Non Correlated Forex Pairs – Get all the Crucial Information.

Have you ever thought about what the non correlated forex pairs are? Why is it crucial to understand them if you are interested in a successful and long-term Forex trading career? First of all, the Foreign exchange market has become extremely popular in the past couple of years, with hundreds of thousands of enthusiastic individuals worldwide trying to profit from it.

However, being a successful professional in Forex requires certain skills and knowledge. Even though it’s a highly volatile industry, where its market has a daily turnover of $6.6 trillion, making profits also requires traders to be very knowledgeable about Forex and its workings. One of the main things that every serious trader must understand is what non correlated forex pairs are.

So, what do these non correlated Forex pairs represent, and why is it important to know how to recognize them? Let’s find out more about the general forex correlation and how to trade non correlated Forex pairs then, shall we?

Currency correlation and non correlated Forex pairs

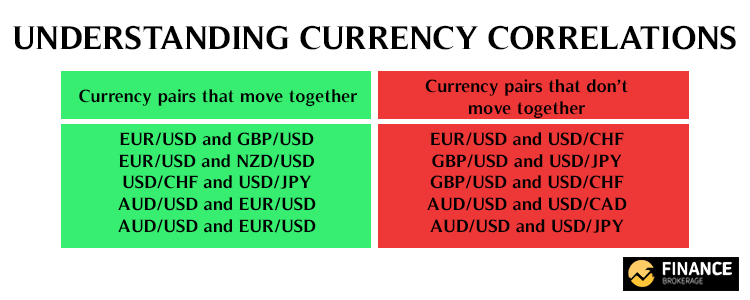

In Forex, a currency correlation represents either a positive or a negative relationship between two currency pairs. Regarding positive correlation, two currency pairs move unitedly, while a negative correlation means that these pairs move in opposite directions. The term “correlation” itself means that currency pairs mimic one another.

When building an effective strategy, a correlation of currency pairs plays a significant role. By operating with strongly correlated pairs, traders usually aim to double their profits. However, there are non correlated Forex pairs that usually move in total disagreement with each other. So, why are these non correlated Forex pairs worth traders’ attention?

What are non correlated Forex pairs exactly?

Non correlated Forex pairs, in simple terms, represent the currencies’ values that can virtually cancel each other out. Even though it might look counterproductive to entrust in pairs that usually don’t agree, in real life, such “illogical moves” have proven their effectiveness.

Regarding this approach, the number one to consider is via sorting non correlated Forex pairs by their volatility. Remember that currency pairs helped with their non correlated alternatives represent the most volatile currency pairs.

So, the base currency shows that another currency is a negative currency pair (USD/JPY and USD/CAD, for example, where USD is considered a base currency). However, it’s crucial to understand that currency pairs are prone to change into inverse correlation over some period.

These changes usually come as a result of political and economic factors. We can tell that non correlated Forex pairs are those that work independently.

Examples of non correlated forex pairs

One of the best examples of non correlated forex pairs is GBP/NZD and EUR/USD. The main reason these two currency pairs are considered the best non correlated forex pairs examples is that they have no common currency. Plus, these pairs are known to represent four different economies.

It means that the US, UK, New Zealand, and Eurozone are non-connected, implying that if one increases, the other won’t follow 100% of the time. Also, USD/CHF is another great example of one strong non correlated currency pair in Forex. By establishing identical positions at the same time in this pair, a trader is able to hedge risk exposure efficiently.

However, non correlated Forex pairs that move in opposite directions are usually reserved for short-term risk management. In addition, these noncorrelated Forex pairs aren’t expected to result in huge profits over time.

Also, one example is the GBP/USD and EUR/USD pairs with the US dollar as the base currency. For that reason, they’re moving in the same direction. But it’s not always the case. AUD/USD and EUR/JPY haven’t got the same currencies. That’s why they tend to be lower and are considered non-correlated Forex pairs.

Short-term volatility – a great threat to positions

Keep in mind that short-term volatility usually represents a great threat to positions. Thus, when one particular currency declines, its greatest non correlated Forex pairs rise. That results in nearly zero potential losses.

However, in opposition to trading correlated pairs altogether, traders use noncorrelated Forex pairs that go in opposite directions for short-term risk prevention that isn’t expected to result in huge overplus.

The correlation between non correlated Forex pairs is prone to change.

Suppose you are interested in attempting risk management via non correlated Forex pairs. In that case, it’s crucial to consider that correlation is usually liquid, meaning that the relationship between pairs is prone to change from time to time.

So, even though numerous currency pairs are, historically speaking, non correlated pairs, the degree of that non correlation relationship is prone to commute. Sometimes traders can expect the correlation between particular non correlated Forex pairs to go from positive to negative and the other way around.

What do traders use to handle the constantly changing correlation?

For controlling the constantly changing correlation between currency pairs in Forex, traders usually go for tools that can be helpful. One of the main tools for handling the ever-changing correlation is known as the “interactive correlation matrix.” This tool functions by applying a specific formula that can evaluate the exact level of correlation between two currency pairs.

Regardless of your experience level, the interactive correlation matrix is a sufficient tool to help you. During a trading session, it’s only important to check it several times to ensure that you’re getting in the right direction.

Keep in mind that getting informed about the world’s economies on a daily basis and how they affect each other, reflecting on price fluctuations, is another crucial asset in your trading toolbox. Understanding the origins of the relationships between numerous currencies is one of the key elements that can lead traders to success.

What are the main reasons for the inverse correlation?

Some reasons make traders change their currency pair into inverse correlation. Once they need to convert one particular currency pair into a negative correlation, it’s presented by the “0”. Here is the situation:

- A particular currency pair goes upwards, while the inverse correlation goes downwards_ PIP for PIP.

- EUR/USD currency pair is going downwards, so the USD value is gaining. Then traders tend to purchase USD currency, believing its economy has a bright future.

- Traders Activate the downward moves when they start selling EURs and buying US dollars.

- Pairs with USD would increase, such as the USD/CAD pair, when USD increases in value in inverse correlation. Thus, traders would sell CAD currency and buy USD one.

However, the main question could be, “Why is USD currency among all other currencies?” The answer is that USD represents a reverse currency. So, anything affecting the USD will certainly greatly affect all USD pairs crossed in the Foreign exchange market.

Non correlated Forex pairs list – examples

To understand the whole concept of negative correlation pairs or non correlated Forex pairs, here are the best examples that will make it much easier to comprehend:

- EUR/USD USD/CHF

- USD/CAD AUD/USD

- AUD/NZD NZD/SGD

- USD/JPY Gold

Remember that the correlation between USD/CHF and EUR/USD is considered negative. The USD/CHF non correlated Forex pair often moves in the opposite direction to the famous EUR/USD currency pair. Usually, the negative correlation between EUR/USD and USD/CHF is below -0.70, being able to fall as low as -0.97.

What is the future of the general Forex market?

Now that you’ve understood the basics of non-correlated Forex currencies, if you’re eager to start trading on the Forex market, you will probably be interested in what the future holds for Forex in general and why it seems more enthusiastic individuals worldwide are starting to trade intensively.

First of all, Forex can be extremely lucrative and profitable if the approach to it is done correctly from the business point of view. However, a huge success in Forex can only happen after some time. It requires a lot of effort, skills, knowledge, and persistence to be done correctly and to make profits.

2020, Forex trading has increased approximately 300% since March 2020, and that trend seems to continue. According to experts in this industry, by 2030, Forex reserves and funds may approach $50 billion. It’s expected that the Forex market will flourish in the next decade, making it very attractive for newbie investors and traders who want to make a living from the Forex market.

Key Takeaways

- Non correlated Forex pairs are those that move independently of each other because currencies in two separate currency pairs are completely different or are from different economies.

- Separate economies mean, for example, the UK, Eurozone, New Zealand, and the US.

- Forex is able to be traded in positive and negatively correlated currency pairs.

- Currency correlations are used by Forex traders who either aim to use it for creating value via commodity correlations or to increase their risk and hedge their trades.

- Safe currencies include USD, JPY, and CHF, while Risk currencies are MXN, ZAR, and CAD.

- The easiest Forex pair and the most stable one to trade is EUR/USD.

- AUD/USD is the currency pair that positively correlates with Gold.

- Gold is negatively correlated with the US dollar.

- Success in Forex is possible with significant discipline, dedicated work, practice, and learning from experienced Forex traders.

- The future of Forex is more than bright, and therefore it is profitable to invest your time and money in the Forex market. Good luck!