EURUSD and GBPUSD: Much Better-Than-Expected

- During Asian trading, the euro managed to break away from the 1.00000 level and make a positive move against the dollar.

- During the Asian trading session, the British pound continued to weaken against the dollar, but the picture turned as the European session began.

- The UK economy rebounded in May; data released by the Office for National Statistics showed on Wednesday.

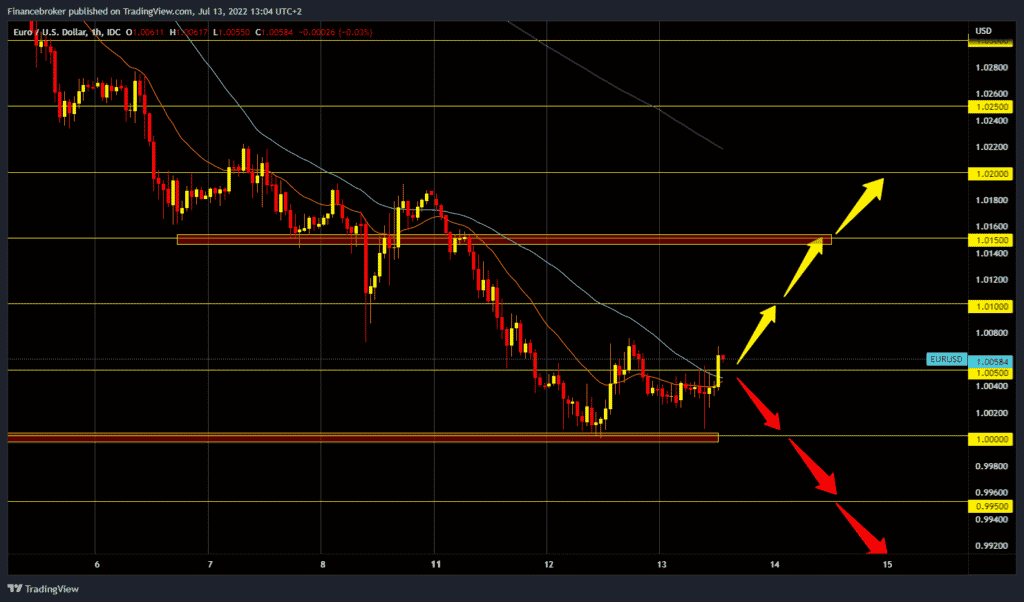

EURUSD chart analysis

During Asian trading, the euro managed to break away from the 1.00000 level and make a positive move against the dollar. A 0.75% interest rate hike in the US at the end of July is almost certain to push the dollar higher against other currencies. The euro is trading at $1.00640, representing a 0.29% gain for the common European currency since the start of trading tonight. At 2:30 p.m., June’s consumer price index (inflation) in the US will be published. Expectations are that inflation will accelerate from 8.6% to 8.8%. For a bullish option, we now need to hold above the 1.00500 level. We found support in the MA20 and MA50 moving averages. Based on that, we can expect the pair to continue towards the 1.01000 level and thus eliminate yesterday’s losses. If we manage to make a break above, our next potential target is the 1.01500 resistance zone. We need a negative consolidation and a return to the support zone around the 1.00000 level for a bearish option. A break below would form a new two-decade low. Potential lower targets are 0.09950 and 0.09900 levels.

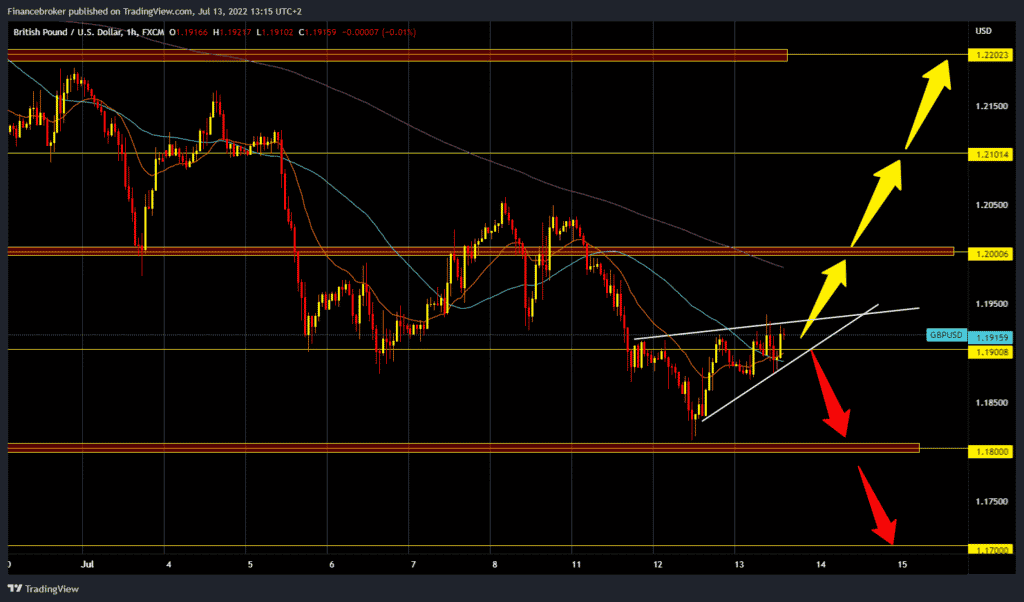

GBPUSD chart analysis

During the Asian trading session, the British pound continued to weaken against the dollar, but the picture turned as the European session began. This morning’s figures show a much better-than-expected UK GDP performance in the first quarter. Stronger US Treasury yields and domestic political instability are weighing on the pound. The pound is trading at $1.19115, representing a 0.24% increase in the British currency since the start of trading last night. For a bullish option, we need to continue today’s positive consolidation and stay above the 1.19000 level. If we succeed, our next target is a 1.20000 psychological level. A break above the pound would further soften the previous decline and increase optimism that a continuation of the recovery is possible. We need a negative consolidation below the 1.19000 level for a bearish option. Then a fall continuation would follow, and the targets are 1.18500 and 1.18000 levels.

Market overview

UK Economy

The UK economy rebounded in May; data released by the Office for National Statistics showed on Wednesday. Gross domestic product increased by 0.5% compared to April when production decreased by a revised 0.2%. Economists forecast that GDP will remain at the same level after the initially estimated April decline of 0.3%. On an annual basis, GDP increased by 3.5%, significantly faster than the expected 2.7%. The data suggest the economy is holding up well in the face of high inflation, said Paul Dales, an economist at Capital Economics. This could encourage the BoE to increase interest rates by 50 basis points, rather than 25 basis points, at its next meeting in August. Given that real disposable household incomes will fall further in the third quarter, recession remains a real risk.