EURUSD, GBPUSD Pairs Analysis and FOMC meeting

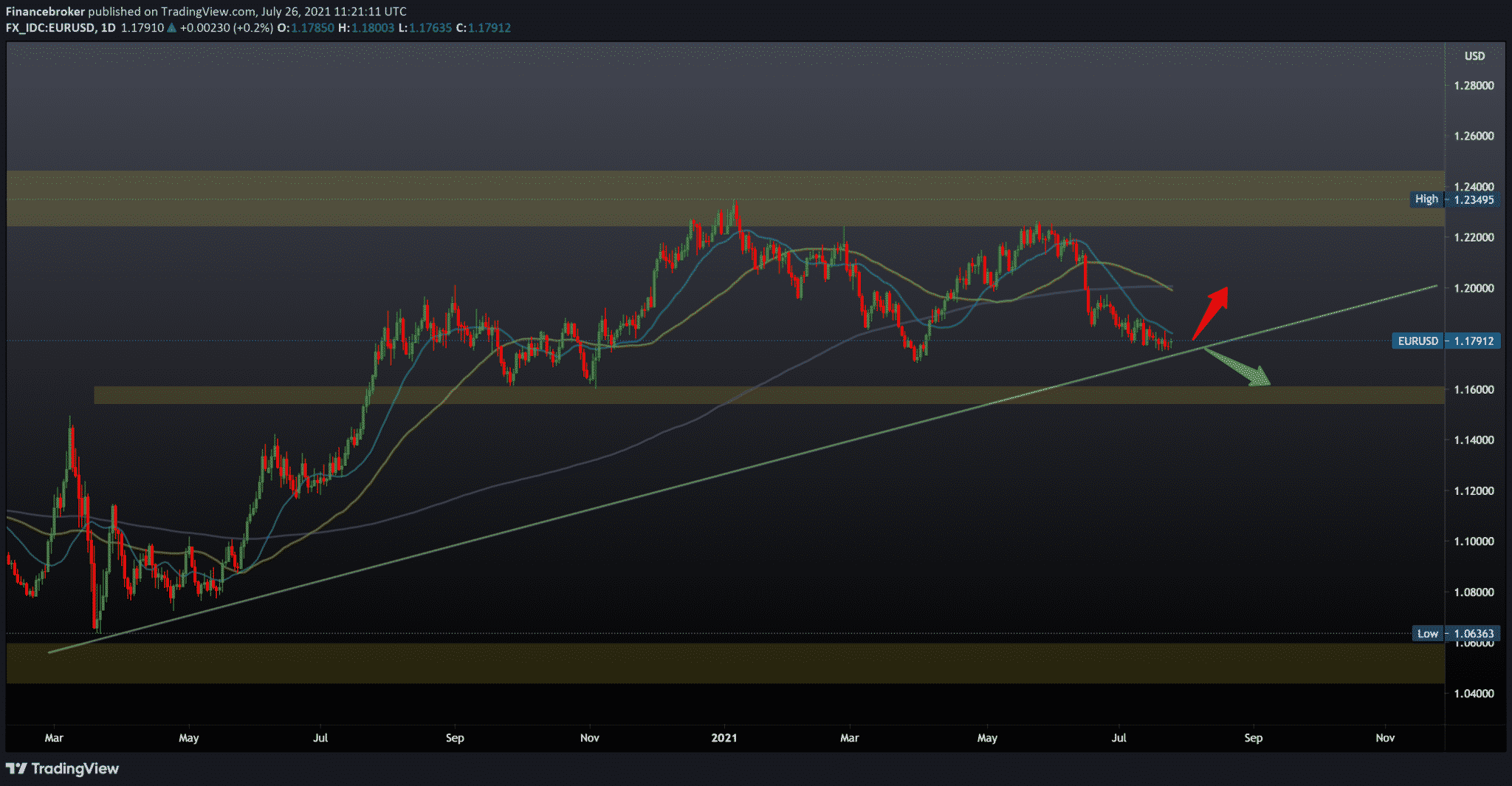

Looking at the chart EURUSD on the daily time frame, we see that the pair continues to consolidate just below 1.18000; at the current 1.17800, the dollar is in a slight weakening that the euro could use to its advantage and make some gains. So if this continues until the end of the day, we can expect the pair to break 1.18000, giving the euro more optimism that it can progress even more. We are also testing the bottom trend line, which can be potential good support for us. As an extra wind in the back, we can get it by crossing over the MA20 simple moving average. If that happens, our target is 1.20000, and the resistance to MA200. For all currencies in the main basket, the euro is recording gains for now.

According to the institute, supply problems are burdening the manufacturing and retail sectors, and almost 64% of industrial firms complain about the shortage of raw materials. The companies are more optimistic and better assess their current situation, but the optimism regarding the coming months has weakened. The Ifo index of expectations fell to 101.2 from 103.7 in June, while the index of current conditions rose to 100.4 from 99.7.

Various events, including the COVID-19 pandemic, natural disasters in China and Germany, and cyber attacks, have conspired with global supply chains to a tipping point, creating instability in the flow of raw materials, parts, and consumer goods, according to companies, economists and shipping experts. The tourism and consumer sectors were particularly concerned about the potential fourth wave of coronavirus. After more than two months, the cases of pain are declining, now the cases of COVID-19 are growing in the largest European economy since the beginning of July, mainly due to the spread of a more contagious variant of Delta.

The GBPUSD pair analysis

Looking at the GBPUSD chart on the daily time frame, we see that the pair has stayed above the MA200, a simple moving average and that we are now testing the MA20. Here, the level at 1.38000 is important to us now, as a potential resistance to 1.39000, a place of previous instability, and 1.40000 is still our psychological target. Retreating below the MA200 will return the bias to negative territory with a view on the previous low around 1.36000 and psychological support at 1.35000.

The stalemate between the EU and Great Britain due to the Northern Ireland Protocol, together with the nervousness of COVID-19, continued to act as a wind for the British pound. The situation with COVID-19 in Britain has been deteriorating in recent weeks amid the spread of a highly contagious Delta version of the virus. This, to a greater extent, overshadowed the decision of the British government last week to lift the restrictions on coronavirus in Great Britain.

Meanwhile, concerns about the economic consequences of the coronavirus pressed on investor sentiment. This was evident from the generally weaker tone around the stock market, which favored the relative status of a safe haven for the US dollar compared to its British counterpart.

Traders can also refrain from any aggressive investments. It would be better to wait on the sidelines ahead of this week’s key risk event – the monetary policy meeting of the FOMC, which is scheduled for Wednesday night.