EURUSD and GBPUSD: Short-lived consolidation

- During Asian trading, the euro continues at the same level as yesterday against the dollar.

- During Asian trading, the British pound consolidated somewhat against the dollar.

- Boris Johnson will notify his resignation as British prime minister on Thursday after he was abandoned by ministers and MPs from his Conservative Party who said he was no longer fit to govern.

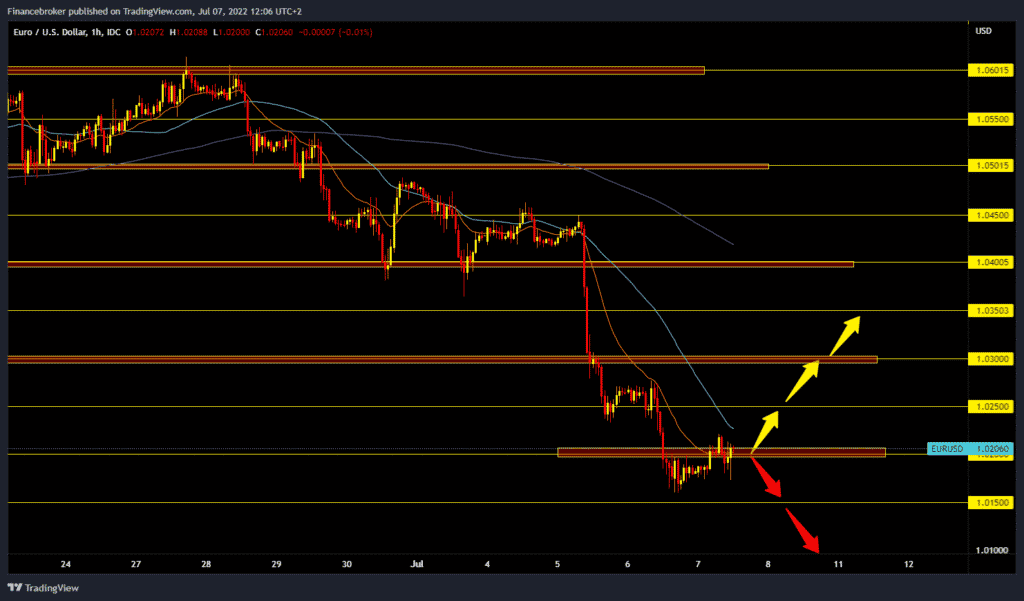

EURUSD chart analysis

During Asian trading, the euro continues at the same level as yesterday against the dollar. Temporary signs of euro consolidation are visible, but they seem to be short-lived. There is more and more talk about equalizing parity 1:1. For the first time in the last 30 years, Germany’s trade balance with foreign countries fell into deficit. At the beginning of the week, ECB officials announced a small increase in the ECB’s benchmark interest rate.

The poor economic perspective of the EU due to the possibility of a recession and the suspension of the flow of Russian natural gas put too much pressure on the common European currency. The euro is trading at $1.02000, representing a strengthening European currency by 0.22% since the start of trading tonight. At 1:30 p.m., notes from the last ECB meeting are expected. For a bearish option, we need a continuation of the negative consolidation and a retest of yesterday’s low at 1.01600. A euro break below moves us to the next support at 1.01500. Our potential lower support target is 1.01000 level. For a bullish option, we need to consolidate better above the 1.02000 level. After that, the pair could continue towards the 1.02500 level. Then we would get support in the MA20 and MA50 moving averages, and the potential next target is the 1.03000 level.

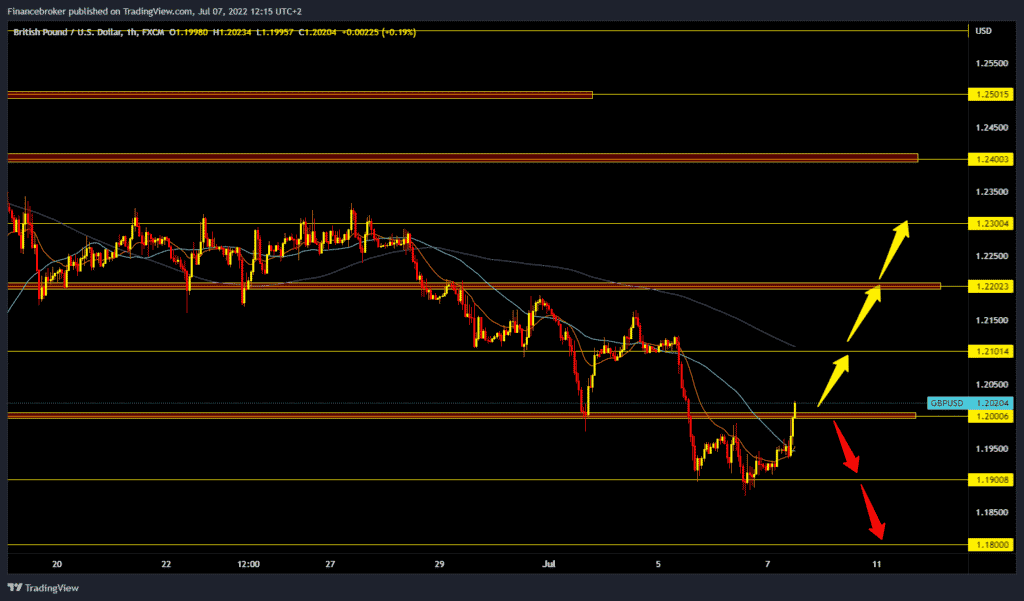

GBPUSD chart analysis

During Asian trading, the British pound consolidated somewhat against the dollar. Agonizing scenes from the UK Parliament where the current government’s political crisis is flaring up put pressure on the island’s currency. Finally, Prime Minister Boris Johnson resigned as Prime Minister. Post-Brexit disagreements with the EU over the status of Northern Ireland, stronger US Treasury yields undermining, and domestic political instability is weighing on the pound.

The pound is trading at $1.20100, representing a 0.76% strengthening of the British currency since the start of trading tonight. For a bullish continuation, we now need consolidation above the 1.20000 level. We have received support at MA20 and MA50, and the GBP could now use this to its advantage against the USD. Potential targets are 1.20500 and 1.21000 levels. For the bearish option, we need negative consolidation and pullback below the 1.20000 level. After that, with increased pressure, we could go down to yesterday’s low at 1.18770 level.

Market overview

Boris Johnson resigns

Boris Johnson will notify his resignation as British prime minister on Thursday after he was abandoned by ministers and MPs from his Conservative Party who said he was no longer fit to govern.

Eight ministers, including two secretaries of state, resigned in the last previous hours, and an isolated and powerless Johnson was poised to bow to the inevitable and announce his retirement later on Thursday.

All but a handful of allies abandoned Johnson after the latest in a series of scandals ended.

“His resignation was inevitable,” Justin Tomlinson, deputy leader of the Conservative Party, tweeted. “Now, we must quickly unite and focus on what is important. These are serious times on many fronts.”

The excitable Johnson came to power almost three years ago, promising to secure Britain’s departure from the European Union and save it from the bitter wrangling that followed the 2016 Brexit referendum.