What is a Rounded Top in Forex – Get All The Basics Of It

Are you another Forex devotee wondering what a rounded top in the Forex market is lately? Have you been looking for new ways, techniques, and tools that might help you improve your Forex trading career in the long run? If you’re wondering what a rounded top Forex is, it’s time to get all the basics of it from a true professional.

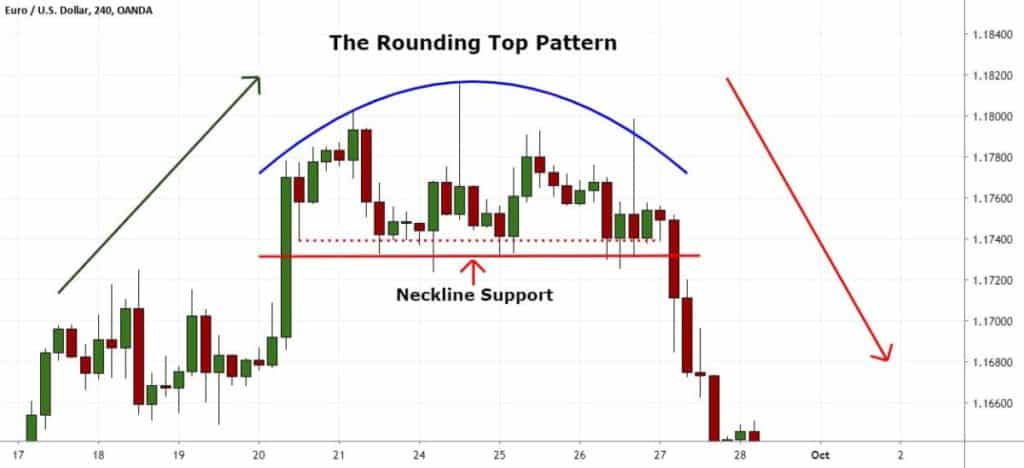

In the shortest way, a rounded top refers to a specific pattern that looks like an inverted “U” shape. It’s also called an “inverse saucer” by some technical analysts. The main goal of the rounded top pattern is to enable the end of an uptrend and a probable start of a downtrend.

In other words, the rounded top in Forex signals a great opportunity for going short in the Foreign exchange market. This particular pattern is used in technical analysis by Forex experts who are eager to increase their profits. So, why is this rounded top pattern so crucial to understanding nowadays? Let’s get to know all the essentials of it, shall we?

Understanding Rounded Top pattern in the Forex market

Shown as an inverted “U,” this pattern is similar to the inverse saucer and double and triple top price patterns. Its duration could take up some time, from months to even years in some cases.

The rounded tops could be encountered at the termination of the extended upward trends that could imply a reversal regarding long-term movements in price. To understand the full downturn in price, investors in the Forex market need to be familiar of its possible long-duration period in advance.

A bearish rounded top Forex pattern

Keep in mind that a rounded top represents a bearish reversal pattern, so it’s known as the bearish rounded top forex pattern. The presence of this type of pattern suggests that there’s a probability that the Forex market will reverse lower, enabling traders with valuable selling opportunities. This pattern is useful in case it’s formed during a bearish trend.

In this case, the rounded top could be like the head and shoulder pattern. It’s identified thanks to the existence of numerous highs that go after an arc. They follow it in the following manner:

- Left: Lower highs

- Middle: Higher Peaks

- Right: Lower peaks once again.

The main goal of acknowledging the rounding top pattern

The main goal of acknowledging the top rounding pattern represents waiting for a clear substitute in trend. These changes should be from upward-trending prices to downward ones. If investors succeed in recognizing these changes, they’ll be able to earn profits.

In addition, traders will be able to preserve themselves from purchasing into not-so-desired markets or earning money from decreasing prices. They’ll be able to earn profits from falling prices with the technique known as “short-selling.”

What are the top three components of a Rounded Top?

If you’re interested in learning additional stuff about what Rounded Top Forex has to offer, it’s crucial to understand that there are top 3 essential components of it:

- It has an upside down volume pattern that’s lower medial of the pattern or high on each end.

- Rounding shape in which prices taper off and trend higher or lower.

- The support price level that people can find at the pattern’s base.

Traders should keep an eye on the volume.

Traders in the Forex market should keep an eye on the volume regarding the rounding top. The volume should be higher while the chart price, on a downtrend, increases and also decreases.

As mentioned above, this pattern looks like the upside down letter “U”, so that the security price will increase to an additional high. Then it will start decreasing slowly from a resistance level. The main goal of that decrease is to set up the rounding top.

Keep in mind that volumes in this situation could be sky-high once the price also increases. They also can experience a high when the sell-off phase happens in a downtrend.

Formed amid a bullish trend

The rounding top is formed amid a bullish trend. Once it’s formed, it submits the expected bearish price action. It’s predicting the trend extending. The continuation pattern is the opposite of it since it predicts a trend reversing.

Experienced Forex traders consider rounded top as a sign of two potential situations:

- To short a specific currency pair;

- To exit a long open position.

How can traders identify the Rounded Top Pattern?

One of the main questions regarding this type of pattern is how traders are able to identify it most effectively. Here are some of the basic Rounded Top identification steps that anyone is able to take:

- You are getting to identify the bullish trend in your price chart. Remember that a bullish trend includes, as mentioned above, higher highs series and lower lows.

- Establish the rounding top. The periodic highs present in this case have a decrease in magnitude. In this case, the rounding top will appear as a curve that has a downward slope. Declining trend volumes is what it will display during a formation.

- Make a “neckline” in the chart. It’s crucial to draw it since it’s a standard price point. This point is the one that gives traders an answer to what exactly is the lower extreme of the rounded top pattern.

To trade the rounded top in the Forex market, selling under the bottom of the present pattern is essential.

What are the top three advantages and disadvantages of the rounded top?

The main advantages of the rounded top pattern in the Forex market are:

- The pattern is extremely easy to spot and identify.

- This pattern happens in every market very often.

- It leads up to significant bearish trends.

Besides these advantages, here are some of the disadvantages of the rounded top pattern that numerous traders are able to identify with:

- It could provide traders with false signals regarding consolidating markets.

- Some traders might take a lot of additional time to execute in-frame charts.

- In consolidating markets, this rounded pattern is able to produce false signals.

Regarding the rounded top pattern, traders should keep in mind that it isn’t another forecast gadget. It refers to a technical pattern that gives certain information to the investors that stock began to weaken in the settlement to keep their stock. It also might signal the beginning of vending shares in much larger numbers.

However, this scenario is only sometimes the one that’s happening. Once the price breaks down to go after the downward trend once the rounded pattern’s been displayed, it rebounds out of the support level, retracing much higher prices.

Keep in mind that some observers in the Forex market suggest that the rise in prices equals more than 30% of the gap from the support level. It’s leading back to the support that’s the probability that will enable increasing of the new highs. Regarding that situation, the cost pattern reveals a bullish forecast all the way to the foregoing high.

Getting back to foregoing highs

You need to remember that in case this type of pattern sequence chart doesn’t get to reversal, it may start returning to foregoing highs. In case these highs encounter resistance once again, it would make a double top.

The security’s price regarding a double top pattern will enable traders to see 2 U-shape upside-down patterns. If that’s the situation, the security price will still be as high as possible, and investors will be considered entirely bearish.

A bearish indicator

Traders should also remember that this type of double top, which includes the mix of these 2 rounding tops, represents a bearish indicator. The main reason is that the individuals buying have tried twice unsuccessfully to expect their higher prices to actually happen.

Once investors resist the bearish trend, it’s the time when this kind of pattern forms. Once they aren’t resisting and starting to exit it, they’re expected to complete it quickly. In general, this type of pattern, which reminds of a rounding top, indicates when is the completion of a present bullish trend.

Indicating the opportunity to go short

Traders still doubting whether a rounded top in Forex indicates going long or short should keep in mind that the rounded top indicates the possibility of going short. Since we’ve learned that this type of pattern looks like an inverted “U” letter, often called an “inverse saucer,” it’s not so hard to spot and tell what kind of indicator it truly refers to.

The rounded top pattern shows exactly the termination of an uptrend, which means that a downtrend has started to happen. That’s why the rounded top pattern in Forex indicates the opportunity to go short rather than long, as some traders might think.

Key Takeaways

- A rounded top in the Forex market represents the specific type of pattern that appears as an inverted “U” letter.

- The pattern usually signals a downtrend’s beginning and an uptrend’s end.

- It indicates a valuable opportunity for traders to go short.

- Regarding the rounded top pattern, traders should keep an eye on the volume.

- The advantages of this pattern are that it’s easy to identify, happens often, and leads to bearish trends.

- The disadvantages of the rounded top pattern are that it might provide traders with false signals and could take a lot of time to execute in frame charts.