Binary trading tutorial – how to trade binary options?

Are you actively looking for a binary trading tutorial? Have you been searching for a relevant source where you’ll get to learn how to trade binary options as a true professional? First of all, it’s essential to understand an array of binary trading tutorial examples that you may encounter on the internet.

Significantly, you understand what is binary options trading in the first place. Getting a clear picture of it will make your trading much more accessible, and you will go through the whole binary trading tutorial in short order, effortlessly.

Suppose you start your trading career and know nothing about options trading for beginners. In that case, we’d like to give you a proper explanation of this option before we move on to our practical tutorial. You will learn what it is and how it can enable you to earn trading from the comfort of your home!

What is a binary option?

A binary option represents a financial option that is an “exotic option,” or in other words, more complex than numerous others. It is a financial option where a standard payoff could mean a fixed monetary amount or no amount at all.

It is based on a simple “yes” or “no” proposition, such as “Will an underlying asset be above a particular price at a certain time or not?” Traders typically place wagers on whether that situation will happen or not.

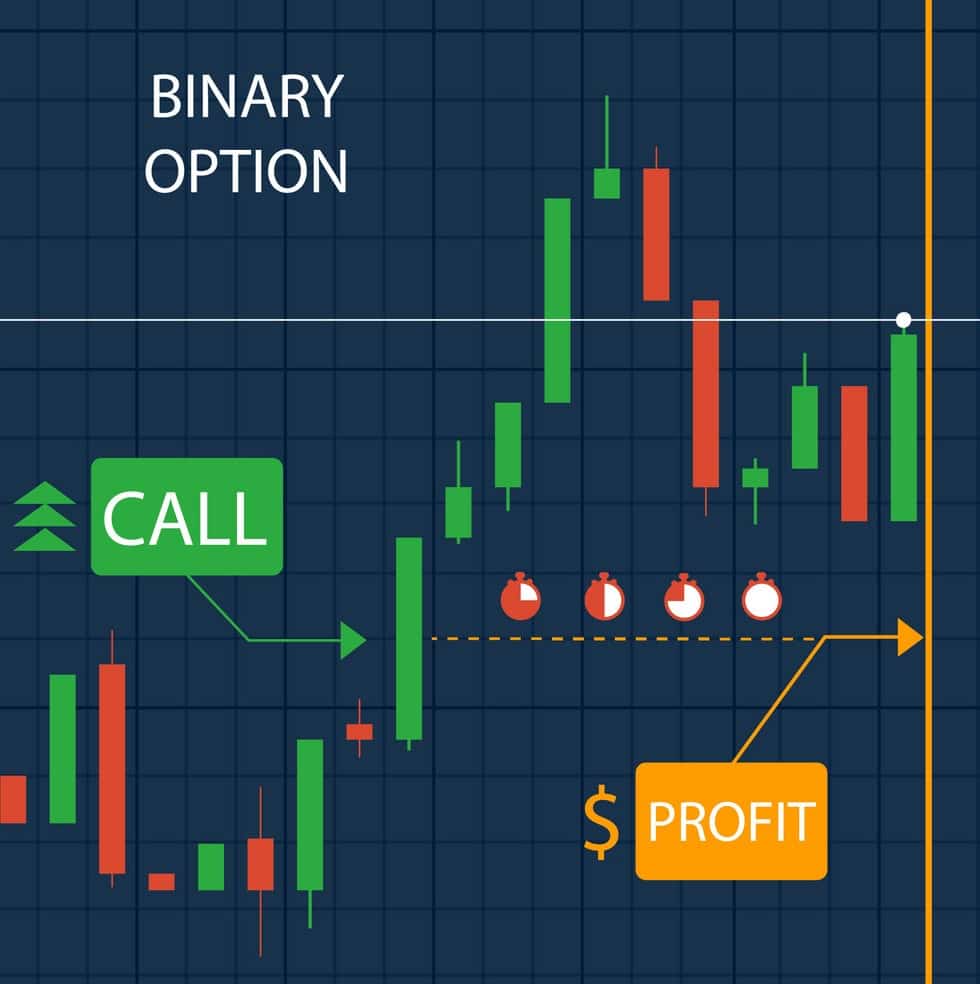

The principle goes like this: If a customer believes that the price of an underlying asset will get above a particular price at a given period, a trader will buy the binary option. On the other hand, if a binary trader believes it will go below that price, they will sell the option. For example, in U.S exchanges, binary price is constantly under $100.

Main types of Binary options

We have two primary types of binary options:

- The cash-or-nothing option pays some fixed amount of cash if the option expires in the money.

- An asset-or-nothing option pays the exact value of the underlying security.

However, they’re also referred to as all-or-nothing options, digital options that are usual in Forex and interest rate markets, and FROs, or fixed return options.

Binary options are primarily for theoretical asset pricing; however, it’s no surprise that they are often exposed to fraud in their applications and are considered a way of gambling in some jurisdictions.

Binary trading options explained.

Binary options trading represents trading uncomplicated options contracts with a particular fixed risk and reward. Traders can choose up, down, touch, no, touch, and numerous other trading strategies since the option is based on a “one or the other” approach for payout.

Even though there are different options, traders must understand one thing. They should choose a binary option based on whether or not crypto, stock, commodities, or another underlying asset, for example, will move upwards or downwards in a given time.

Binary options trading means that traders are betting money on a given period prediction. Traders could see how much money they can earn if a prediction turns out to be correct.

If it turns out that it’s correct, a trader will get its money back in addition to the return, which is generally large, around 70% and more. On the other hand, if it is incorrect, a trader shall lose its bet and the money they’ve risked.

So, let’s get started with a binary trading tutorial now that you’ve understood all the fundamentals of this popular option!

Step 1. – Understand the binary options basics.

Before we get started with binary trading, it is vital to understand all the basic terminology, such as:

- Asset: Commodity, stock, underlying currency, or index that the binary option is based on.

- Current rate: Asset’s currency cost.

- The range option: The specific limit that a company will specify for different zones.

- Broker: A financial company or individual allows traders to trade binary options on the options markets.

- Expiration dates: Exact time and date when the option will be settled into cash.

- In-the-money: Scenario in which the movement of an asset is described correctly by the trader, thus making the binary option worthy of money.

- Out-of-the-money: It’s the opposite of the in-the-money option. It means mispredicting the asset price and losing money.

- Rate of profit: A total percentage of income that one trader gets after the trade expires. This rate of profit shows how good the choices of a trader have been on the whole market.

- Call/Put options: A call represents a contract that enables the right to buy the asset until the contract expires. In contrast, the put refers to a contract that provides the right to sell the asset at the strike price at any point up until the expiration of a contract.

- One-touch options: This type of option pays out a premium to a person who holds the option if the spot rate goes to the strike price any time before the option expires.

- A trading range: A specific security trade between high and low prices for a given period. A trading range occurs once a specific security trades between high and low prices for a particular period.

Step 2. Take into account all opportunities and risks

Binary trading represents nothing to process, so you should expect a high risk. If you want to gain tremendous success in predicting the changing value of an asset, you have to do a lot of quality research on that particular asset and recent changes.

However, even doing so, nobody can guarantee that you will win. If you lose, don’t get devastated if you lose the entirety of what you bet. Even in this case, don’t forget that with more enormous risks come more extensive opportunities. With trading binary options, traders could expect to make much money, especially as returns remain between 70% and 85%.

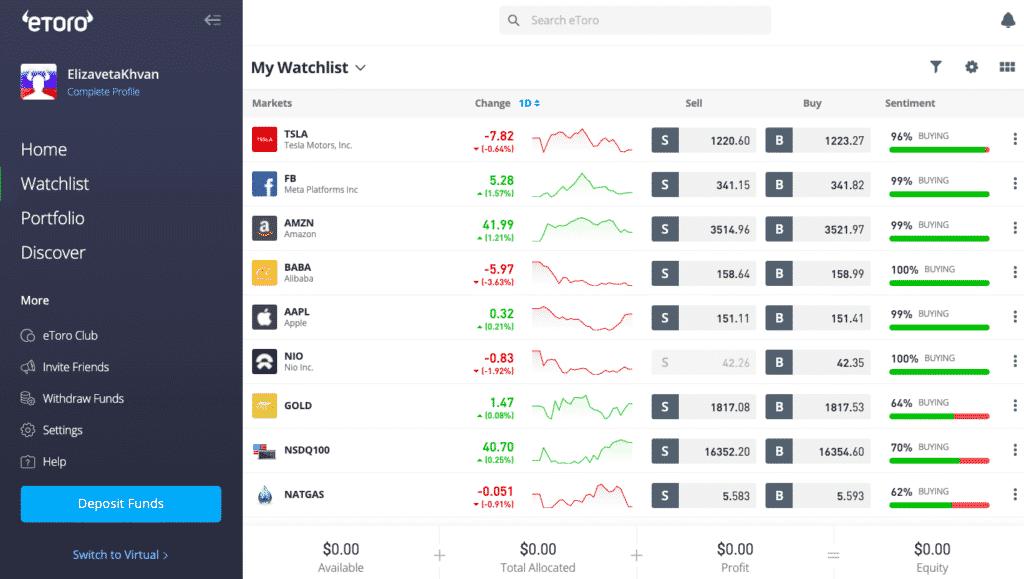

Step 3. Pick wisely your binary broker

The third step in this binary trading tutorial is to pick wisely your binary broker. As mentioned above, a binary broker represents a company or an individual responsible for allowing traders to trade binary options on the options market.

In order to choose a relevant broker of the highest quality, it’s crucial to see what your preferred broker offers and what kind of binary options broker is. The internet has numerous fraudulent brokers; hence, we advise you to always double-check your preferred broker before proceeding with it.

It’s crucial to ensure that your chosen broker has a high trust level in Traders Union and that broker’s offering includes unique bonuses.

Step 4. Try a demo version on the binary site

Once you’ve chosen a trustworthy binary broker, we recommend opening a binary demo account first. Don’t get confused because it’s considered a “fake” trading account because users use fake money to practice trading on trading platforms of their choice.

Demo accounts stimulate the motions of the market to provide a legitimate and real trading experience without any risk of losing invested real money. Besides being risk-free, demo accounts are an excellent tool for learning how to trade binary options.

Step 5. Choose one of the best binary trading strategies

Whether you’ve just stepped into the binary trading options universe or been into it for a while, it’s always good to find helpful trading strategies that will help you increase your profits. After gaining relevant experience with your demo account and trusted broker, the next step should be to choose a quality binary trading strategy.

Here are some of the most effective binary trading strategies that professional traders use:

- Follow the News to get as much information from as many sources as possible to understand your asset and predict whether its price will rise or fall.

- The Straddle Strategy should be used with the news strategy. This strategy leverage swings to enable profits regardless of if the price falls or rises.

- Follow the Trends strategy includes following the latest trends, and it’s the best strategy for beginners since asset prices typically move in conjunction with trends.

Step 6. Don’t be impatient and greedy

Ultimately, in this binary trading tutorial, you should know that binary options are highly high-risk instruments, and it’s crucial to follow to rules strictly. Furthermore, it’s best to trade with leveraged funds since most successful binary traders risk 1% and less of their total capital.

Here is one practical example: Suppose a trader has a $1000 account. They should maintain their risk to approximately $10-$20, not more than that. Generally speaking, professional traders do not advise beginners or less experienced traders to risk more than 5%, even though 1-2% is optimal for success.

Is Binary trading considered to be profitable?

If you wonder whether binary trading is profitable, the answer is positive. Yes, binary trading is highly profitable if you know how to do it properly. However, the risk is also immensely high. Quality of the trading strategy, good broker’s conditions, the market’s overall state, and the trader’s mindset play a huge role in achieving success.

Finally, it’s essential to follow these binary trading steps: always start small and be patient enough until you reach your goals! Don’t let your greediness and impatience ruin your long-term desires! Good luck on your path to binary trading success!