EURUSD and GBPUSD: Pressure is Increasing

- During the Asian trading session, the euro continues its bearish trend and fell below the 1.01500 level.

- During the Asian trading session, the pound failed to maintain the 1.20500 level.

- The euro zone’s trade deficit widened at the end of the second quarter as exports fell amid rising imports.

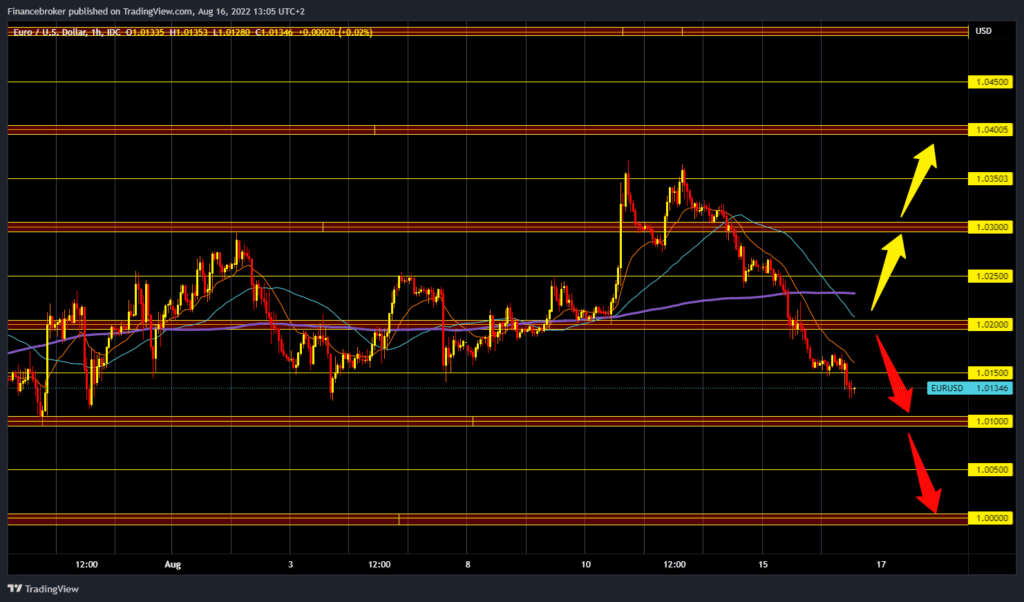

EURUSD chart analysis

During the Asian trading session, the euro continues its bearish trend and fell below the 1.01500 level. The dollar continues its recovery from last week’s decline and climbs up to 106,870 levels, representing a 0.35% increase in the dollar since the start of trading last night. Conversely, the pair EURUSD fell 0.30% since the start of trading last night. Today, it is very possible for the pair to go down to the 1.01000 level. We need a continuation of the negative consolidation and a drop below the 1.01000 level for a bearish option. After that, the euro would continue to descend to 1.00500 and 1.00000 levels. For a bullish option, we need a new positive consolidation and a return above the 1.01500 level. After that, the pair could move into a new bullish option. Potential higher targets are 1.02000 and 1.02500 levels.

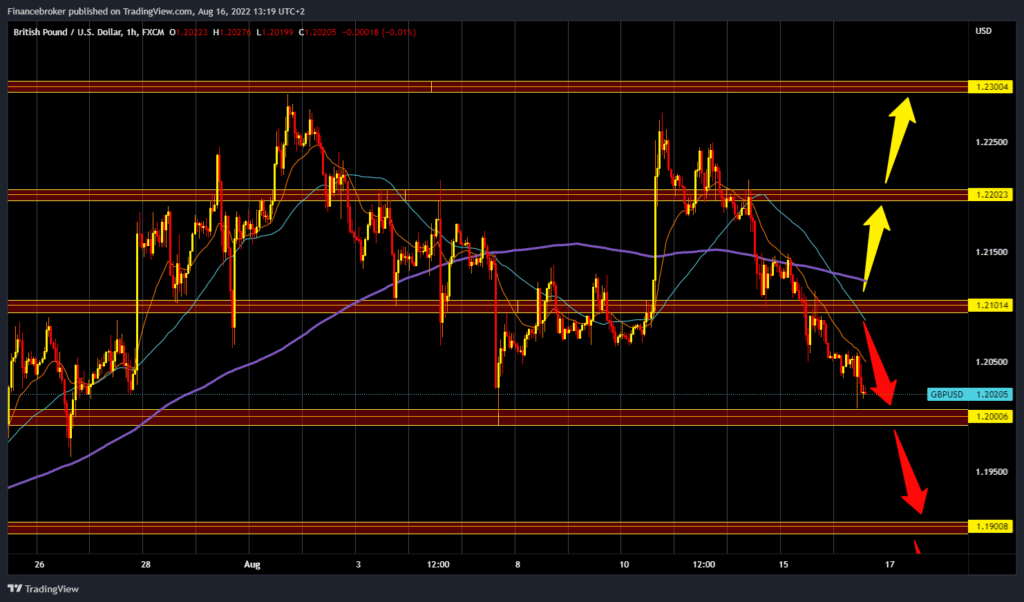

GBPUSD chart analysis

During the Asian trading session, the pound failed to maintain the 1.20500 level. Pressure is increasing on the pound, which has led to a drop to the 1.20000 level. Now we are looking to see if we will manage to stay at that level and find the strength to stop the fall. If we fail to do so, the pound will continue to fall below the 1.20000 level. Potential lower targets are 1.19500 and 1.19000 levels. For a bullish option, we need a new positive consolidation and a move towards the 1.20500 level. At that point, we get additional support in the MA20 moving average. After that, the pair could continue up to the 1.21000 level. Potential higher targets are 1.21500 and 1.22000 levels.

Market Overview

The euro zone’s trade deficit widened at the end of the second quarter as exports fell amid rising imports. The trade deficit rose to 30.8 billion euros in June from 27.2 billion euros in the previous month. The trade balance is in negative territory for the ninth consecutive month in June.

The number of vacancies showed a decrease from June to August 2020. The number of job vacancies was 1.274 million, 19,800 less than in the previous quarter. The unemployment rate in the second quarter remained at 3.8%, the same as in the last month.