EURUSD and GBPUSD Forecast: The Growth Potential

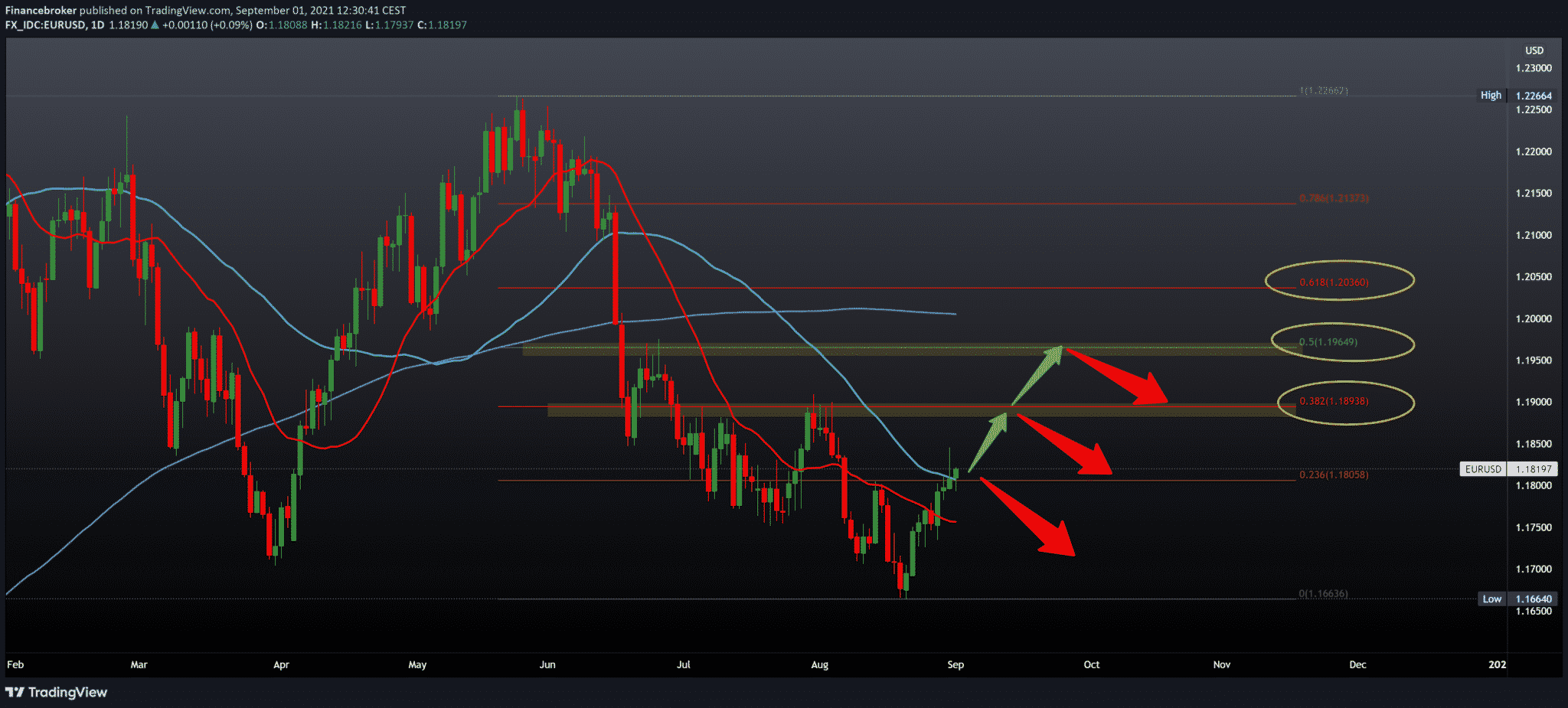

Looking at the chart on the daily time frame, we see that the EURUSD pair found support in the 50-day moving average and that based on that, we can expect further growth towards 1.19000 to 38.2% Fibonacci level. A weaker dollar helped the euro consolidate and record current gains. If EURUSD manages to climb above 38.2% Fibonacci level, then we can expect a further continuation towards 50.0% Fibonacci level at 1.19650. We need to pull below the moving averages for the bearish scenario or wait for the EURUSD pair to make a lower low and then continue to the bearish side. Our bearish target is low at 1.16650.

GBPUSD chart analysis

Looking at the chart on the daily time frame, we see that the GBPUSD pair has been consolidating in the 1.37000-1.38000 zone for a week now. We still have resistance on the upper side in moving averages, and the most important thing for us is the 200-day moving average, which can determine a longer-term trend. GBPSD has support at 23.6% Fibonacci level at 1.37300, and to continue the bullish trend, we need a break above 38.2% Fibonacci level at 1.38300. A further jump can lead us to the previous high at 1.39800, close to 61.8% Fibonacci level at 1.39900. For a possible continuation of the bearish trend, we need a retreat below the 23.6% Fibonacci level, after which we can expect to revisit the previous low at 1.36000, while our psychological level is at 1.35000.

Marker overview

Marker overview

The unemployment rate in the EUzone fell in July after the reopening of second-wave economies, data released by Eurostat showed on Wednesday.

The unemployment rate fell to 7.6 percent in July, as expected, from 7.8 percent in June. The unemployment rate is 8.4 percent, in the same period last year.

The number of unemployed people decreased by 350,000 in July compared to June. On an annual basis, unemployment fell by 1.336 million.

Further estimates by economists are the fall in the unemployment rate contributes to medium-term inflationary pressures, which will undoubtedly raise further growing concerns about the European Central Bank‘s policy at next week’s meeting.

Production in the eurozone saw another strong rise in August, but the pace of momentum slowed as supply problems strained production, IHS final data Markit showed on Wednesday.

The final index of manufacturing procurement managers fell to a six-month low of 61.4 in August from 62.8 in July. The flash was 61.5.

This was the second consecutive period in which the sector’s growth slowed since the record expansion of research in June.

Production of goods in the eurozone continued to grow in August, but the growth rate was the weakest in six months. At the same time, the total number of new orders increased for the fourteenth month in a row in August.

To increase output, manufacturers increased their workforce in August.

As for prices, the research showed that the pressures on prices continued to increase stubbornly in the middle of the third quarter.

Germany’s production activity grew at the slowest pace in the six months of August, as a lack of supply limited production. The IHS Markit / BME final PMI production title came to 62.6 in August, from 65.9 in July. The most recent reading was slightly below flash 62.7.

Despite the title index falling to its lowest level in six months, the French manufacturing sector remained in strong growth territory in August. The final factory PMI fell to 57.5 from 58.0 in the previous month. The flash was 57.3.

The Italian manufacturing sector grew for the fourteenth consecutive month in August, with the last growth being the third largest. The corresponding index rose to 60.9 from 60.3 in the previous month. The expected result was 60.1.

In August, the growth of factories in Spain accelerated due to a strong increase in new orders and production. Production PMI rose to 59.5 in August from 59.0 in July.

Marker overview

Marker overview