EURUSD and GBPUSD: The Pressure is even Greater

- At the beginning of this week, the euro continues the bearish trend from Friday.

- On Friday, the pound fell to the 1.18000 level, and today it is trying to hold on to that level.

- The euro is weighed down by concerns that a three-day cut in gas supplies to Europe.

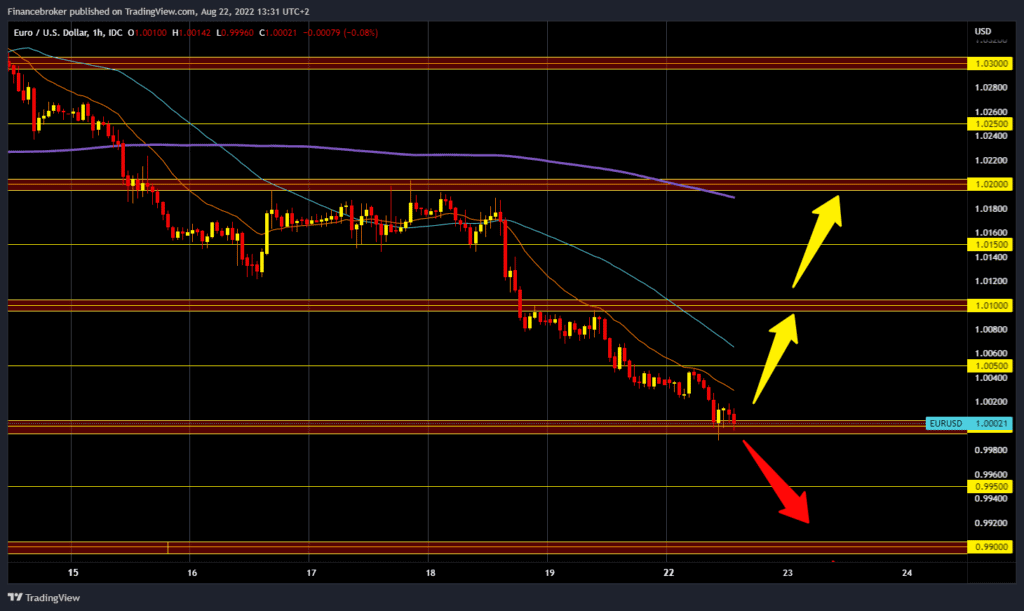

EURUSD chart analysis

At the beginning of this week, the euro continues the bearish trend from Friday. During the Asian session, the euro failed to break above the 1.00500 level. A new pullback followed, and the EURUS pair again fell below the 1.00000 level. The pressure on the euro is even greater, and we could expect a further decline in the European currency. Our previous visit to this place was on July 15. We need a new positive consolidation and a euro jump above the 1.00500 level for a bullish option. After that, we need to hold above that level in order to try to continue towards the 1.01000 level. If we succeeded in climbing to that level, the euro would gain support in the MA20 and MA50 moving averages. Potential higher targets for us would be 1.01500 and 1.02000 levels. We need a continuation of the negative consolidation and a fall below the 1.0000 level for a bearish option. Bearish pressure is evident, and a fall below this support zone would only increase the negative pressure on the European currency. Potential lower targets are 0.99000 and 0.98000 levels.

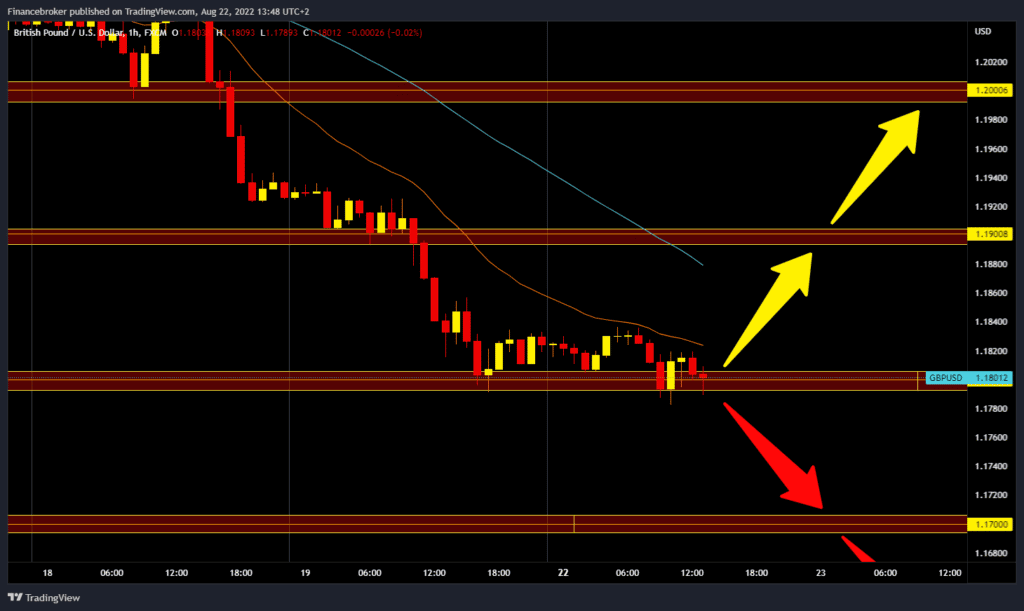

GBPUSD chart analysis

On Friday, the pound fell to the 1.18000 level, and today it is trying to hold on to that level. The pressure on the British currency seems too big, and a break below the pound is very likely. Today’s low is at the 1.17800 level. We again had a brief attempt to recover above 1.18000 but without success as we are back below again. For a bullish option, we need a new positive consolidation. After that, we need to move away from the support zone. Our first target is the 1.18500 level. If we could do that, we would get the support of the first MA20 moving average. A potential higher target is the 1.19000 level. For a bearish option, we need a continuation of the negative consolidation and a further pullback of the pound below the 1.18000 level. The first target is the July low at the 1.17600 level, and the next target is the 1.17000 level.

Market Overview

The euro is weighed down by concerns that a three-day cut in gas supplies to Europe, announced for later this month, will worsen the energy crisis. The dollar index hit fresh five-week highs as Federal Reserve officials reiterated an aggressive monetary stance ahead of this week’s Fed meeting. We have no important economic news today.