Market overview: Little Pause

S&P 500 might be getting a little ahead of itself in the very short-term – the price decline looks in need of some really brief consolidation. Bonds have likewise paused, and the retreat in Treasury yields that I told you about would happen first, is unfolding. The 10-year one closed below 3%, and with the focus slowly but surely to shift some more from inflation to the deteriorating real economy and job market, I‘m expecting yields to decline still (before turning up longer term again). The Fed hasn‘t yet pivoted – and for the next couple of sessions won‘t. – but the pressure on raising rates by much, is slowly receding Precious metals (and copper) don‘t like the retreat in inflation data (PCE deflator) and inflation expectations – coupled with the real economy prospects, these are to suffer, with gold being relatively, relatively most resilient (which wouldn‘t protect it from declining of course). Unlike crude oil where I remain of bullish persuasion when it comes to the two possible correction scenarios described earlier (the fight for $108.50 talked yesterday, is on).

Yesterday, I got an interesting question on what actual value retail traders provide to the markets. If you‘re also wondering, have a look at my take in the first and second part of the reply – it‘ll resonate.

In connection with the Nov 12, 2021 legal update on my homepage, the key main hearing is to continue shortly. Demanding event involving long travels – I’ll be issuing only brief updates for the nearest 5 trading days. I won’t be able to provide any analyses, updates or many Twitter activities between Jul 11-15. Looking forward for my return to serving you on Jul 18!

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

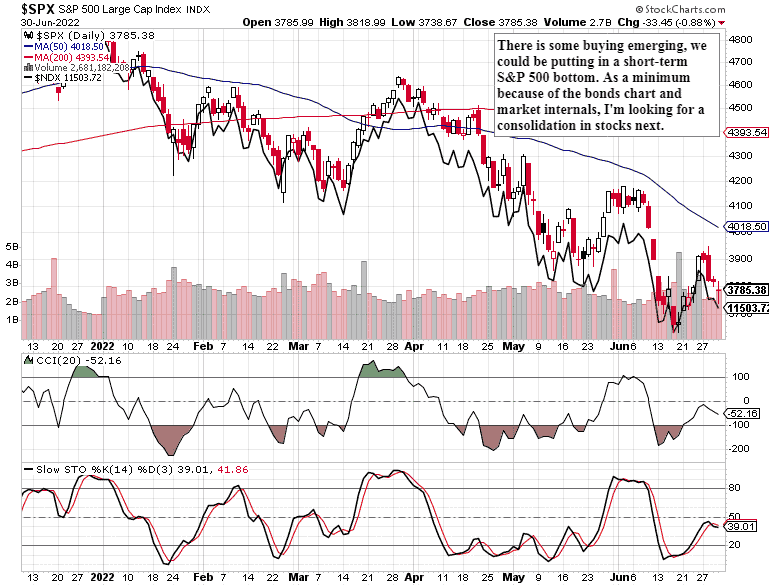

S&P 500 and Nasdaq Outlook

The caption says it all – S&P 500 is pausing somewhat, and looking for the next short-term direction – the lower knot I wrote above yesterday, materialized. Consolidation of the steep turn to the downside that I caught for you, is in order.

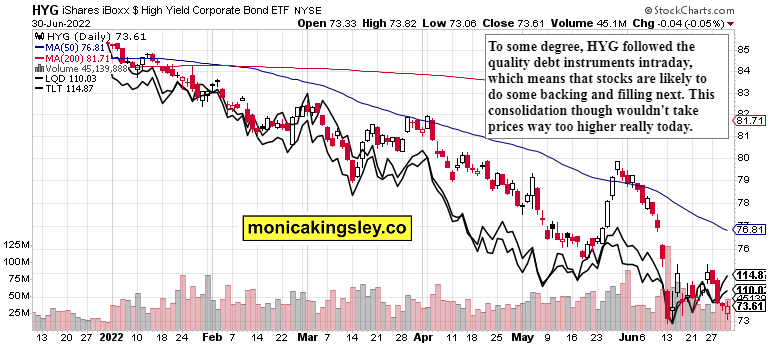

Credit Markets

Bonds are taking a break in the strong risk-off posture, and that‘s likely to coincide with the reprieve in stocks.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.