EURUSD and GBPUSD

- During the Asian trading session, the euro advanced against the US dollar.

- During the Asian trading session, the pound was in sideways consolidation.

- As the G7 summit is underway, a US official said on Monday that the G7 is close to setting a global limit on Russian oil prices, but for now, there are no indications on how this will be implemented in practice.

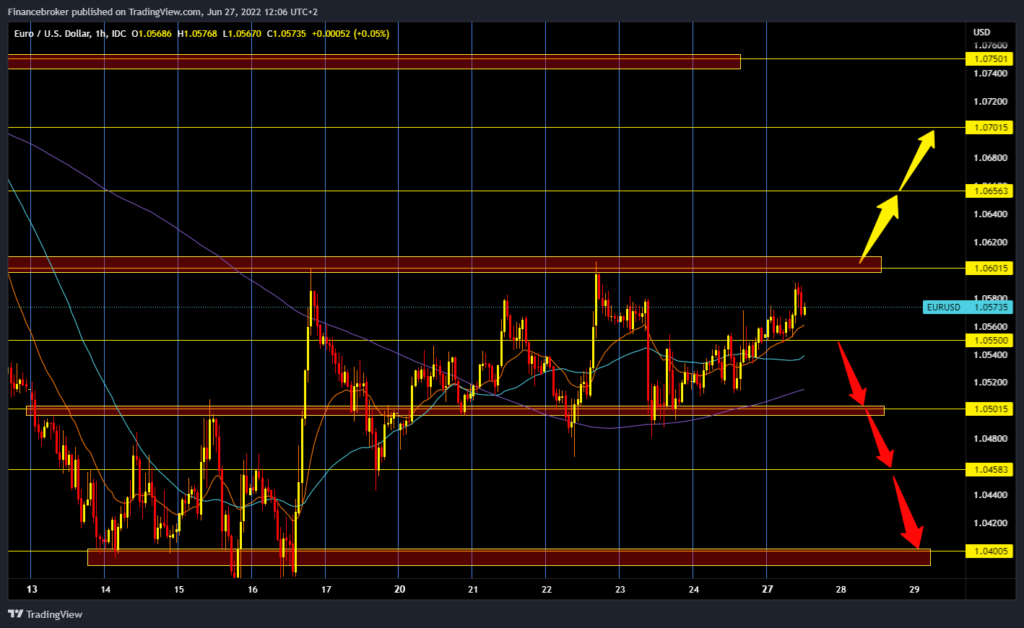

EURUSD chart analysis

During the Asian trading session, the euro advanced against the US dollar. The euro is now at 1.05800, which is 0.27% more than at the beginning of trading last night. Today we could also see the 1.06000 level testing. A break above would help the euro form more stable support above the 1.05500 level. The above potential targets are 1.06500 and 1.07000 levels. For the bearish option, we need a negative consolidation and pullback with a level of 1.058000. We will then retest the support at the 1.05500 level. If she doesn’t give us enough support, the EURUSD pair will drop below. This would certainly increase the bearish pressure and prevent us from further recovery. The potential target series are 1.04500 and 1.04000 levels.

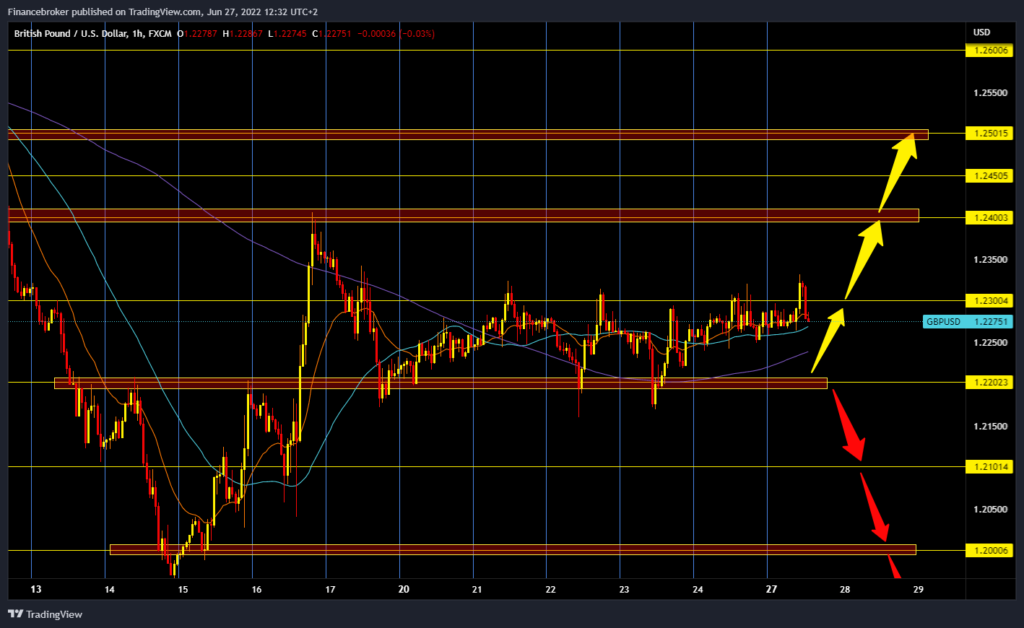

GBPUSD chart analysis

During the Asian trading session, the pound was in sideways consolidation. As the European session began, the pound jumped sharply to 1.23300, where it encountered resistance. A pullback followed very quickly, and the pound returned to last night’s starting position at the 1.22750 level. Additional support in this zone are MA20 and MA50 moving averages; if they last, we can expect another bullish boost. This week’s bullish target is the 1.24000 level. We need a continuation of this negative consolidation and a pullback below the 1.22500 level for the bearish option. After that, the bearish pressure would increase because the pound would fall below the MA200 moving average. The first potential lower target support is the 1.22000 level. If we fail to stay above, the pound could drop to the next higher support at the 1.21000 level.

Market overview

As the G7 summit is underway, a US official said on Monday that the G7 is close to setting a global limit on Russian oil prices, but for now, there are no indications on how this will be implemented in practice. It is unclear how the G7 plans to structure at what price and implement it with India and China. European stock markets made big gains in early trading on Monday, building on sharp growth on Friday as markets watched the G7 meeting in Bavaria, the European Central Bank conference in Portugal, and a pile of economic data this week.

Lagarde, Powell, and Andrew Bailey of the Bank of England are due to speak at a policy panel at the ECB meeting in Sintra on Wednesday. The sooner the Fed gains control of inflation, the sooner the hiking cycle ends, and it will begin to loosen its monetary policy.

Given that market participants are fixed on inflation, recession, and what the Federal Reserve is doing, the main event this week is the release of the PCE index on Thursday. Markets will follow any signs that price growth is slowing down. Last month, there were trial signs of hope – the basic personal consumption price index (PCE) rose 4.9% compared to a year ago.