EURUSD and GBPUSD: September Maximum

- Yesterday, the pair EURUSD formed a new September maximum at the 1.02000 level.

- During the Asian trading session, the pound managed to make a break above the 1.17000 level.

- German economic confidence weakened in September to the lowest level since 1992.

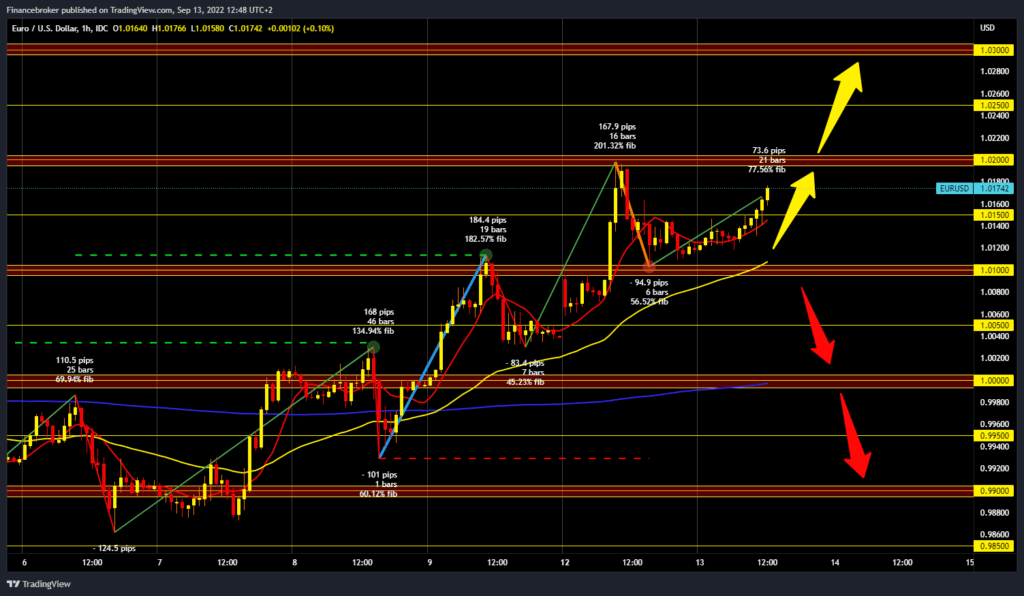

EURUSD chart analysis

Yesterday, the pair EURUSD formed a new September maximum at the 1.02000 level, after which we saw a pullback to the 1.01000 level, where we found new support. Since then, a new bullish consolidation has started, and the pair managed to climb to the 1.01500 level during the Asian trading session. Now we see a break of the euro above, and we could retest the 1.02000 level. If we managed to break above, we would form a new higher high. Then we need to hold above if we want to see a bullish continuation. Potential higher targets are 1.02500 and 1.03000 levels. We need a negative consolidation and pullback below the 1.01500 level for a bearish option. Additional support at that level is in the MA20 moving average. A break of the euro below would likely send us down to retest support at the 1.01000 level and the MA50 moving average. Potential lower targets are 1.00500 and 1.00000 levels.

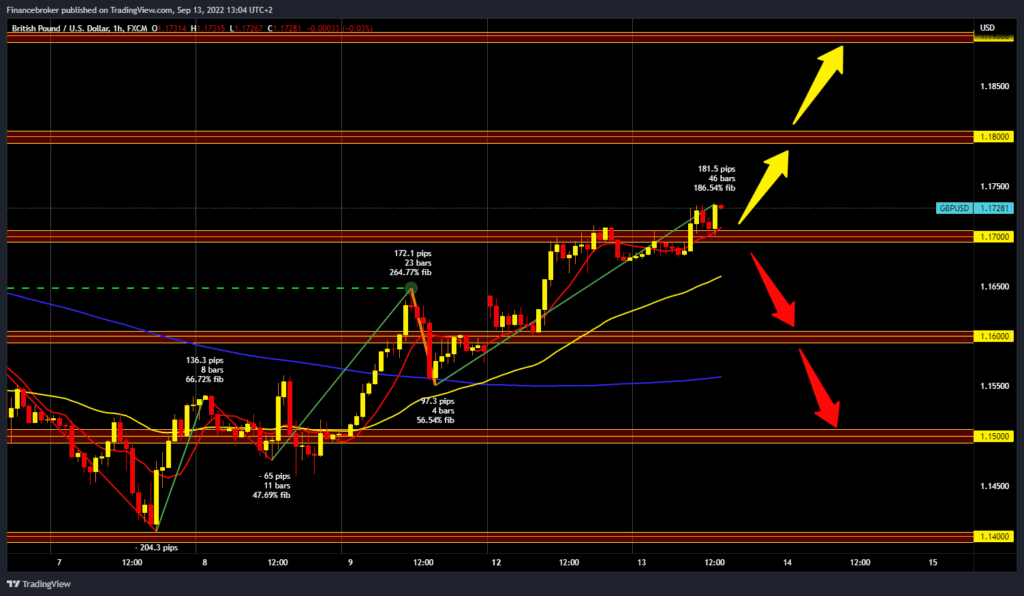

GBPUSD chart analysis

During the Asian trading session, the pound managed to make a break above the 1.17000 level, and the bullish impulse continued in the European session. Today’s maximum is at the 1.17300 level, and as things stand, the pound could continue even higher and thus form a new high for this month. Potential higher targets are 1.17500 and 1.18000 levels. We need a negative consolidation and a return below the 1.17000 level for a bearish option. The pound could continue to weaken towards the 1.16500 level and the MA50 moving average. Our next target is 1.16000, this week’s low. If he doesn’t hold out either, the next potential targets are the 1.15500 and 1.15000 levels.

Market Overview

German economic confidence weakened in September to the lowest level since 1992. Financial market experts are very concerned about the possibility of a winter energy shortage and its subsequent impact on the economy. According to the ZEW- Leibniz Centre for European Economic Research results, the ZEW indicator of economic sentiment fell to -61.9 in September from -55.3 in August. Economic sentiment regarding developments in the Eurozone also weakened in September.