Gold and Silver: Metal prices are in retreat against USD

- The price of gold continues its retreat that began last week.

- On Friday, the price of silver tried to start a new bullish trend, but it only managed to reach the $21.30 level.

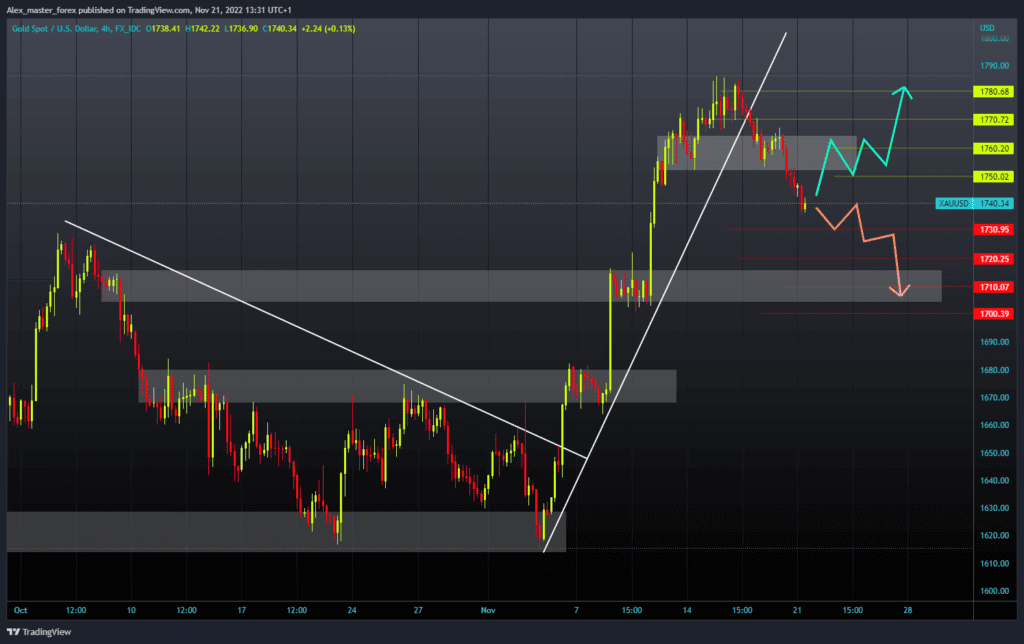

Gold chart analysis

The price of gold continues its retreat that began last week. The price of gold rose above the $1,780 level last week, then managed to pull back from that level to the $1,750 level. Pullback continued, and the price fell to $1,735 this morning. We are now consolidating around the $1740 level, and we could expect a new bearish impulse that would continue to lower the price of gold.

Potential lower targets are $1720 and $1710, while the psychological level is at $1700. For a bullish option, we need a new positive consolidation and a return above the $1750 level. A break above and staying there would be of great help to us for the further continuation of the price recovery. Potential higher targets are $1760 and $1770, as well as last week’s high at $1787.

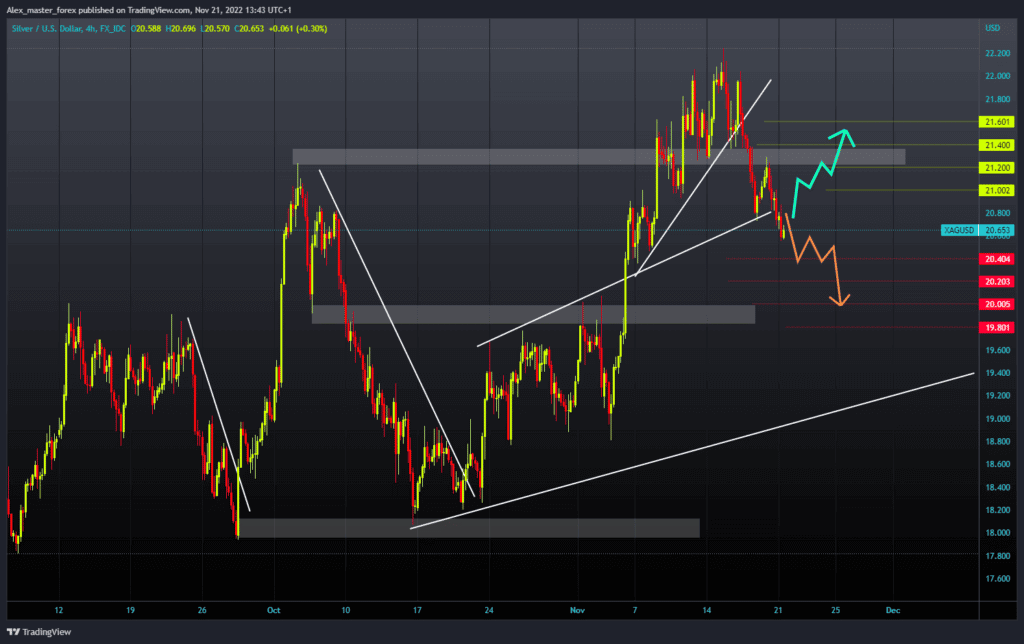

Silver chart analysis

On Friday, the price of silver tried to start a new bullish trend, but it only managed to reach the $21.30 level. After that, we see a new bearish consolidation forming a new lower low at the $20.60 level. Now we are trying to hold on there to stop further decline in the price of silver. For a bearish option, we need passive consolidation and a breakout below today’s support. Then we need to hold down there, and after that, we would see a further decline in price to the next support zone.

Potential lower targets are the $20.40 and $20.00 levels. For a bullish option, we need a new positive consolidation and a return to the previous high at the $21.30 level. Staying above would help us form a new higher low from which we would start to new recovery. Potential higher targets are the $21.40 and $21.60 levels.