By staking their coins as well as becoming validators, coin holders are able to make their torpid assets work for them in exchange for rewards. They also generate passive income. The cryptocurrency protocol is also secured. Besides, user transactions are confirmed.

It is a win-win for all sides. Do not forget that users who stake their coins are still in possession of their assets. They have the freedom to remove the staking pool at any time, depending on the terms and conditions of the cryptocurrency protocol.

NFT staking uses the same system since NFTs are essentially tokenized assets. Users have the ability to lock up their non-fungible tokens on specific platforms for safekeeping and receive rewards based on the established annual percentage yield (APY) as well as the number of NFTs staked.

As in the case of cryptocurrencies, not every NFT can be tasked for rewards. Keep in mind that different projects have different requirements, so check the conditions of your chosen project first before you acquire any NFTs.

What you must know about NFT staking rewards

It is worth mentioning that the type of reward NFT holders can get for staking their collection depends on the platform used and the type of non-fungible token staked. Most platforms which allow users to stake NFTs offer daily or weekly rewards. The staking rewards are usually issued on the platform’s native utility token.

The token is often listed on exchanges and can be traded for other cryptocurrencies or fiat money.

Some staking platforms include a decentralized autonomous organization in which NFT holders can lock up their assets in the decentralized autonomous organization pool to participate in the platform’s governance and vote on future proposals.

Since a big part of the NFT market is ascribed to in-game NFTs, most staking opportunities are on play-to-earn platforms.

Now, we can have a look at some of the best platforms for NFT staking. There is no lack of such platforms. All you have to do is stake your NFTs in a compatible wallet to get started. Below are some of the best platforms when it comes to NFT staking.

Various platforms

We can start with NFTX. It is a platform for creating ERC20 tokens that are backed by NFT collectibles. Users have the opportunity to deposit their NFTs into an NTFX vault and mint an ERC20 token that’s compatible and fungible at a 1:1 ratio. Notably, these tokens, called vTokens, can be staked for yield rewards. Moreover, it is possible to use vTokens to purchase specific NFTs from a vault.

Holders can pool their tokens in automated market makers to create a liquid market for other users to trade. They can then earn trading fees as liquidity providers. Furthermore, tokens that have liquidity and trading volume get a “floor price” – the lowest market price for an NFT – which is perfect for investors trying to price their NFTs.

Another engaging platform is Splinterlands. It is a blockchain-based collectible card game that’s similar to Hearthstone in that players can build up a collection of cards listing various abilities and stats and use them in matches.

Splinterlands has its own native token called SPS that’s set up as a DAO on the Binance Smart Chain. Users have the ability to stake their SPS tokens on players participating in ranked battles, liquidity pools, as well as the DAO pool for governance voting.

Potential investors

We covered various topics related to NFT staking. It is important to mention one crucial issue as well. Probably, many people also want to ask this question: Is NFT staking a profitable investment or not?

The concept of NFT staking is a relatively new concept, and people shouldn’t forget that fact. Without a doubt, liquidity is a big issue for non-fungible tokens – partly because the ecosystem is not developed well and also because the majority of NFTs are purchased for the purpose of HODLing as long-term investments. Despite challenges, many investors are willing to enter the crypto market. They want to explore and potentially earn rewards on NFT platforms.