What is the famous Three Line Strike Candlestick Pattern?

Have you ever thought about how to trade the three line strike? What represents the Three-Line Strike Candle Pattern, and why does it seem that numerous enthusiastic traders are very interested in it? First, to become a successful trader, it’s crucial to know how to do a proper technical analysis, and recognizing patterns is an essential aspect of it.

With good technical analysis knowledge, traders are able to act in every possible situation. Once evaluating price actions, with the technical analysis knowledge, you’re calculating the flows of investors’ point of view based on numerous market consolidations and trends.

When these prices start going sideways, they form patterns that could be utilized to dictate what will be the price movements one day. Knowing how to recognize various chart patterns, enables you to get the full idea of how to differentiate patterns that indicate a continuation and those that denote a reversal happening.

IFurther in this text, we’ll cover one among the most significant patterns: a three-line strike candlestick pattern. You’ll get to know what a bearish three-line strike is and how to trade it. For acquiring great profits, it’s essential to learn how to recognize, use and profit from this famous Three Line Strike Candlestick Pattern. So, let’s get started with the basic definition of the three-line strike candlestick pattern, and learn all of its essentials, shall we?

What is a Three Line Strike Candlestick Pattern?

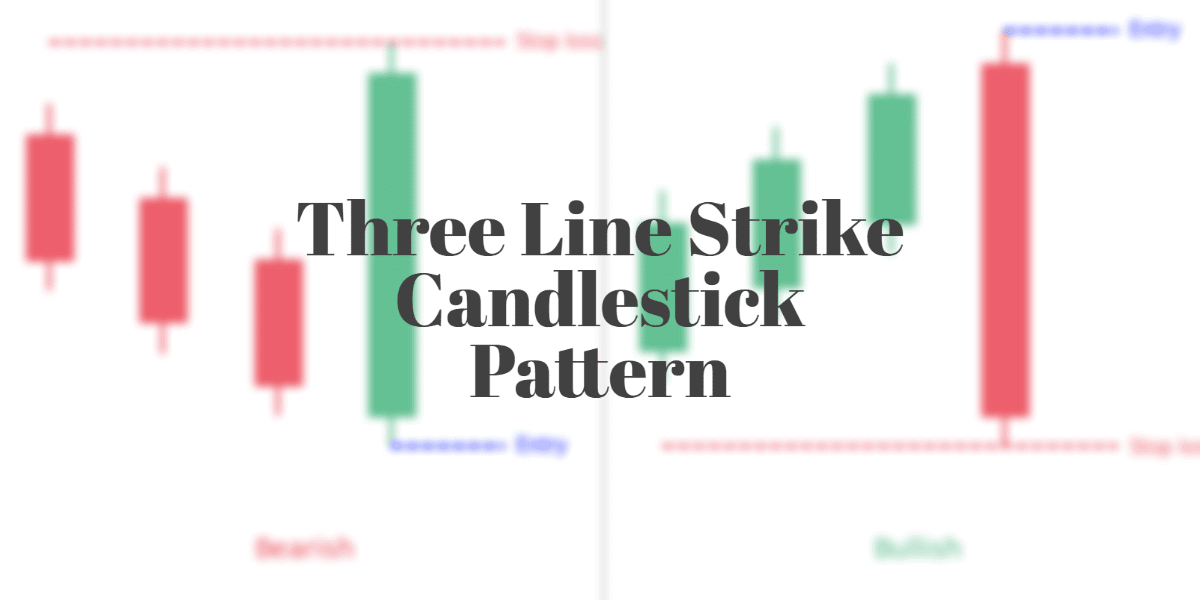

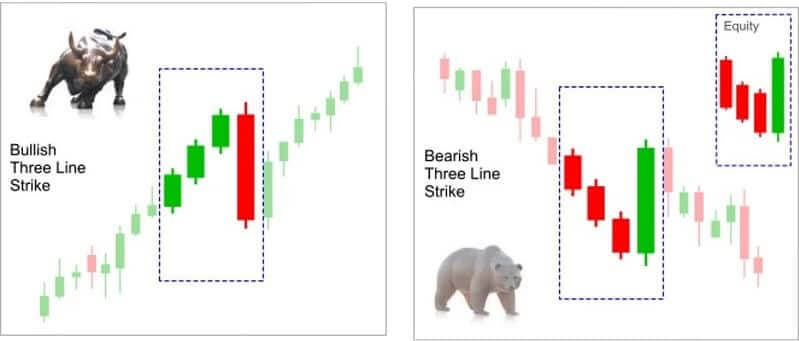

A Three Line Strike Candlestick Pattern represents a trend continuation candlestick pattern consisting of four different candles. This three-line strike pattern is considered a rare pattern. It means that finding them could be possible with a scan. Remember that a daily scan can show you the sharp reversal that could be used in the downtrend as a bearish entry point.

This pattern, such as any other, exists to help traders to determine a trend that’s expected to keep going. Once the trend goes in a specific way, all prices will break off before going higher. Traders know it by the term “Continuation Pattern”.

This pattern is opposite to a pattern that was developed to indicate a reversal. The three line strike candlestick pattern represents a continuation pattern. For newbies, candlestick patterns represent a particular group of at least two candle bars.

A candle bar represents a price bar that shows all the data to a person that indicates the following:

- Open

- High

- Low

- Close

In all cases, it’s at any time a chartist is evaluating. Regarding the three line strike candlestick pattern, we have a bullish and a bearish trend continuation, which depends on their heights and collocation.

The best way to identify the Three Line Strike Candlestick pattern

The best way to identify the Three Line Strike Candlestick pattern is to understand that it’s rare in the Forex market. For that reason, it’s hard to judge its reliability. Regularly, patterns are established. The process of establishment is happening altogether.

Triangle patterns and other types of large patterns are able to affect the breakdown of numerous different candlestick patterns. For instance, an average pattern could also do that for a continuation pattern to result in the reversal pattern.

Patterns like the three-line strike candlestick are able to form the famous “cup and handle,”. It’s a term that describes a specific pattern with a bullish signal extending an uptrend. They usually reverse. For that reason, a three-line strike pattern forms on the top of symmetrical triangle patterns that might result in different ways.

Risk Management Techniques

There are certain risk management techniques that traders can use once they use the so-called “three-line strike entry .” They are like any other trend-following strategy. The main objective is to recognize and catch a trend and follow it until the trend reverses.

With all this, traders would be able to place a stop below their entry and then move it higher once the market trends upward. In addition to that, for a bearish pattern, traders could move the stop loss downward.

Input Parameters of the Three-Line Strike candlestick

Every trader needs to be aware of certain input parameters of the Three-Line Strike candlestick to read it successfully. Here are these important input parameters:

- The length parameter includes the number of candles utilized for calculating the average body height. In case the candle surpasses the average, traders consider it long.

- The trend setup parameter represents the number of preceding candles used to check whether the trend exists.

What is the best way to trade the Three Line Strike Candlestick?

If you were asking yourself, “How to trade the Three Line Strike Candlestick,” in order to do it successfully, traders must trade it at the price chart’s local extremes right after the so-called “preceding movement or descending or ascending .” Nonetheless, it’s not recommended that traders use a flat, which represents a sideways movement.

It’s better to use timeframes, i.e., time intervals, liquid and greater assets such as:

- Stocks

- Currency Pairs

- Commodity Futures

- And stock Indices.

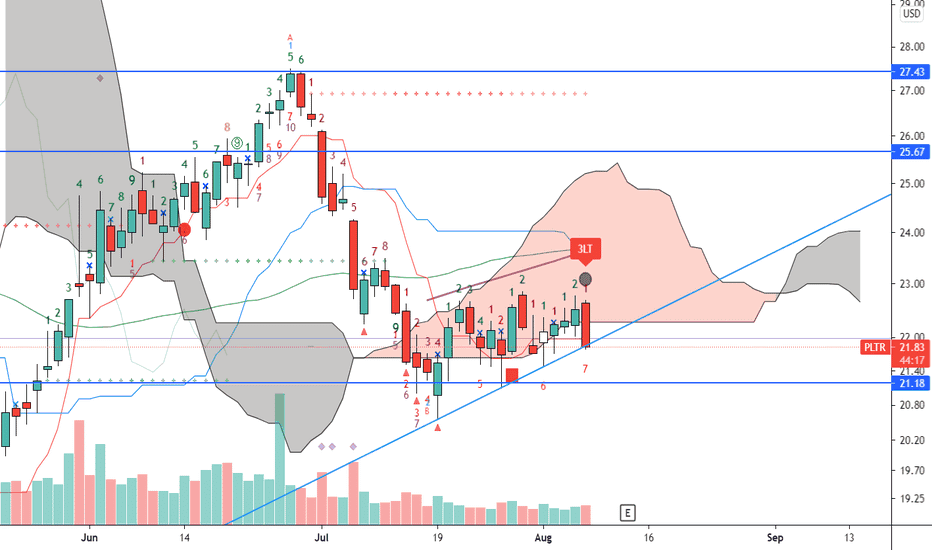

Examples of trading

Here are the two main examples that will be more than helpful when learning how to trade the Three Line Strike Candlestick pattern:

Purchasing by Bearish Three Lines Strike

On the other hand, traders could purchase by Bearish Three Lines Strike. It can be done so at the lows of the price chart after a decline. That is the exact time when a reversal Bearish Three Lines Strike pattern will form.

It’s recommended that traders get to the market once the price gets greater than the high of the fourth line, which is described as the huge candlestick, the white one. After the position is opened, it’s advised to set a Stop Loss slightly lower compared to the pattern’s low.

Profit could be taken once the price results in a crucial resistance level, which is a base of classical tech analysis. Traders can also expect a profit from the correction lines of Fibonacci.

Selling by Bullish Three Lines Strike

A Reversal Bullish Three Lines Strike pattern will appear after the quotes’ growth. Once it happens, traders should get to the market with a selling position once the quotes begin to fall down.

After the drop below the 4th candle is when traders are advised to get to the market. Once traders have entered the market, placing a Stop Loss higher in comparison to the pattern’s high is recommended. When the price results in a strong support level or in line with the famous Fibonacci lines, note that.

The Three Line Candlestick Pattern Strategy – the best choice

The best trading strategy with the Three Line Strike Pattern is to look for the formation of the three bearish candlesticks. Once it’s done, traders will notice the fourth large bullish candlestick to deluge the 1st three bearish candlesticks.

The fifth candlestick would break above the 4th bullish candlestick then, and when it happens, it’s crucial to take the long position immediately after the price smashes above the 4th one. Underneath the base of the 4th candle is where traders should put a stop-loss.

Keep in mind that traders are also able to take short positions once the price is under the 4th candle. In that situation, traders inevitably set a stop surpassing the 4th candle.

Advantages and disadvantages of the Three Lines Strike Candlestick

If you were asking yourself the advantages and disadvantages of utilizing the Three Lines Strike Candlestick pattern, you need to remember that several criteria form it. This particular pattern doesn’t occur that often. It has a unique criteria that results in its occurrence.

It all compares to a pennant or a flag, which are non-candlestick continuation patterns that don’t have any criteria to occur. It’s crucial for determining that a certain continuation is happening. The trend reversal generally enables an excellent initial opportunity for traders to be a part of a certain trend.

In addition to all that, traders are able to utilize these specific patterns together with numerous other tools. One of these tools is a moving average crossover pattern.

Bottom Line

What is crucial to remember is that the Three Line Strike Candlestick pattern rarely occurs. It’s because of the specific criteria that don’t happen so often. It’s considered a continuation pattern that represents a pause that refreshes higher.

Also, it assists in identifying the famous consolidation in a trend. Remember that using a scanner is also helpful in identifying the Three line Strike pattern. The Bullish Three Line Strike represents the fourth candle bullish continuation pattern that forms a famous bullish trend. It’s considered to signal the bullish trend’ continuation.

Keep in mind that it is very important to understand technical analysis and how to recognize and use candlestick patterns wisely, because that’s the only way you can achieve significant success in the market and therefore make huge profits.

In order to successfully enter a trade that’s based on this pattern, it’s crucial to have a great understanding of the risk management and utilize the risk management strategy in the best possible way. Only in that way, traders would be able to use the full potential of this candlestick pattern! Good luck on your path to success!