EURUSD and GBPUSD Rates – Better Than Expected

- During the Asian session, the euro strengthened against the dollar.

- During the Asian session, the British pound strengthened against the dollar.

- The unemployment rate in the UK has dropped to its lowest level since 1974.

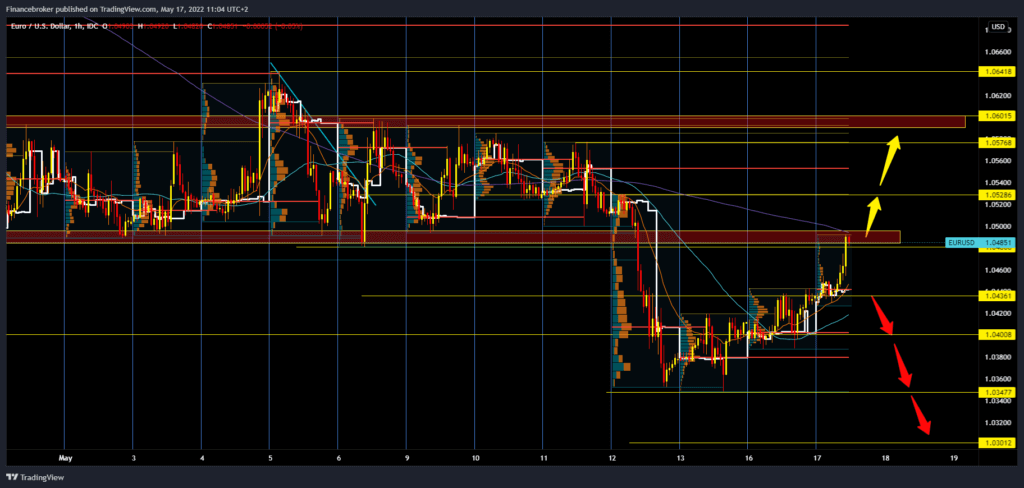

EURUSD chart analysis

During the Asian session, the euro strengthened against the dollar. Disappointing data on economic activity in the federal state of New York strengthened the thesis about the potential slowdown of the strongest economy in the world, so the US dollar is in a slight retreat. Political coordination between representatives of EU member states continues. Yesterday’s meeting of EU foreign ministers showed no consensus in the EU for introducing an embargo on oil imports from Russia, which is positive news from an economic point of view. From a political point of view, disagreement within the EU is not in favour of the euro. The euro is exchanged for 1.04850 dollars, which represents the strengthening of the common European currency by 0.50% since the beginning of trading tonight. The bullish trend has been continuing since yesterday, the pair has found support at 1.04360, and since then, we have seen a strong bullish momentum. The next bullish target is the 1.05000 level. If the euro managed to consolidate above 1.05200 levels, it would return to the previous May zone of movement. The maximum in May so far was at the 1.06420 level. We need new negative condolence and a retreat to the previous support zone at the 1.04300 level for the bearish option. After that, the pair could drop to the next support at 1.040000 dollars with increased bearish pressure. The May low is at the 1.03477 level.

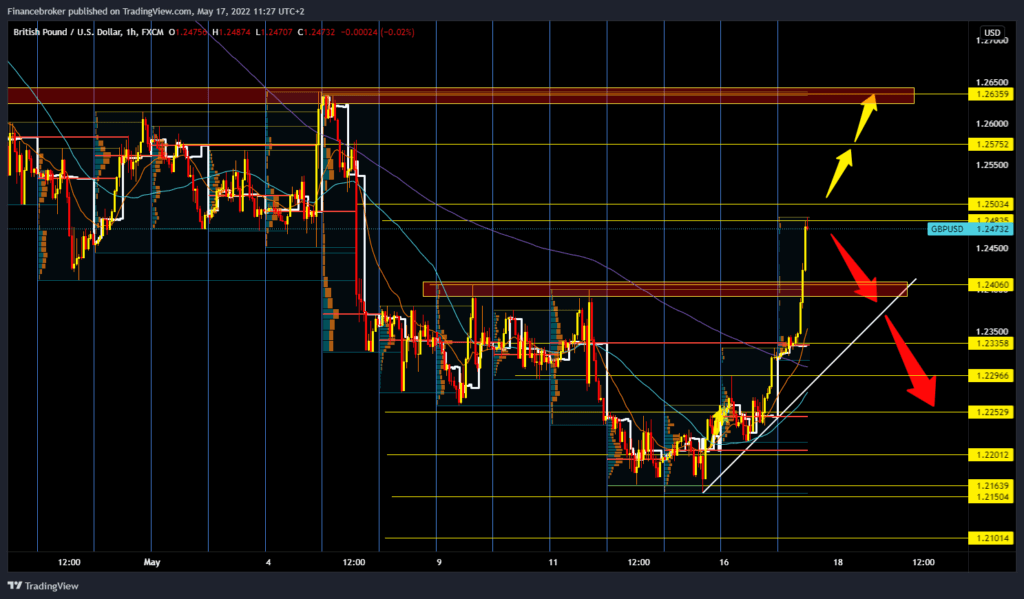

GBPUSD chart analysis

During the Asian session, the British pound strengthened against the dollar. Better than expected data from the British labor market were released this morning. Yesterday, disappointing data on economic activity in the federal state of New York strengthened the thesis about the possible slowdown of the American economy. The US currency has been in decline ever since. Goldman Sachs also revised its U.S. GDP growth forecast this year down from + 2.6% to + 2.2%. The pound is trading at $ 1.24555, which has strengthened the British currency by 1.35% since the beginning of trading tonight. Data on price inflation in the UK are expected tomorrow. Later

before the US session begins, US retail data for April will be released. Pair is very close to the 1.25000 psychological level, and if we see a break above, we will return to the zone of movement from the beginning of the month. Our May high was $ 1.26360. We need a new negative consolidation and a pullback to the 1.23500 level, the starting point of the bullish impulse for the bearish option. From the bottom, we can draw the support line, and if a break occurs below, then we are considering a potential continuation of the bearish trend. Our bearish targets are 1.22500, 1.22000, 1.21500 and so on.

Market overview

The unemployment rate in the UK

Data released by the Office for National Statistics on Tuesday shows the unemployment rate in the UK has dropped to its lowest level since 1974 in the first quarter due to record job vacancies reflecting a tightening of labor market conditions despite the economic slowdown.

The unemployment rate fell to 3.7 % in the three months to March, the lowest since December 1974. The rate remained below the 3.8 % forecast. This is the first time since the records were kept that there are fewer unemployed than vacancies.

Record vacancies point to a dangerous employment crisis that companies are facing, said the head of the economy of the British Chamber of Commerce, Suren Thiru.

With growing economic inactivity confirming that the workforce in the UK is shrinking, labor shortages are likely to persistently stifle growth in the UK by stifling firms ’ability to work at full capacity, Thiru added.