EURUSD and GBPUSD: Better-than-expected picture

- During Asian trading, the euro continued to weaken strongly against the dollar.

- During Asian trading session, the British pound weakened against the dollar.

- Bank of Japan statement

- ECB and inflationary expectations

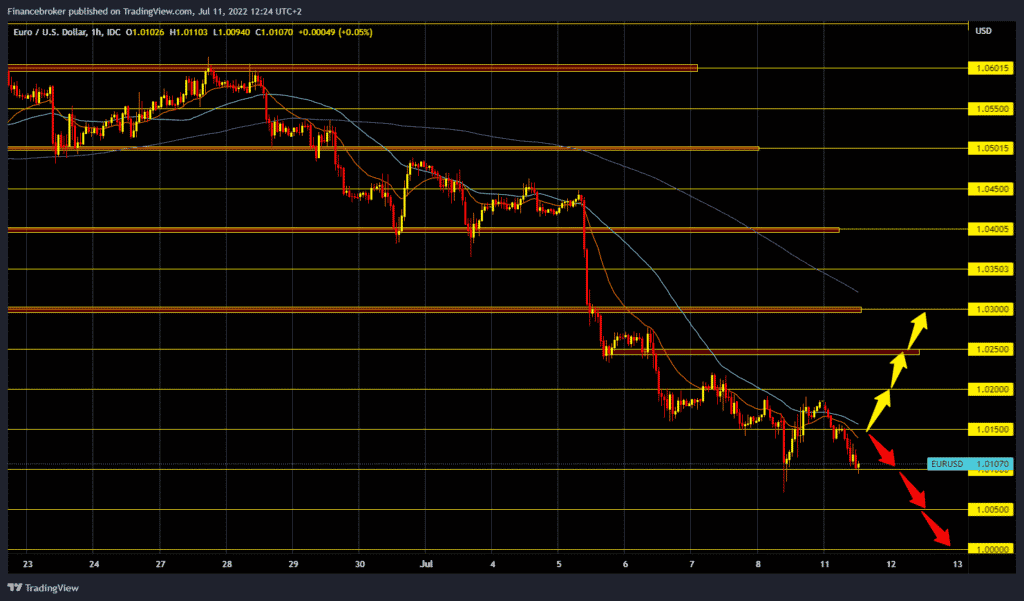

EURUSD chart analysis

During Asian trading, the euro continued to weaken strongly against the dollar. The regular monthly (NFP) report from the US labor market showed a better-than-expected picture on Friday as 372,000 jobs were added (expected 268,000). It also signals that price inflation in the US could continue to rise, and thus interest rates there. The euro is trading at $1.01030, which represents a weakening of the common European currency by 0.79% since the start of trading last night.

Strong pressure continues to weigh on the euro, which could lead to a further pullback below the 1.01000 level. Potential lower support targets are 1.00500 and 1.00000 levels. For a bullish option, we need a new positive consolidation and a return above the 1.01500 level. Then we get additional support in the MA20 and MA50 moving averages. After that, the euro could continue to the 1.02000 resistance zone, and a break above it would create space for us towards the 1.02500 and 1.03000 levels.

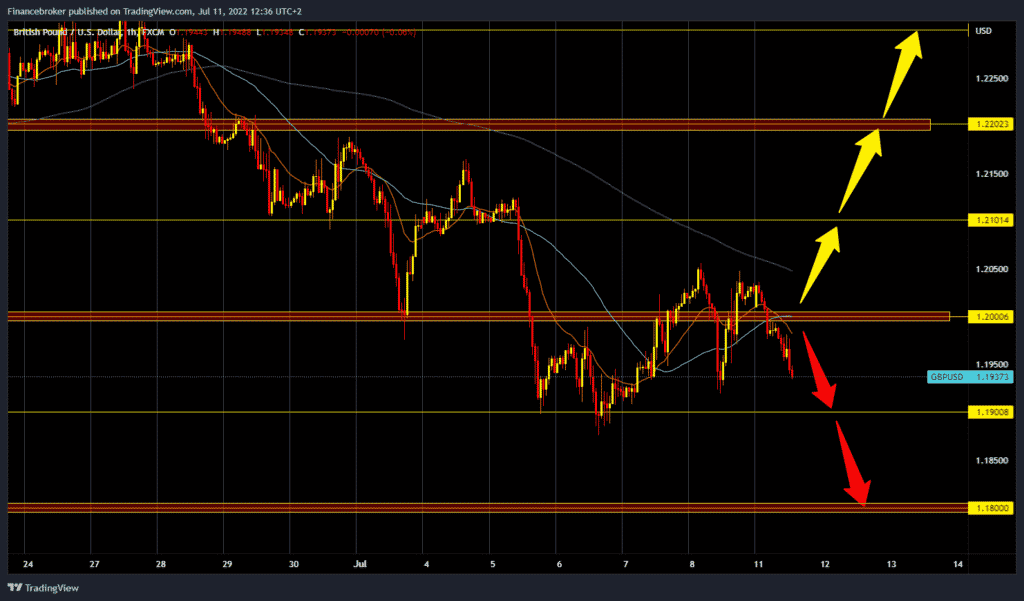

GBPUSD chart analysis

During Asian trading session, the British pound weakened against the dollar. Capital flight to safe havens continues at the start of the new week, with the dollar gathering new strength against its currency rivals. The pound is trading at 1.19440, which represents a 0.69% weakening of the British currency since the start of trading tonight. Bank of England Governor Andrew Bailey will speak before the UK Treasury Board today. For a bearish option, we need a continuation of the negative consolidation.

Our first target is the support zone at the 1.19000 level. If she does not provide us with support, the pound will fall to new this-year lows, and the targets are 1.18500 and 1.18000 levels. For a bullish option, we need a new positive consolidation and a return above the 1.20000 psychological level. After that, we are looking at the zone around 1.20500 instead of the previous resistance zone from Friday last week. Additional resistance at that level is the MA200 moving average. A break above the pound could take us up to the 1.21000 level.

Market overview

Bank of Japan statement

According to the Regional Economic Report on Monday, the Bank of Japan upgraded its economic assessment for seven of the nine regions and maintained its stance on the other two.

Many regions reported that while the effects of supply-side restrictions, partly caused by the lockdown in China, were seen, their economies were recovering moderately with the impact of the pandemic on private consumption waning, the BoJ said.

ECB and inflationary expectations

Eurozone bond yields fell on Monday, while long-term inflation expectations fell below 2 % as recession fears deepened after warnings of a possible cut in Russian gas stockpiles.

French Finance Minister Bruno Le Maire said on Sunday that the French government is preparing to cut off Russian gas supplies completely.

Analysts still expect fairly aggressive monetary tightening through the end of the year while being more cautious through 2023. “In short, faster monetary tightening through the end of 2022, then a halt next year, if not a reversal,” said Eric F. Nielsen, Group Chief Economic Advisor at Unicredit.

ECB policymakers have pledged to buy more bonds from debt-laden countries such as Italy and Germany.