EURUSD and GBPUSD: Sensitive sentiment recovery

- EURUSD consolidated during the Asian trading session after yesterday’s jump from 1,06500 to 1,07500 level.

- During the Asian session, the British pound consolidated about 1,25800 levels.

- Eurozone retail trade fell unexpectedly in April due to weak food sales, Eurostat reported on Friday.

- German exports rose more than expected in April, despite sanctions imposed on Russia that reduced trade in Europe.

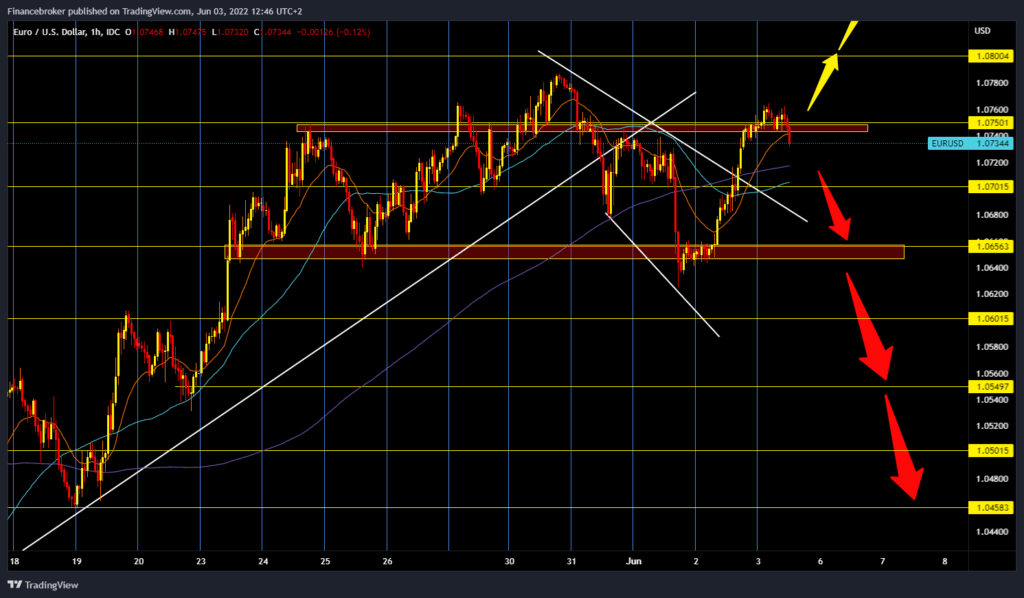

EURUSD Chart Analysis

EURUSD consolidated during the Asian trading session after yesterday’s jump from 1,06500 to 1,07500 level. Sensitive sentiment recovery on the market helped the euro yesterday. Extremely high inflation in the eurozone is not helping the euro currency, whose purchasing power reduces even though they grow prospects for turns in the ECB monetary policy, i.e. increasing interest rates. The euro is exchanged for $ 1.07470, which is the minimum decline in the common European currency by 0.01% since the start of trading last night. At 2:30 PM, the American Labor Market report is expected for May month. Pair EURUSD is currently leaning on the Bearish side because we are on resistance zone 1.07500 levels. We may now see Pullback up to 1.07000 levels to try to find support for the next Bullish Impulse. If the euro fails to be held above this zone of support, then we can expect a continuation of the fall to the following lower levels. The potential next level of support is 1,06500.

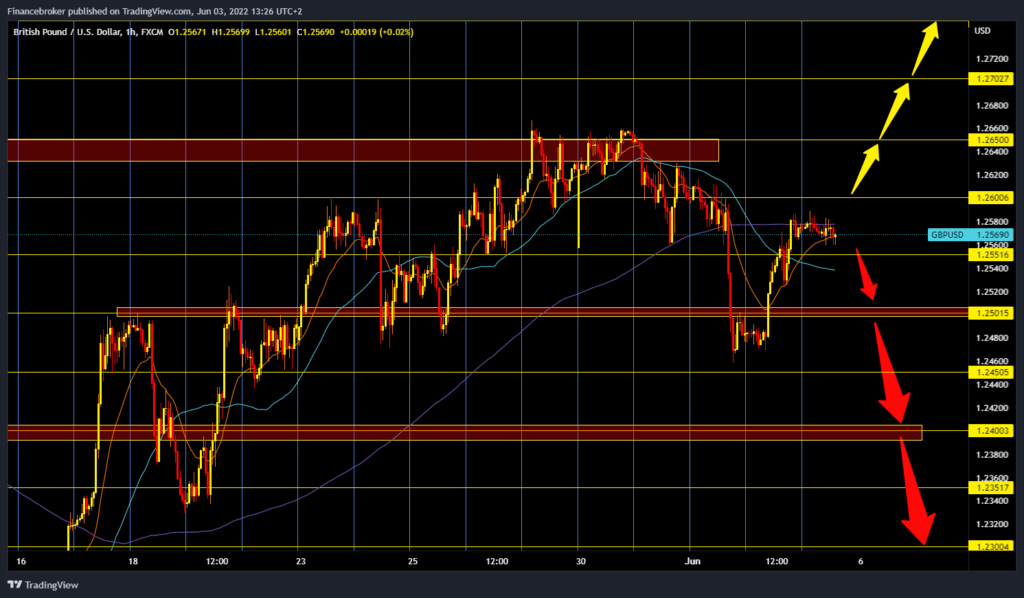

GBPUSD Chart Analysis

During the Asian session, the British pound consolidated about 1,25800 levels. Additional pressure on that level could be in MA200 moving averaging, and Pair now leans to make a break below the 1,25500 level. We expect the news on the Unemployment Rate and U.S. Nonfarm Payrolls in the American session. Everyone is in anticipation of the results, which is why the market is slightly unstable. We need to continue negative consolidation and pullback down to the 1.25000 level for the bearish option. Break below this support zone would return us to the previous bearish trend. We need a positive consolidation in return above 1,26000 levels for the bullish option. After that, we could expect a re-test prevention High at the 1,26500 level.

Market overview

Eurozone Retail Sales

Eurozone retail trade fell unexpectedly in April due to weak food sales, Eurostat reported on Friday. Retail sales fell 1.3% on a monthly basis in April, compared to a revised 0.3% increase in March. Sales are projected to grow by 0.3%. On an annualized basis, retail growth improved to 3.9% in April from 1.6% in March. However, this was less than the expected increase of 5.4%.

German exports

German exports rose more than expected in April, despite sanctions imposed on Russia that reduced trade in Europe.

Exports rose 4.4% on a monthly basis, down from a 3.0% drop in March, Destatis data on Friday showed. Deliveries are expected to grow by only 1.5%. In the same period, imports grew by 3.1 % on a monthly basis. However, growth was slightly slower than the 3.2% increase in March.