Market overview: Range Break Ahead

S&P 500 consolidated in a narrow range yesterday and didn‘t offer too many clues apart from bonds doing relatively fine – and one more sign pointing towards the likely path of the current trading range‘s resolution (reserved for premium subscribers).

What the junk bonds are telling here, is that the bears are momentarily a little ahead of themselves – as stated in yesterday‘s key analysis, the tech earnings:

(…) wouldn‘t be as disastrous as is the market‘s expectation – suffice to look at Tesla. And if they are smart to avoid guidance for 2H 2022 (second half), S&P 500 may not stop above 4,030s in the least. HYG holds the key now, VIX isn‘t about to spike sharply, and the dollar isn‘t on a tear either.

Macroeconomically, we have many leading indicators dipping negative – such as the new orders component of the Philladelphia Fed manufacturing index, which makes U.S. recession at the end of 2022 / early 2023 a foregone conclusion. S&P global composite is now negative as namely Europe is struggling already. So, the stock market bulls are running on borrowed time, yet in the best case scenario, it can take longer than the next week for prices to resume their downswing – reality of not lower P/E multiples, but of lower earnings over the quarters ahead, would catch up with stocks as much as the stubborn inflation keeping above 5% no matter the coming two Fed rate hikes. Think stagflation with stocks in a trading range, and reversion to the mean strategies having a good time.

Precious metals don‘t look to have bottomed yet – miners remain too weak, and their decisive upswing on rising volume is the missing ingredient. The situation in crude oil is obviously much brighter – and the same goes for natural gas. Copper is likewise going to see brighter days ahead, riding the (under the hood) risk-on sentiment more reliably than cryptos. The following chart section covers deeper insights into the respective markets.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article features good 6 ones.

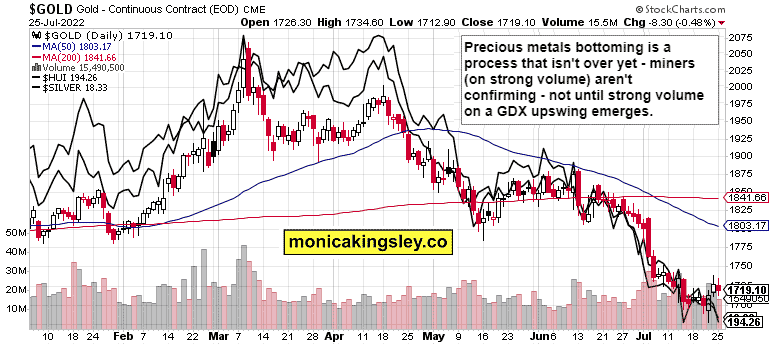

Gold, Silver and Miners

Precious metals don‘t look yet optimistic, and miners need to turn up really – yesterday‘s NEM session was highly disappointing. As said yesterday, unless we see gold to decouple from the dollar or the dollar to roll over, the start of a new PMs upleg is postponed – the Fed needs to get questioned on the still unpleasantly elevated (future) inflation first. Autumn appears a good time for reversal in gold, followed then by silver.

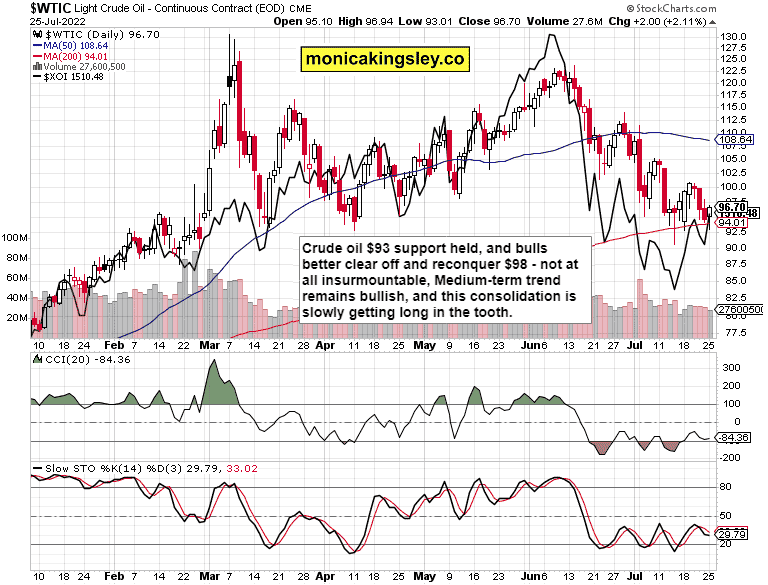

Crude Oil

Crude oil is turning around – this is indeed the most resilient commodity, right after natural gas (sticking with energy). Oil stocks aren‘t lagging badlym which is good – see the progress made since mid July.

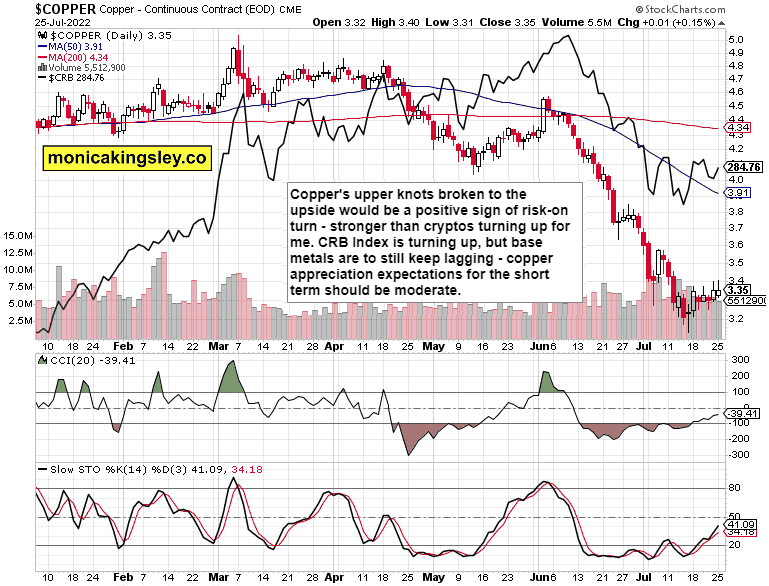

Copper

Copper is about to extend gains, but the red metal isn‘t out of the woods – the base metals as such haven‘t really moved. That‘s a current reflection of the stagflationary reality awaiting a couple of quarters down the road.

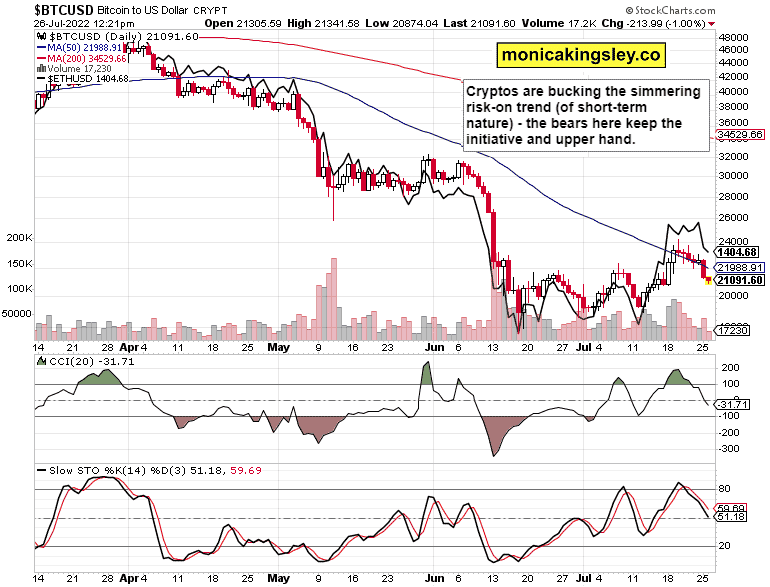

Bitcoin and Ethereum

Cryptos aren‘t making progress, and are instead decoupling from the simmering risk-on sentiment. Increased focus on all that‘s wrong in the space, doesn‘t help – the bears remain in the driver‘s seat.

Thank you for having read today‘s free analysis, which is a small part of the premium Monica’s Trading Signals covering all the markets you’re used to (stocks, bonds, gold, silver, oil, copper, cryptos), and of the premium Monica’s Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates. While at my homesite, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves. Thanks for subscribing & all your support that makes this endeavor possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.