EURUSD and GBPUSD Tumbling Like a Rock

- During Asian trade, the euro weakened against the dollar.

- During the Asian session, the British pound weakened against the dollar.

- Inflation in the UK jumped in April and surpassed previous records.

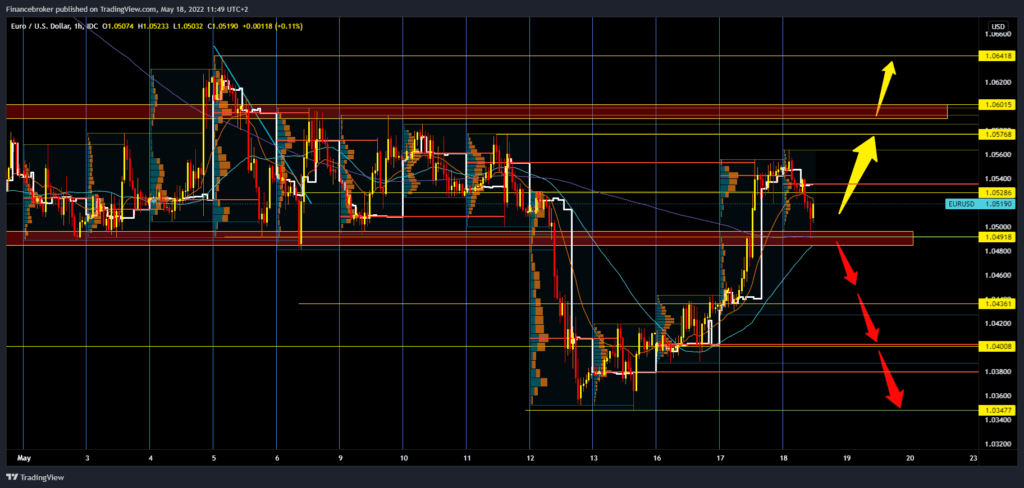

EURUSD chart analysis

During Asian trade, the euro weakened against the dollar. Yesterday, the Dutch member of the ECB’s monetary board, Klaas Knot, stated that the increase in the rate by half a % should not be ruled out if the data on the growth of inflation in the eurozone is unfavorable. That gave a boost to the euro. On the other hand, positive data on retail in the United States in April left a positive mark on the dollar. The euro is exchanged for 1.05140 dollars, representing the strengthening of the common European currency by 0.33% since the beginning of trading tonight. Inflation in Europe is still at a high level, and today’s report showed that. This lowered the euro to 1.04918 level. We need a continuation of this negative consolidation and a pullback below the 1.04800 level for the bearish option. We have the following potential support at the 1.04360 level. If this support does not last, then we can expect a further decline towards the following levels of 1.04000, then 1.03800, and 1.03400. For the bullish option, we need a return above 1.05600 levels. After that, we can expect further price growth towards the next resistance zone around 1.06000 levels.

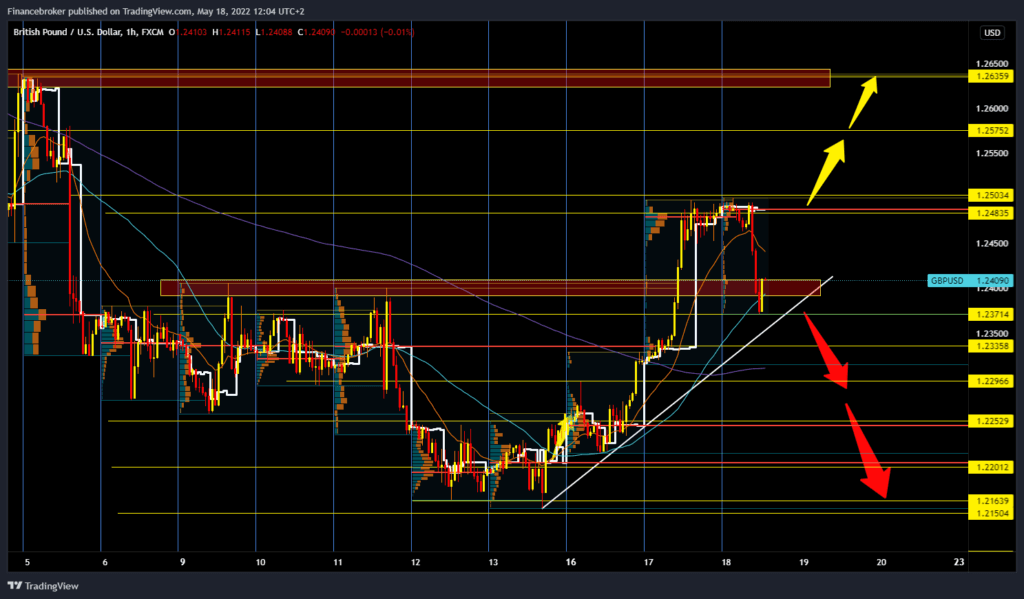

GBPUSD chart analysis

During the Asian session, the British pound weakened against the dollar. The tightening of the post-Brexit relationship between the UK and the EU regarding the status of Northern Ireland is pulling the pound down. Also, this morning it was announced that price inflation in the UK in April was slightly lower than expected, which somewhat reduced expectations from the extremely aggressive monetary policy of the Bank of England in the coming period. That is why the pound is in retreat. On the other hand, positive data on retail sales in the United States in April from yesterday affected the dollar’s recovery. The pound is exchanged for 1.24100 dollars, which is weakening the British currency by 0.65% since the beginning of trading tonight. Today’s high was at 1.25000, after which the pound fell to the 1.23720 level. Now the pound is recovering, and the bullish momentum has started again at the current 1.24050. For the bullish option, we need a new positive consolidation that would continue this week’s bullish trend and bring us back to this morning’s maximum. We need a break below the bottom support line for the bearish option. Breaking the pounds below would increase bearish pressure, and our targets are 1.23360, 1.22965, 1.22500, 1.2000 and so on.

Market overview

Inflation in the UK

Inflation in the UK jumped in April and surpassed previous records, mainly due to food and fuel prices. This signals to us the high cost of living that would reduce household income and confirms the expectations of the BoE for further tightening this year.

Inflation rose sharply to 9.0% in April from 7.0% in March, the Office for National Statistics said on Wednesday. Forecast was inflation will rise to 9.1%.

Inflation will retreat after a 10.0% peak is expected in October, as the stimulus of global factors withdraws, said Paul Dales from Capital Economics.

At its May meeting on monetary policy, the Bank of England forecast inflation to rise to around 9% in April and to rise further in the coming months, averaging just over 10% at its peak in the fourth quarter.

Dales said interest rates will have to rise by 200 basis points to 3.00% for inflation to return to the 2% target.