EURUSD and GBPUSD: An Opportunity For Growth

- After the euro fell to the 0.98800 level yesterday, the lowest in the last 20 years, we saw a recovery to 0.99800 but no break above the 1.00000 level.

- During the Asian trading session, the pound made a jump from 1.15000 to 1.16000 level.

- Inflation in the Netherlands rose further in August to set a new record.

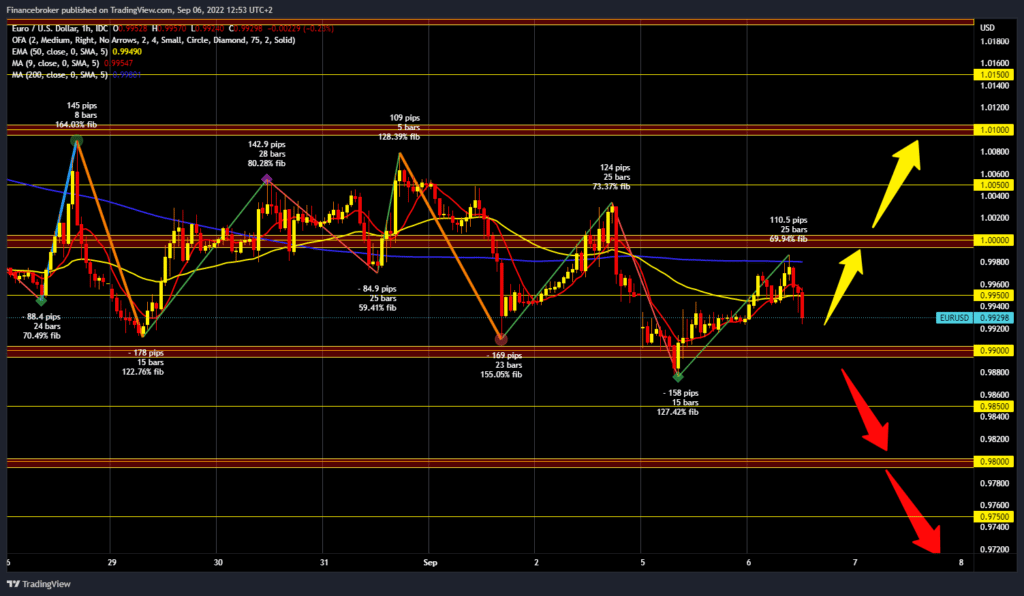

EURUSD chart analysis

After the euro fell to the 0.98800 level yesterday, the lowest in the last 20 years, we saw a recovery to 0.99800 but no break above the 1.00000 level. A new pullback below the 0.99500 level followed, then a break below, and now we are at the 0.99330 level. The pair could find itself again at the 0.99000 support level. For a bearish option, we need a continuation of this negative consolidation to the lower support. If we see a break below, it would be a sign that the pair EURUSD could fall even lower and form a new lower low. Potential lower targets are 0.98500 and 0.98000 levels. For a bullish option, we need another positive consolidation and a return to the 1.00000 resistance zone. If we were to climb above, we would receive support in the moving averages for the continuation of the bullish trend. And potential higher targets are 1.00500 and 1.01000 levels.

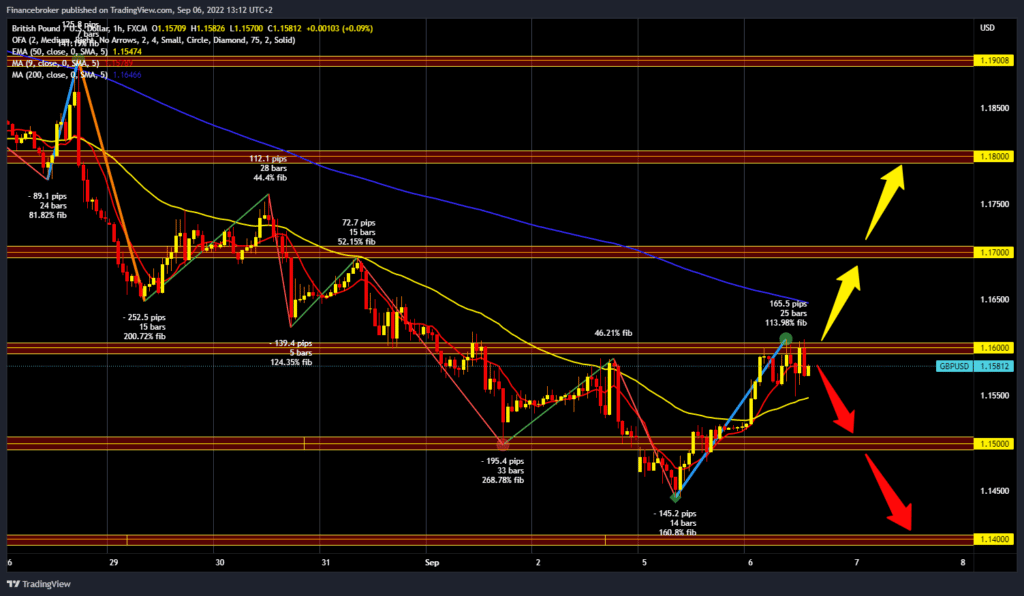

GBPUSD chart analysis

During the Asian trading session, the pound made a jump from 1.15000 to 1.16000 level. The continuation of today’s consolidation is in the range of 1.15750-1.16000 levels. For now, we have encountered resistance here, and we need to break the pound above to continue the bullish option. Then we need a new positive consolidation to the next resistance in the zone around the 1.16500 level, and the additional resistance at that point is in the MA200 moving average. A potential higher target is at the 1.17000 level, the previous high from August 31. We first need a negative consolidation and a drop to the 1.15500 level for a bearish option. We have additional support at that point in the MA50 moving average. If we fall below, then we can expect the pound to seek support again at the 1.15000 level. Potential lower targets are 1.14500 and 1.14000 levels.

Market overview

Inflation in the Netherlands rose further in August to set a new record, with growth fueled by higher energy prices, preliminary data from the National Statistics Office showed on Tuesday. The consumer price index rose by 12.0% year-on-year, following a 10.3% increase in July. Headline inflation also rose for the second month in a row.