China’s Robinhood rivals plan to get crypto trading licenses

Two Chinese companies, Tiger and Futu Brokers, decided to continue their rivalry abroad. Both of them stock trading app Robinhood and they are applying for licenses in the United States and Singapore that would allow local users to trade digital currencies.

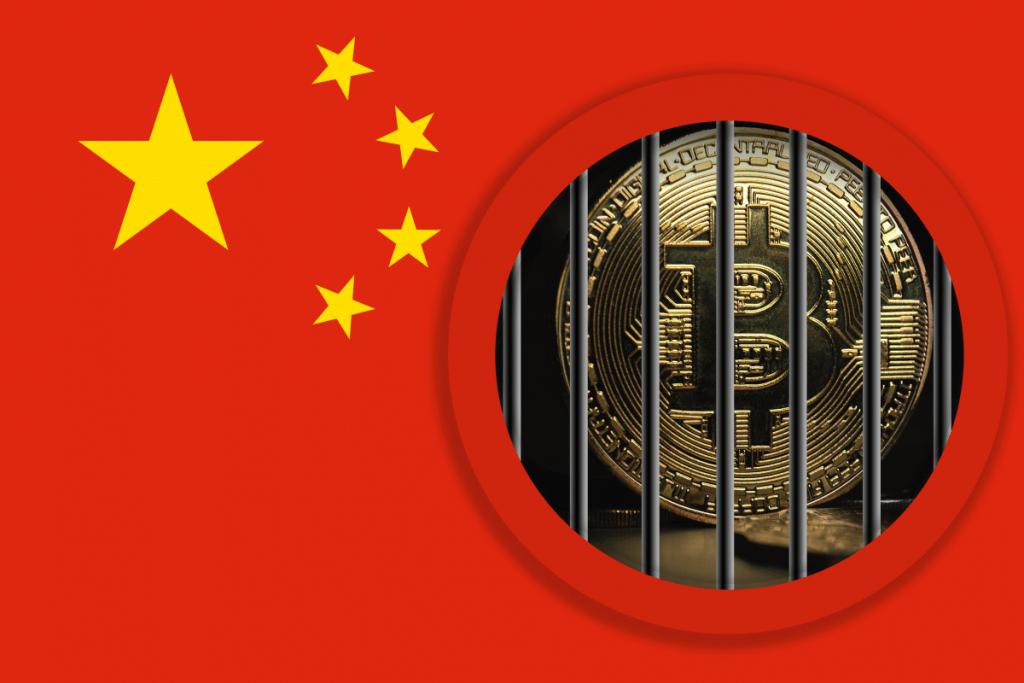

Cryptocurrencies and especially Bitcoin remained in the spotlight, and their popularity is growing steadily. Bitcoin prices reached record heights over this year, bringing substantial profit to its owners. However, Chinese regulators remain suspicious when it comes to cryptos. They are currently trying to limit speculation in the market. The authorities also issued new warnings against digital currency trading during the last few weeks. They caution about bitcoin mining, which is an energy-heavy computing process.

Despite the Chinese government’s efforts to regulate crypto, traders flock to this market as it offers lots of new opportunities. Robinhood first launched Bitcoin and Ethereum trading in the United States in 2018. The company has added 3 million customers a month this year.

Arthur Chen, Futu’s chief financial officer, noted that they hear a lot of interest from their users worldwide in terms of crypto, and they have listened to that. He also added that Futu hopes to offer cryptocurrency-related products as soon as the end of this year.

Why do Futu and Tiger prefer to move their business abroad?

Tiger and Futu Brokers’ first clients were primarily Chinese employees of major tech companies like Baidu and Alibaba. These companies are listed in the U.S. So, they managed to pique their employees’ interest in trading stocks abroad.

Lately, both companies focus on markets outside mainland China. That’s understandable, considering that Beijing banned yuan-bitcoin transactions, and it also tightly controls capital flows out of the mainland.

Chen stated that Futu had gained 100,000 paying clients in Singapore, and that happened in less than three months since launching there in early March. According to him, approximately one-fourth of new paying clients in Q1 came from Singapore and the United States.