SafeMoon and Litecoin: Litecoin in a bullish trend to $79.50

- The SafeMoon price tried to start a recovery yesterday.

- The price of LItecoin is in a three-day bullish trend.

SafeMoon chart analysis

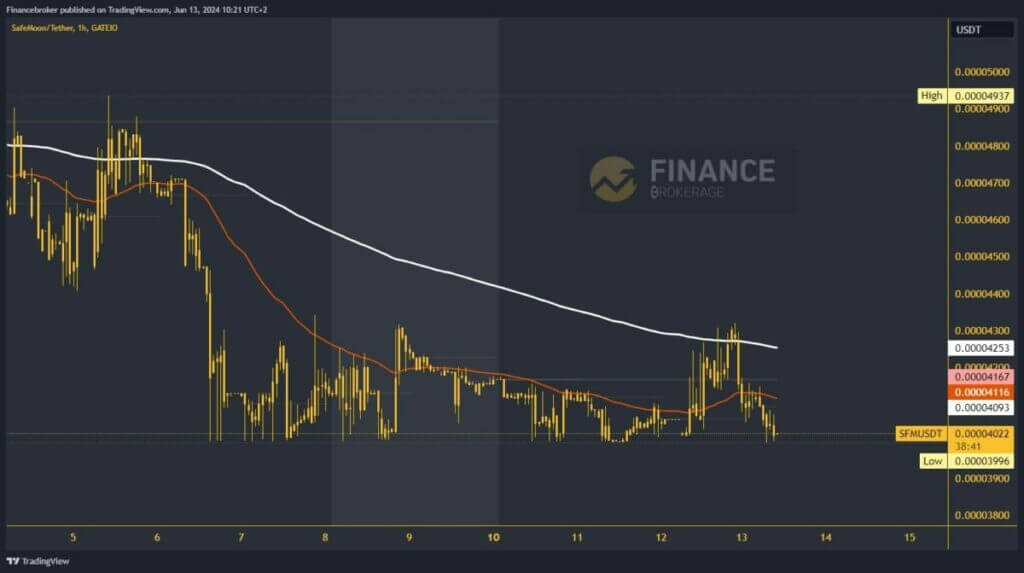

The SafeMoon price tried to start a recovery yesterday. The short-term trend was stopped at the 0.00004300 level. We met the EMA200 moving average there, which did not allow us to stabilize above it. After that, the price makes a bearish impulse and returns down to the zone of 0.00004000 levels. We are again putting pressure on the already seven-day support zone.

Potential lower targets are the 0.00003950 and 0.00003900 levels. We need a positive consolidation and a return to the 0.00004300 level for a bullish option. Then SafeMoon would have to stabilize up there. With the support of the EMA200 moving average, we expect to initiate a bullish consolidation and visit higher levels. Potential higher targets are the 0.00004400 and 0.00004500 levels.

Litecoin chart analysis

The price of LItecoin is in a three-day bullish trend. Last night we had the formation of a new high at the $79.30 level. The price now follows the lower trend line, forming higher lows at the bottom. This picture tells us that we should see a continuation to the bullish side and a break above yesterday’s high. Potential higher targets are $79.50 and $80.00 levels.

Additional resistance of Litecoin will be in the EMA200 moving average in the zone of the $80.00 level. We need a negative consolidation and a drop to the $77.00 level for a bearish option. Such a move would break the previous bullish formation. After that, we can expect an increased bearish momentum and continued pullback to the bearish side. Potential lower targets are $76.50 and $76.00 levels.