EURUSD and GBPUSD: 20-year Lows

- Pair EURUSD sets new 20-year lows.

- During the Asian trading session, the pair GBPUSD retreated to 1.17150 levels, forging a new two-year low.

- Japan’s manufacturing sector continued to grow in August, the latest survey from Jibun Bank showed on Tuesday, with a reading of 51.0.

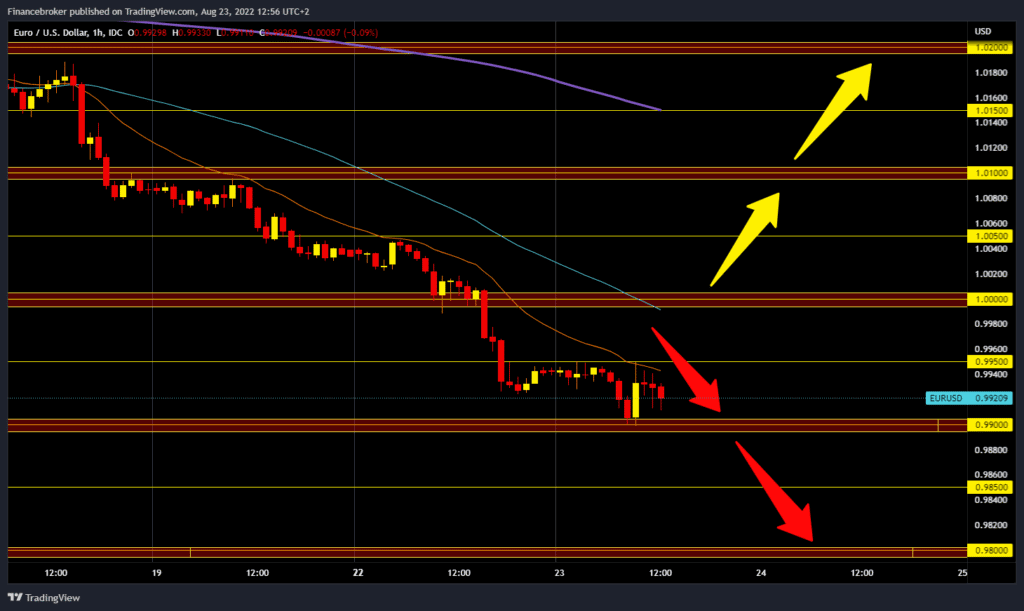

EURUSD chart analysis

Pair EURUSD sets new 20-year lows. This morning we saw the euro at the 0.99000 level, the last time we were there was in 2002. After that, we see a short recovery to the 0.99500 level, but no break above. The dollar index continues to dominate, strengthening the US currency. For a bullish option, we now need a new positive consolidation above 0.99500. After that, we could try to climb up to 1.00000 levels. Additional resistance at that level is in the MA50 moving average. Potential higher targets are 1.00500 and 1.01000 levels. We need a continuation of the negative consolidation and new pressure on the 0.99000 level for a bearish option. A break of the euro below would open up space for us towards the following lower levels. Potential lower targets are 0.98500 and 0.98000 levels.

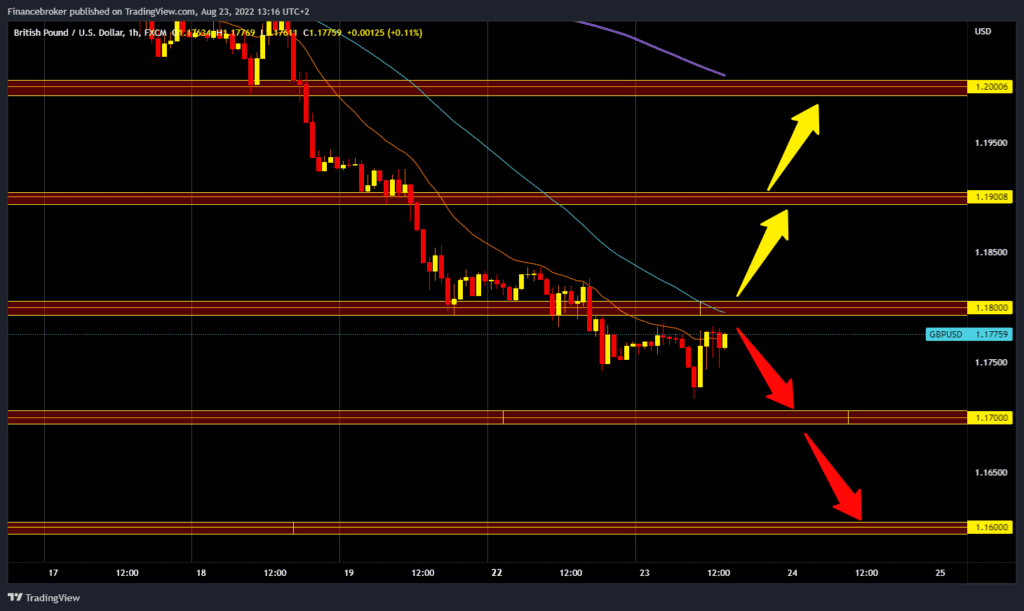

GBPUSD chart analysis

During the Asian trading session, the pair GBPUSD retreated to 1.17150 levels, forging a new two-year low. In the European session, we see a minor recovery to the 1.17850 level and are slowly approaching 1.18000 levels. Additional resistance at that point can be in the MA50 moving average. For a bullish option, we must go back above 1.18000 first and try to hold above. After that, we need a positive consolidation for a further continuation to the bullish side. Potential higher targets are 1.18500 and 1.19000 levels. For a bearish option, we need a continuation of the negative consolidation and a return to the resistance zone at the 1.17000 level. Potential lower targets are 1.16500 and 1.16000 levels.

Market Overview

Japan’s manufacturing sector continued to grow in August, the latest survey from Jibun Bank showed on Tuesday, with a reading of 51.0. Since the beginning of the year, the results of the manufacturing sector have been declining. New order growth fell the fastest since September 2020. Meanwhile, the job creation rate has largely stagnated. The total number of new jobs fell for the first time in four months due to weaker domestic demand.

UK The Manufacturing Purchasing Managers’ Index showed today the worst results in the last two years. The data showed that the manufacturing sector fell to 46.0, from 52.1 in the previous month. Such data will probably affect the pound for a longer period of time.