Solana and Cardano: Cardano at a new September high

- This morning’s bullish consolidation brought the price of Solana back above $150.00 again

- Cardano’s price managed to climb to a new weekly high today at the 0.399 level

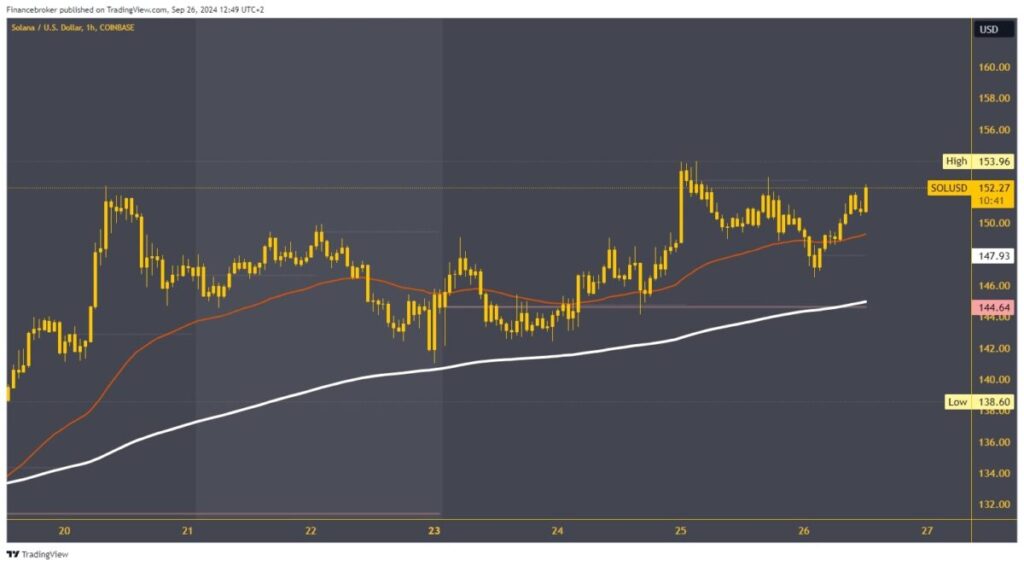

Solana chart analysis

This morning’s bullish consolidation brought the price of Solana back above $150.00 again. We expect to see a continuation all the way to the $154.00 weekly high. The current bullish momentum seems strong enough to push the price of Solana to that high. Depending on the strength of the impulse, we could see a break above to a new weekly high. Potential higher targets are the $156.00 and $158.00 levels.

For a bearish option, the Solana price would have to return below $149.00 and the EMA 50 moving average. With that step, we move to the $148.00 daily open zone. There, we expect to see a further pullback of the price below $146.00 and continue towards the weekly open price. Additional support for Solana will be in that zone in the EMA 200 moving average, which has been keeping the price on the bullish side for a week. Potential lower targets are the $144.00 and $142.00 levels.

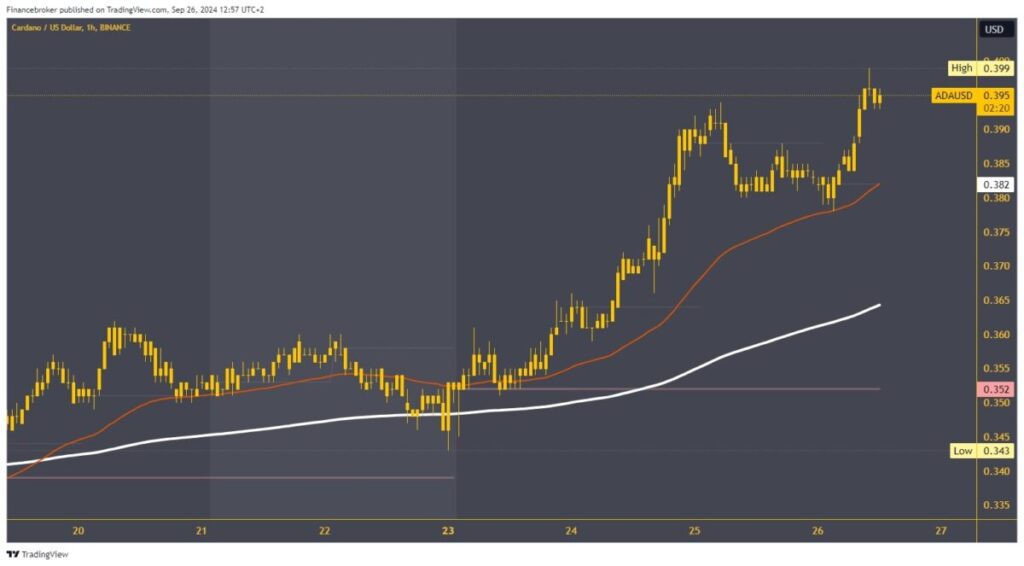

Cardano chart analysis

Cardano’s price managed to climb to a new weekly high today at the 0.399 level. The price broke through yesterday’s high and thus indicated that it has the strength to progress further on the bullish side. We are currently at 0.395, and so far, we are successfully staying there. Cardan now needs a new impulse to continue on the bullish side to break above today’s high. Potential higher targets are the 0.400 and 0.405 levels.

For a bearish option, we need a negative consolidation of the Cadrano price back below the 0.390 level. With that step, we would move significantly away from this morning’s high, which could strengthen the bearish momentum. Going down to 0.380, we will test the daily open level and the EMA 50 moving average. The inability to hold on there will cause the price of Cardano to start retreating to a new daily low. Potential lower targets are 0.375 and 0.370 levels.